Pelosi’s Nvidia Stock Sale Raises Eyebrows Amid Market Decline and Legislative Ties

05 September 2022

173 views

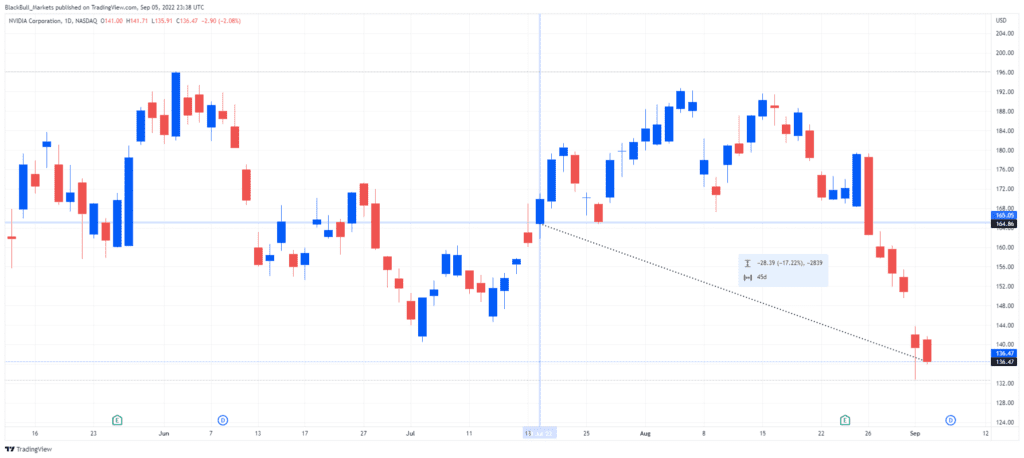

Recent stock transactions by U.S. House Speaker Nancy Pelosi and her husband, Paul Pelosi, have once again drawn public scrutiny, particularly regarding their investment in Nvidia (NASDAQ: NVDA). The couple sold 25,000 shares of the semiconductor giant in July, valued between $1 million and $5 million. The shares were sold at $165.05 each, resulting in a loss of $340,000. However, this sale proved to be a timely decision, as Nvidia’s stock plunged 18.3% on September 1st, a drop that would have cost the Pelosis an additional $753,000 had they not reduced their holdings.

Nancy Pelosi, the first female Speaker of the U.S. House of Representatives and second in line to the presidency, frequently finds her financial dealings in the spotlight due to her prominent public role. The July sale of Nvidia shares, although potentially a savvy investment move, has fueled controversy and speculation, particularly in light of recent legislative and geopolitical developments.

Semiconductor Industry Ties

Paul Pelosi’s initial investment in Nvidia came on June 17, when he exercised 200 call options to purchase shares at $100 each. This transaction, also valued between $1 million and $5 million, occurred as the CHIPS Act was awaiting approval in Congress. The CHIPS Act, signed into law by President Biden in August, is designed to bolster domestic semiconductor manufacturing, design, and research. The law allocates $52 billion for semiconductor incentives and research investments, along with a 25% investment tax credit for manufacturing—a potential boon for companies like Nvidia.

While the timing of Paul Pelosi’s investment raised some eyebrows, New York Post columnist Charles Gasparino referred to it as the “latest home run” for Pelosi, who he claimed has seen significant success in the stock market, particularly with companies that benefit from government legislation. The July sale of Nvidia shares, coming soon after the CHIPS Act gained momentum, has led to speculation that it may have been an attempt to avoid any perceived conflicts of interest.

In addition to the legislative context, Nancy Pelosi’s visit to Taiwan on August 2nd has added another layer of complexity to the situation. The visit, which was met with strong condemnation from China, included a meeting with Mark Liu, chairman of Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest chipmaker.

Broader Investments and Legislative Implications

Beyond Nvidia, the Pelosis hold investments in a variety of public companies. According to Business Insider, their portfolio includes stakes in AllianceBernstein (NYSE: AB), Alphabet (NASDAQ: GOOGL, GOOG), Amazon (NASDAQ: AMZN), American Express (NYSE: AXP), Apple (NASDAQ: AAPL), Micron Technology (NASDAQ: MU), Microsoft (NASDAQ: MSFT), PayPal (NASDAQ: PYPL), Salesforce (NYSE: CRM), Tesla (NASDAQ: TSLA), Visa (NYSE: V), Walt Disney (NYSE: DIS), and Warner Bros. Discovery (NASDAQ: WBD).

Nancy Pelosi’s involvement in these companies has spurred legislative efforts to prohibit members of Congress from trading stocks. After months of resistance, Pelosi recently dropped her opposition to the proposed legislation. Despite being included in Insider’s list of the 25 richest members of Congress, with an estimated net worth of at least $46.1 million, Pelosi has consistently denied any allegations that she uses insider information to guide her husband’s investment decisions.