Mastering Stock Trading: Lesson 3 — Behavioral Finance and Its Impact on Investment Decisions

21 июля 2024

226 views

Introduction to Behavioral Finance

Behavioral finance studies how psychological factors influence investor behavior and financial markets. Understanding these biases and emotions can help you make more rational investment decisions and avoid common pitfalls.

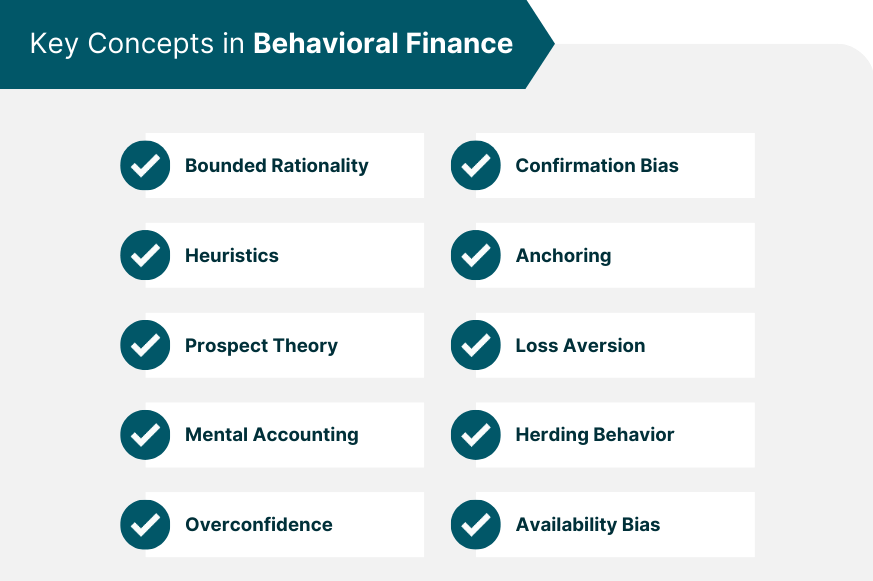

Key Concepts in Behavioral Finance

Cognitive Biases

- Overconfidence Bias: The tendency to overestimate one’s abilities and the accuracy of one’s predictions.

- Impact: Leads to excessive trading and taking on too much risk.

- Example: An investor believes they can consistently time the market better than professional fund managers.

- Confirmation Bias: The tendency to seek out information that confirms existing beliefs while ignoring contradictory evidence.

- Impact: Results in holding onto losing investments longer than warranted.

- Example: An investor only reads news articles that support their bullish view on a stock, ignoring negative reports.

- Anchoring Bias: The tendency to rely too heavily on the first piece of information encountered (the «anchor») when making decisions.

- Impact: Leads to irrational decision-making based on initial impressions.

- Example: An investor fixates on the price at which they purchased a stock, affecting their decision to sell.

Emotional Biases

- Loss Aversion: The tendency to prefer avoiding losses over acquiring equivalent gains.

- Impact: Results in holding onto losing investments to avoid realizing a loss.

- Example: An investor refuses to sell a stock that has dropped significantly because they can’t bear to realize the loss.

- Herding: The tendency to follow the crowd, often leading to irrational market behavior.

- Impact: Causes market bubbles and crashes.

- Example: Investors rush to buy a stock because everyone else is, driving up the price beyond its intrinsic value.

- Regret Aversion: The fear of making decisions that could lead to regret, leading to inaction or overly cautious behavior.

- Impact: Results in missed opportunities or overly conservative investments.

- Example: An investor avoids investing in stocks altogether after a bad experience with one investment.

Practical Strategies to Mitigate Biases

- Diversification: Reduces the impact of individual investment mistakes by spreading risk across various assets.

- Example: Building a diversified portfolio that includes stocks, bonds, and other asset classes.

- Setting Rules and Limits: Establishing predefined criteria for buying and selling to avoid emotional decision-making.

- Example: Using stop-loss orders to automatically sell a stock if it drops below a certain price.

- Regular Portfolio Review: Periodically reviewing and rebalancing your portfolio to ensure it aligns with your investment goals and risk tolerance.

- Example: Quarterly reviews to assess performance and make necessary adjustments.

- Education and Awareness: Continuously learning about behavioral finance and being aware of your biases.

- Example: Reading books, attending seminars, and engaging with financial communities to stay informed.

Practical Application

- Scenario: You notice you’re hesitant to sell a losing stock due to loss aversion.

- Steps:

- Acknowledge the Bias: Recognize that loss aversion is influencing your decision.

- Review Your Investment Thesis: Re-evaluate the stock based on its fundamentals and future prospects, not past performance.

- Set a Rule: Decide to sell if the stock drops below a specific threshold or if it no longer meets your investment criteria.

Example

- Overconfidence Bias:

- Scenario: You believe you can consistently pick winning stocks based on your analysis.

- Impact: You trade frequently, incurring high transaction costs and underperforming the market.

- Mitigation: Compare your performance to a benchmark index to maintain perspective and adjust your strategy accordingly.

- Herding:

- Scenario: You buy a popular stock because everyone else is, without conducting your own research.

- Impact: You end up buying at an inflated price and suffer losses when the bubble bursts.

- Mitigation: Conduct thorough research and base your decisions on fundamental analysis rather than market sentiment.

Conclusion

Understanding behavioral finance and recognizing cognitive and emotional biases are crucial for making rational investment decisions. By implementing strategies to mitigate these biases, you can improve your investment outcomes and avoid common pitfalls.

This concludes the Stocks Advanced Shares Tutorials course. With these advanced insights and techniques, you are well-equipped to navigate the complexities of the stock market and make informed, rational investment decisions. Keep learning and practicing to continue refining your skills and achieving your financial goals.