Psychology of Copy Trading: How Emotions Shape Your Success

15 January 2025

240 views

Psychology of Copy Trading: How Emotions Shape Your Success

Copy Trading is often seen as an effortless path to profit. You simply select an experienced trader and let automation do the work. Yet, even in this seemingly “emotion-free” environment, psychology quietly drives most decisions.

The Unseen Hand: Emotions in an Automated World

Fear, greed, and impatience still influence how investors choose whom to follow, how long they stay in a trade, and how they react when the market turns red. Technology can execute trades automatically—but it can’t turn off your emotional reactions.

So, does psychology matter in Copy Trading? Absolutely. Even with automation, emotions directly impact trader selection, risk tolerance, and long-term strategy discipline. Understanding your emotional patterns is the first step toward consistent, rational decision-making—and the real foundation of sustainable profits.

Emotional Traps in Copy Trading

Automation doesn’t eliminate emotion—it just changes where it appears. Instead of reacting to market charts, investors now react to trader statistics, rankings, and short-term performance swings. The same psychological mechanisms still operate, just under a new disguise.

Here are the most common emotional traps:

1. Fear (Loss Aversion)

The fear of losing money often manifests as premature withdrawal—closing copied trades too early or unfollowing a trader after a minor drawdown. A single losing streak can trigger panic, even if the overall strategy remains profitable in the long run.

Fear may cause you to exit trades early or stop following a trader after short-term losses.

To counter this, investors must remember: short-term losses are part of any long-term trading system. Stability requires tolerance to volatility.

2. Greed (Overconfidence and Unrealistic Expectations)

Greed pushes investors to chase impressive-looking traders with extremely high returns, often ignoring the risk levels behind those results. A gain in one month may look attractive, but it can also signal reckless leverage and luck rather than skill. The desire for instant results frequently ends in disappointment or complete loss when volatility strikes.

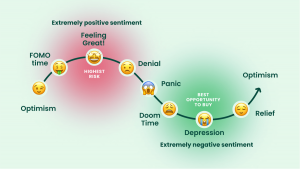

3. FOMO (Fear of Missing Out)

Seeing others earn fast profits can create the illusion that you’re “missing your chance.” FOMO-driven investors often jump into copying the top-ranked trader without proper research—right before that trader’s performance naturally corrects. This emotional rush replaces analysis with impulse.

4. Impatience

Many new investors expect immediate returns. When the copied trader goes through a quiet or losing phase, they quickly switch to another one—never giving any strategy enough time to show consistent results. This leads to fragmented results, constant churn, and growing frustration.

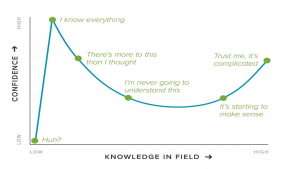

The Illusion of Trust: Why Confidence ≠ Control

Copy Trading is built on trust. You delegate decisions to an experienced trader with a proven track record. However, many investors mistake trust for safety, assuming that copying a top performer guarantees success.

In reality, trust without risk control turns into dependency. Here’s how it happens:

- Overexposure: Placing too much capital on one trader because “they haven’t lost yet.”

- Selective Attention: Ignoring red flags like increasing drawdowns or erratic behavior.

- Emotional Attachment: Identifying too strongly with the trader’s success and taking losses personally.

What’s the biggest emotional mistake?

Chasing quick profits with risky traders instead of sticking with proven long-term performers.

True trust in Copy Trading isn’t about believing in one person—it’s about believing in your process. Confidence must be backed by discipline, diversification, and data.

The Crowd Effect and Survivor Bias

Copy Trading platforms display lists of “Top Traders,” which can activate one of the most powerful psychological forces in finance—herd behavior. When many investors follow the same trader, others assume it’s the safest choice. Not necessarily.

The Crowd Effect

In financial markets, our social instinct can lead to collective irrationality—everyone chasing the same “hot” signal. This often results in investors joining after a trader’s best performance phase, right before a natural correction. Following the crowd provides emotional comfort, but it rarely leads to above-average results.

The Survivor Bias

Another distortion is survivor bias—the tendency to focus only on success stories. We see the top-ranked traders on the leaderboard but never the hundreds who failed and disappeared. This creates the illusion that consistent success is common, when in reality it’s the exception.

How to Think Critically

To avoid being blinded by popularity:

- Study historical data, not just recent results.

- Analyze drawdown periods—how a trader behaves under pressure matters more than how they perform in rallies.

- Check consistency: a trader who gains monthly over two years may be safer than one who spikes in a week.

Success in Copy Trading is not about joining the biggest crowd—it’s about making informed, independent decisions.

Smart Automation: Can Technology Reduce Emotional Bias?

Even with emotional awareness, human psychology is powerful. That’s where technology comes in. Modern Copy Trading tools increasingly integrate AI algorithms to help investors maintain objectivity and minimize emotional errors.

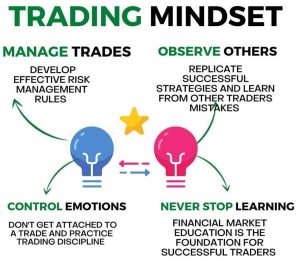

Developing an Investor’s Mindset

No technology, no strategy, and no trader can fully protect you from your own mindset. Emotional resilience is what separates consistent investors from impulsive ones.

Patience

The most underestimated skill in investing. Copy Trading isn’t about instant gratification—it’s about compounding small, stable gains over time.

Patience means giving a strategy room to breathe, even through temporary setbacks.

Discipline

Discipline is emotional strength in action. It means following your plan when every instinct tells you to act impulsively. In Copy Trading, discipline shows up as:

- Sticking to pre-defined allocation and stop levels.

- Reviewing performance periodically, not emotionally.

- Avoiding panic exits and euphoric overtrading.

Realistic Expectations

The market doesn’t reward wishful thinking—it rewards strategy and self-control. Realistic expectations reduce frustration, prevent overreaction, and allow you to stay invested long enough to see meaningful results.

What mindset is best for Copy Trading?

Practical Tools for Emotional Stability

These methods help control impulsive behavior and build emotional endurance:

- Keep an Investment Journal: Document your decisions and feelings during major market events. Writing down patterns helps turn emotions into measurable data.

- Set Clear Rules Before You Invest: Define your boundaries in advance: maximum drawdown, minimum time you’ll follow a trader, percentage of capital per trader.

- Review Your Portfolio, Not Your Panic: Checking performance too often leads to anxiety. Schedule a regular review (weekly or monthly) and stick to it.

- Practice Emotional Detachment: Losses are inevitable. Think in probabilities, not personal failures.

- Use Technology Wisely: Let automation handle repetitive tasks and risk enforcement.

Emotional balance isn’t about suppressing feelings—it’s about not letting them dictate financial decisions.

Conclusion: From Copying Trades to Copying Mindsets

Copy Trading bridges technology and human psychology. The truth is simple: the market doesn’t punish emotion; it punishes uncontrolled emotion. You can train your mind to act despite your feelings.

Successful Copy Trading isn’t about copying trades—it’s about copying the discipline, structure, and emotional maturity behind those trades.

Because profits follow patience. And emotional awareness is the most valuable investment you’ll ever make.