UK Inflation Expected to Hit Bank of England’s Target for First Time Since 2021

19 June 2024

174 views

Key Points:

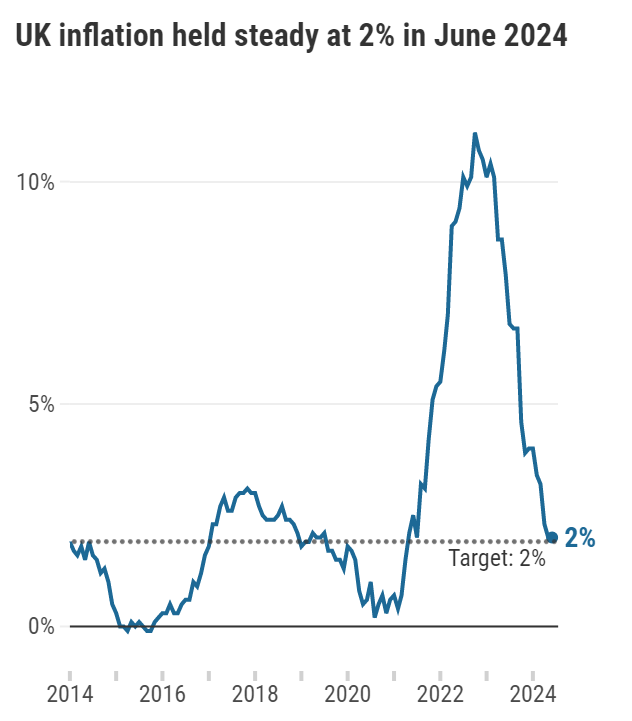

- Projected Inflation Rate: Expected to fall to 2% in May.

- Bank of England Target: Reaching the target for the first time since April 2021.

- Impact on Rate Cuts: Unlikely to prompt a rate cut at the upcoming meeting.

UK inflation is projected to fall to 2% in May, reaching the Bank of England’s target for the first time since April 2021. This anticipated decrease follows a drop from 2.3% in April, reflecting a significant easing of price pressures. Despite this positive development, it is unlikely that a favorable inflation report will prompt a rate cut at Thursday’s Bank of England meeting, especially with a key election approaching on July 4th. Market expectations are leaning towards an initial rate cut in August.

From a technical standpoint, the pound/dollar has been trading sideways recently. With GBP/USD breaking below 1.2700, the first support level is at 1.2667, the low from May 24. Further downside targets include the 100-day moving average (DMA) at 1.2643, followed by 1.2600.

US retail sales data, released recently, may also influence the currency pair’s movements. US retail sales grew by a modest 0.1% in May, falling short of the expected 0.2% gain. Excluding autos, retail sales decreased by 0.1%, and April’s retail sales were revised down from flat to a 0.2% decline. These factors may limit the downside for GBP/USD.