Sentiment and News-Based Trading: Turning Information into Alpha

27 July 2025

158 views

Sentiment and News-Based Trading: Turning Information into Alpha

The financial markets of the 21st century are driven by two competing forces: disciplined quantitative models and unpredictable human emotion. Sentiment trading and news-based trading stand at the critical intersection of these forces, offering advanced traders a measurable edge by quantifying the market’s collective mood.

In today’s hyper-connected, real-time environment, massive streams of qualitative information—ranging from central bank speeches and breaking financial headlines to viral tweets and market-moving rumors—must be instantly transformed into quantitative inputs. The ability to process this deluge of unstructured data faster and more accurately than the competition is the new frontier for alpha generation. For the expert trader, information asymmetry is no longer just about access; it’s about the speed and sophistication of data processing. Mastering the conversion of human language into precise trading signals is the key to superior performance.

What Is Sentiment Trading and Why It Matters

Sentiment trading is a strategy that uses emotional and psychological cues derived from market participants to forecast the likely direction of asset prices. It is built on the premise that collective human emotion—fear, greed, optimism, and pessimism—is a powerful short-term driver of price deviations that traditional models often fail to capture.

The Human Layer of the Market

Traditional trading algorithms often rely on historical price data (technical analysis) or corporate fundamentals (value investing). These models are essential but inherently miss the “human layer” of the market:

- Investor Sentiment: Measures the attitude of individual traders and retail investors, often captured through surveys, poll data, or trading app positioning.

- Market Sentiment: Reflects the overall mood or bias across the entire trading community, including institutional players, often measured through volatility indices or derivative pricing.

Sentiment matters because emotion frequently causes market psychology to overrule logic. We see this effect clearly in modern events, such as the parabolic rallies of “meme stocks” or sudden crypto spikes fueled by social hype. These price movements occur before any change in fundamental value, making sentiment a leading, rather than lagging, indicator of market momentum.

Sources of Market Sentiment Data

The first challenge in sentiment trading is sourcing and validating the data. Since sentiment is qualitative, traders must aggregate information from diverse, often chaotic, sources.

The Multi-Channel Data Landscape

Sophisticated data-driven strategies require monitoring a wide array of sources simultaneously to improve signal accuracy and reduce noise:

- Financial News and Traditional Media: This includes high-frequency data from major news wires (e.g., Reuters, Bloomberg), analyst reports, governmental policy statements, and critical speeches from central bank governors. The tone of a few key financial outlets can often steer institutional thinking.

- Social Media: Platforms like Twitter (X), Reddit, Telegram, and specialized Discord channels are where market narratives emerge and disseminate in real time. Analyzing the velocity, volume, and consensus of conversations on these platforms is essential for spotting retail-driven trends.

- Crowd-Sourced Platforms: Retail sentiment polls, proprietary data from community trading apps, and public discussion boards provide a direct window into the positioning and emotional bias of the non-professional trading public.

- Alternative Data: Unconventional data sources, such as Google Trends data showing spikes in search volume for specific stock tickers or economic phrases, can serve as a proxy for public interest and emerging behavioral patterns.

Relying on a single source, such as one social media feed, risks sampling bias. Multi-source sentiment analysis provides triangulation, ensuring the signal is robust across different market segments.

How Natural Language Processing (NLP) Transforms Information into Signals

The bridge between qualitative text data and quantitative trading signals is NLP in trading—Natural Language Processing. NLP is the core technology that enables the scalability and speed required for modern news-based trading.

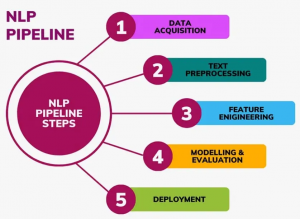

The NLP Pipeline for Alpha Generation

NLP uses machine learning and deep learning to interpret, categorize, and score massive streams of unstructured text data:

- Data Ingestion: High-speed systems constantly collect millions of text documents, social posts, and financial reports per second.

- Entity Recognition: The system first identifies key entities within the text, such as specific asset tickers (e.g., NVDA, TSLA), company names, geopolitical regions, or economic indicators.

