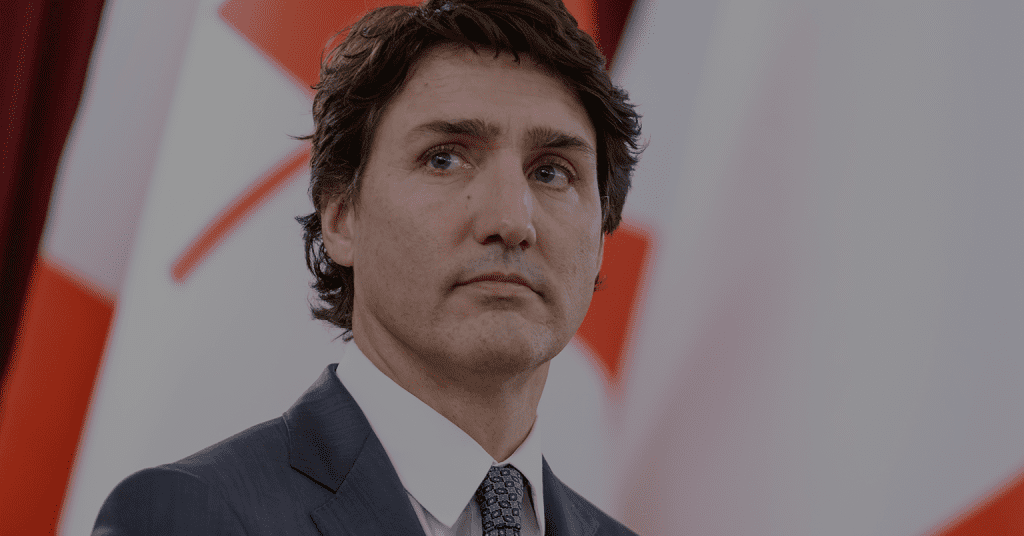

Political Shock in Ottawa: Trudeau’s Imminent Exit Weighs on Canadian Dollar

07 January 2025

211 views

Reports that Canadian Prime Minister Justin Trudeau is preparing to resign this week have injected fresh political uncertainty into markets, with some sources suggesting the announcement could come as early as today. Trudeau’s departure would leave the Liberal Party scrambling for a successor ahead of an election due by late October—an election in which current polling points to a likely Conservative victory.

Market Reaction

In currency markets, USD/CAD pulled back from its January peak of 1.4460 as speculation around Trudeau’s resignation gained traction. The move ended a four-day rally in the pair, highlighting how quickly political risk can reverse market momentum.

Technical Outlook

For USD/CAD bulls, the near-term focus is on reclaiming the 100- and 200-hour moving averages clustered around 1.4390. A sustained move above that zone could reestablish upward momentum. On the downside, traders are watching the 1.4335 range low as critical support—any decisive break below could open the door toward 1.4280.

Broader Implications

Analysts note that Trudeau’s resignation could mark a turning point in Canada’s political and economic trajectory, potentially shifting fiscal and trade policy under a new government. For markets, this uncertainty is likely to translate into higher volatility in the Canadian dollar over the coming weeks.