Which U.S. Data Releases Are at Risk from the Shutdown?

03 октября 2025

149 views

The U.S. dollar faced renewed pressure this week as the federal government entered its first shutdown in nearly seven years, disrupting key economic reporting schedules and injecting fresh uncertainty into markets.

Immediate Impact

The shutdown — expected to last at least three days — means traders should not expect the September Nonfarm Payrolls (NFP) report this week. The NFP is typically one of the most influential data releases for both traders and the Federal Reserve, guiding expectations for monetary policy. Its delay will complicate the Fed’s assessment ahead of its October 29 meeting.

Upcoming Reports at Risk

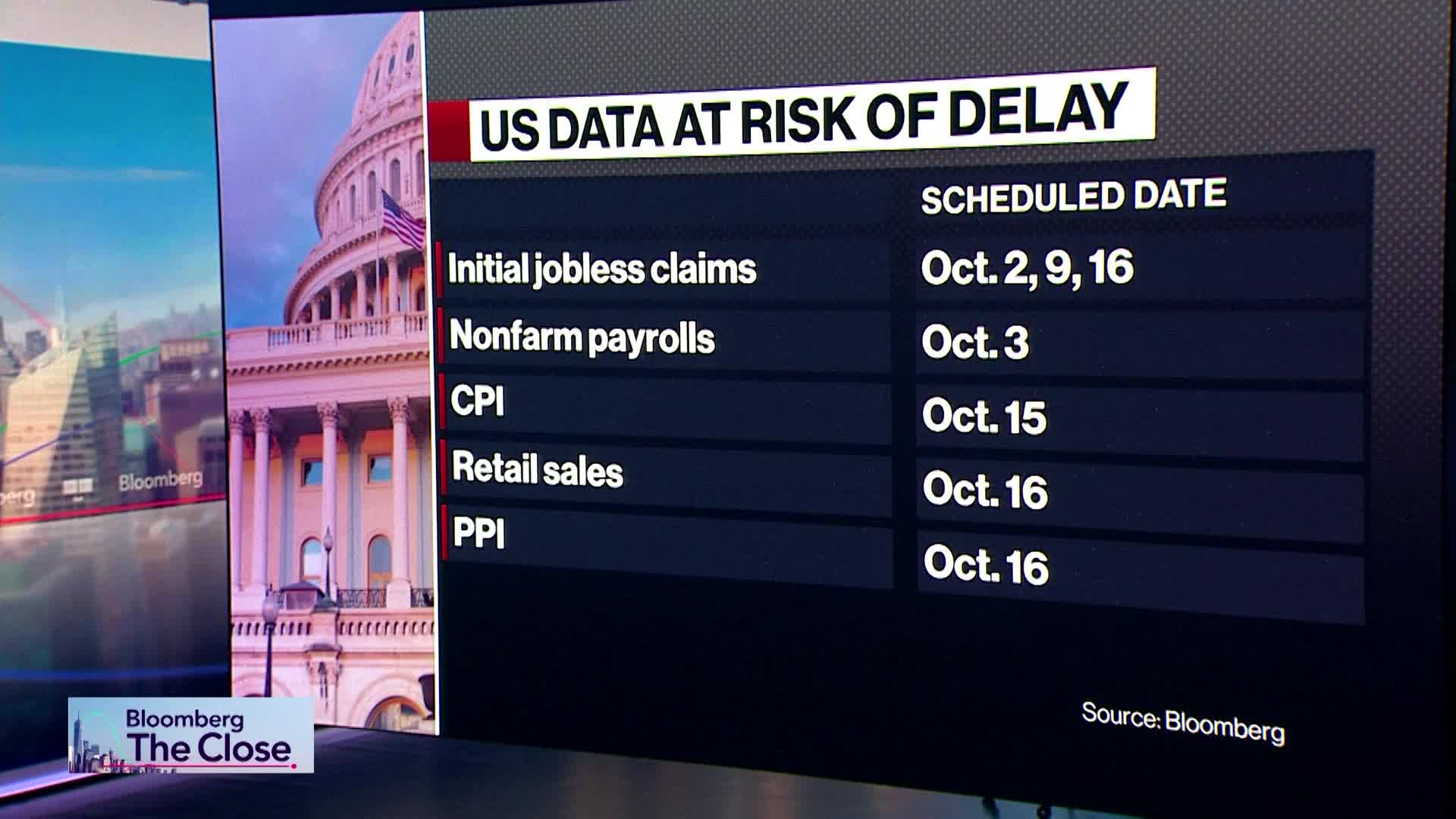

If the shutdown continues, several major reports are likely to be postponed or canceled altogether:

-

Wednesday, October 8: FOMC Minutes

-

Wednesday, October 15: Core and headline CPI inflation

-

Thursday, October 16: Producer Price Index (PPI)

-

Thursday, October 16: Retail Sales

-

Friday, October 17: Housing Starts

Market Implications

The lack of timely data could leave policymakers and investors flying blind in the coming weeks, heightening volatility across FX, gold, and equity markets. With macro visibility diminished, traders may rely more heavily on market sentiment and private-sector indicators to gauge the health of the U.S. economy until federal reporting resumes.