- Text Classification and Scoring: The heart of the process. NLP in trading models analyze the lexical and contextual tone of the text related to the identified entity. Is the language positive (“soaring earnings,” “breakthrough innovation”), negative (“regulatory hurdle,” “missed consensus”), or neutral?

- Weighting and Indexing: The resulting positive, negative, and neutral classifications are translated into a numerical score (e.g., a News Sentiment Score from -1.0 to +1.0). Sophisticated models apply weights based on the source’s credibility (e.g., a reputable financial analyst vs. an anonymous social post) or the historical predictive power of the language used.

Tools like word embeddings (Word2Vec, BERT) and advanced deep learning models allow algorithms to understand subtle context, sarcasm, and nuanced financial language. This unparalleled speed and scalability—algorithms processing millions of data points per second—is the ultimate differentiator against manual human capacity.

Sentiment Indicators and How They Are Used in Trading

The output of the NLP process is a set of quantitative news sentiment indicators used by AI trading bots and quantitative analysts.

Key Indicators and Interpretation

These indicators provide measurable, real-time gauges of market psychology:

- News Sentiment Index: An aggregate score of the net positive or negative tone from a curated basket of financial news sources. Used primarily for medium-term bias and event-driven reactions.

- Social Buzz Volume and Polarity: Tracks the frequency (volume) of mentions for a specific asset and the overall positive/negative ratio (polarity) across social media platforms. Spikes in volume often precede rapid price movements.

- Fear and Greed Index: A composite indicator that measures the overall market mood across multiple inputs, including volatility, market momentum, safe-haven demand, and survey data.

- Crowd Positioning Data: Shows the actual net long/short bias of retail traders on major brokerage or community trading platforms, often used as a direct contrarian signal.

Professional traders frequently employ a contrarian use of sentiment: when sentiment reaches an extreme (e.g., a social media sentiment analysis score indicating peak optimism or “euphoria”), it is often interpreted as a sell signal. Conversely, peak pessimism and fear are often viewed as potential buying opportunities, based on the belief that everyone who could be on one side of the trade has already positioned themselves.

The Impact of News and Social Media on Price Movements

The infusion of real-time sentiment data has drastically altered market structure, making speed a non-negotiable component of profitability.

Speed, Hype, and Herd Behavior

- Algorithmic Reaction: In major markets, algorithmic trading systems react to breaking headlines or central bank statements in sub-second timeframes, often executing trades before human traders can even fully comprehend the information. This speed defines short-term arbitrage opportunities.

- Social Hype and FOMO: Social media sentiment analysis has revealed the powerful effect of herd behavior. Coordinated buying or sudden waves of “Fear of Missing Out” (FOMO) can cause rapid, disproportionate market overreactions, particularly in less liquid assets or those with strong retail followings (e.g., the crypto rallies seen in certain altcoins).

- Amplified Volatility: The immediate, consensus-driven nature of crowd psychology amplifies volatility. A single negative piece of news can trigger a cascade of selling as algorithms and human traders react simultaneously to the negative sentiment score, rather than waiting for fundamental confirmation.

The speed of news diffusion means that milliseconds can define profitability for quant funds operating in the news-based trading space.

Building Real-World Sentiment Trading Systems

For institutional and quant funds, sentiment is integrated into robust, automated systems that combine data science with an execution engine.

Core Components of a Sentiment Strategy

Designing a profitable sentiment model requires a comprehensive and continuous workflow:

- Data Pipeline: The infrastructure for constant, high-volume collection, cleaning, and normalization of unstructured text data. This is the operational backbone.

- Signal Engine: The NLP in trading scoring system, which converts the cleaned data into numerical news sentiment indicators. The model is often trained to predict a short-term price movement over a defined horizon (e.g., the next 5 minutes or 1 hour).

- Execution Layer: AI trading bots or specialized algorithmic execution engines that automatically translate the sentiment signal (e.g., “Sentiment Score > 0.8: Buy 500 units”) into a trade order and manage its execution path.

- Feedback Loop: A crucial machine learning component where the system continuously analyzes the executed trades. If a positive sentiment signal repeatedly leads to a loss, the machine learning model adjusts its feature weights or classification rules to refine its predictive accuracy.

These systems are commonly deployed to trade highly predictable, high-impact events like quarterly earnings announcements, official economic data releases (e.g., Non-Farm Payrolls), or sudden geopolitical events.

Combining Sentiment with Technical and Fundamental Indicators

While sentiment offers powerful insights into short-term deviations, its accuracy and longevity are significantly improved when integrated into hybrid models alongside traditional technical and fundamental analysis.

Synergy for Enhanced Alpha Generation

Combining sentiment with other factors reduces the reliance on a single, potentially noisy, signal:

- Sentiment + Momentum: A powerful confirmation strategy. A strong buy signal is generated when technical momentum (e.g., a stock trading above its moving average) aligns with a rapidly improving sentiment score. This captures both the mechanical trend and the emotional fuel behind it.

- Sentiment + Value/Fundamental: Used as a filtering mechanism. For example, a quant might only consider buying fundamentally undervalued stocks, but only execute the trade when the public tone and market psychology (sentiment) begin to improve, signaling that the market is finally recognizing the value.

- Sentiment + Volatility: Sentiment indices are used to dynamically adjust portfolio risk. When the Fear and Greed Index hits extreme fear, a model may increase its allocation to mean-reversion strategies; when it hits extreme greed, it may dial down exposure due to impending risk.

This portfolio-level diversification benefits from multi-signal integration, ensuring the strategy remains robust across various market regimes.

Challenges and Limitations of Sentiment Trading

Despite the technical sophistication, sentiment trading is fraught with unique challenges related to the nature of human communication and market ethics.

Data Noise and Model Integrity

- Sarcasm, Bots, and Misinformation: Unstructured text is inherently noisy. Sarcasm is difficult for algorithms to process, AI trading bots and spam accounts can artificially inflate sentiment volume, and outright fake news can temporarily distort market mood. This necessitates sophisticated data filtering and source credibility scoring.

- Lag Effect: During genuine market shocks or flash events, the sentiment model may lag. By the time a social media feed registers and processes the emotional change, the price move may have already been executed by low-latency algorithmic trading systems.

- Overfitting: Sentiment models are at high risk of overfitting because they can accidentally learn to trade specific, unrepeatable historical events (e.g., a unique, market-moving tweet from a specific personality). Robust data-driven strategies must be constantly re-validated.

There are also serious ethics and compliance concerns regarding coordinated misinformation campaigns designed to manipulate price, making data scrutiny vital. Solutions include rigorous model retraining on new data regimes and incorporating explainable AI (XAI) to ensure model transparency.

The Future of Sentiment-Driven Strategies

The evolution of sentiment trading is inseparable from the advancement of deep learning and real-time data processing.

The future will be characterized by:

- Multimodal AI: Sentiment models will not be limited to text; they will integrate analysis of executive voice tone in earnings calls (acoustic sentiment) and visual cues in video or imagery, creating a holistic measure of corporate and market mood.

- Behavioral AI: Advanced models will transition from simply measuring what is being said to predicting what actions are likely to follow, integrating cognitive biases into the feature set.

- Cross-Asset Correlation: NLP in trading will correlate sentiment not just within a stock, but across asset classes—for instance, analyzing the impact of negative oil news sentiment on currency pairs or clean energy stock performance.

In the next decade, sentiment will solidify its position not as a peripheral strategy, but as a critical risk factor and a fundamental source of alpha generation within every professional quant portfolio.

Conclusion — Mastering the Market’s Emotional Pulse

Sentiment and news-based trading transform the chaotic reality of human emotion into systematic, measurable trading inputs. By embracing NLP in trading and sophisticated data-driven strategies, advanced traders gain a powerful edge by quantifying the market’s emotional pulse. The key takeaway is that emotion drives markets—but only by using data can that emotion be rigorously quantified, anticipated, and leveraged for profit. The most successful traders of the future are not guessing sentiment; they are engineering it into their trading algorithms.