Mastering Stock Trading: Lesson 2 – Valuation Techniques

19 June 2024

200 views

Introduction to Advanced Valuation

Valuing a stock accurately is crucial for making informed investment decisions. In this lesson, we will cover advanced valuation techniques, including Discounted Cash Flow (DCF) analysis, Comparable Company Analysis, and Precedent Transactions. Understanding these methods will help you determine the intrinsic value of a stock and make better investment choices.

Discounted Cash Flow (DCF) Analysis

What is DCF Analysis?

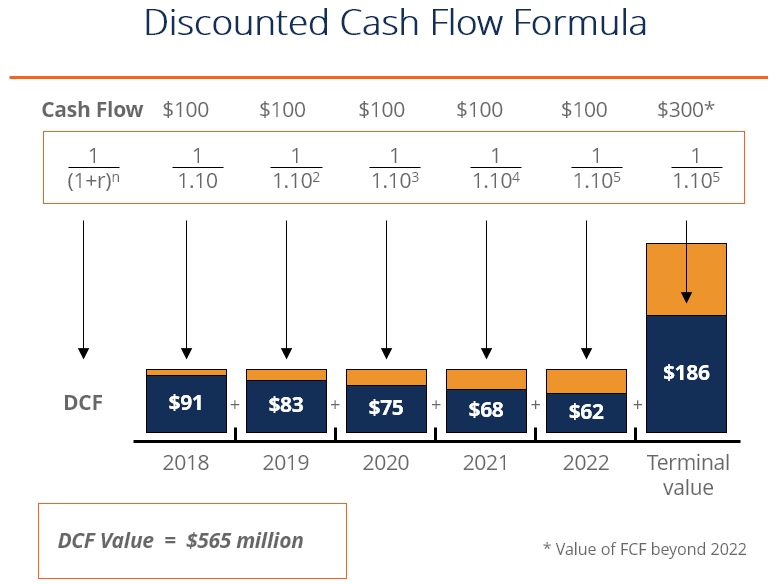

DCF analysis is a valuation method that estimates the value of an investment based on its expected future cash flows. These cash flows are discounted back to their present value using a discount rate, typically the company’s weighted average cost of capital (WACC).

Key Steps in DCF Analysis

- Forecast Cash Flows: Estimate the company’s future cash flows over a specific period, usually 5-10 years.

- Free Cash Flow (FCF): Calculate by subtracting capital expenditures from operating cash flow.

- Determine the Terminal Value: Estimate the value of the company’s cash flows beyond the forecast period.

- Perpetuity Growth Model: Calculate by assuming a constant growth rate of cash flows into perpetuity.

- Discount Cash Flows: Discount the forecasted cash flows and terminal value back to their present value using the WACC.

- Present Value of Cash Flows: Use the formula to discount each year’s cash flow.

- Calculate the Intrinsic Value: Sum the present value of the forecasted cash flows and terminal value to get the total enterprise value. Subtract net debt to find the equity value, then divide by the number of shares outstanding to get the intrinsic value per share.

Practical Application

- Scenario: Valuing Company ABC using DCF analysis.

- Steps:

- Forecast Cash Flows: Estimate ABC’s free cash flow for the next 5 years.

- Terminal Value: Calculate using the perpetuity growth model with a 2% growth rate.

- Discount Cash Flows: Use a WACC of 8% to discount the cash flows and terminal value.

- Calculate Intrinsic Value: Sum the present values, subtract net debt, and divide by shares outstanding.

Comparable Company Analysis

What is Comparable Company Analysis?

Comparable Company Analysis involves valuing a company based on the valuation multiples of similar companies in the same industry. This method provides a relative valuation by comparing financial metrics such as P/E, EV/EBITDA, and P/B ratios.

Key Steps in Comparable Company Analysis

- Select Comparable Companies: Identify companies in the same industry with similar business models and size.

- Gather Financial Metrics: Collect financial data and key metrics for the comparable companies.

- Metrics to Consider: Price-to-Earnings (P/E), Enterprise Value-to-EBITDA (EV/EBITDA), Price-to-Book (P/B).

- Calculate Valuation Multiples: Compute the valuation multiples for each comparable company.

- Apply Multiples to the Target Company: Use the average or median multiples to value the target company based on its financial metrics.

Practical Application

- Scenario: Valuing Company XYZ using Comparable Company Analysis.

- Steps:

- Select Comparables: Identify 5 companies similar to XYZ in the same industry.

- Gather Financial Metrics: Collect P/E, EV/EBITDA, and P/B ratios for the comparables.

- Calculate Multiples: Compute the average P/E, EV/EBITDA, and P/B multiples.

- Apply Multiples: Use the average multiples to value XYZ based on its earnings, EBITDA, and book value.

Precedent Transactions Analysis

What is Precedent Transactions Analysis?

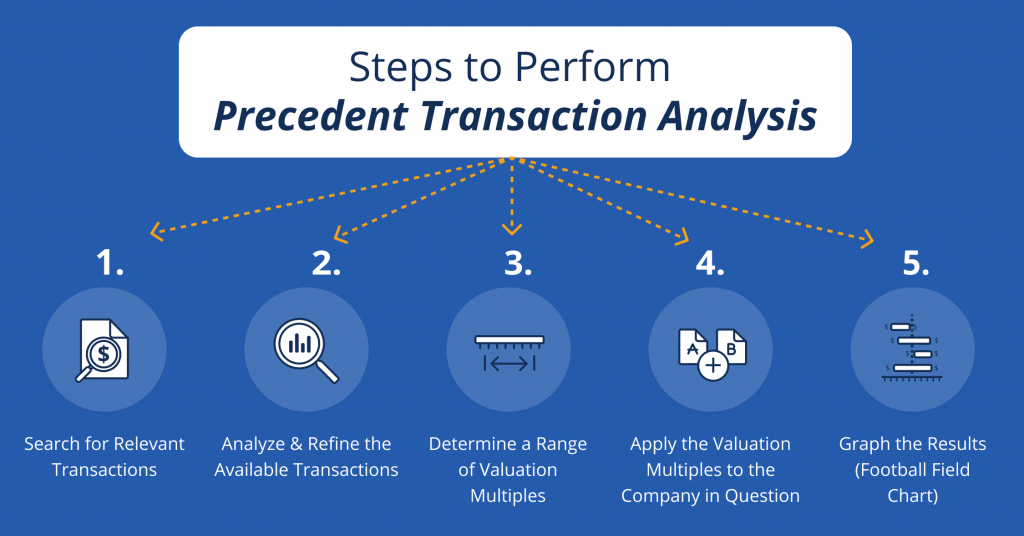

Precedent Transactions Analysis involves valuing a company based on the prices paid for similar companies in past transactions. This method provides insights into market trends and the premium paid for control in mergers and acquisitions.

Key Steps in Precedent Transactions Analysis

- Select Precedent Transactions: Identify similar transactions in the same industry with comparable characteristics.

- Gather Transaction Details: Collect data on transaction values, financial metrics, and valuation multiples.

- Metrics to Consider: Transaction value-to-revenue (TV/Revenue), transaction value-to-EBITDA (TV/EBITDA).

- Calculate Valuation Multiples: Compute the multiples paid in each transaction.

- Apply Multiples to the Target Company: Use the average or median multiples to value the target company based on its financial metrics.

Practical Application

- Scenario: Valuing Company DEF using Precedent Transactions Analysis.

- Steps:

- Select Precedent Transactions: Identify 3 recent transactions involving companies similar to DEF.

- Gather Transaction Details: Collect TV/Revenue and TV/EBITDA multiples from the transactions.

- Calculate Multiples: Compute the average TV/Revenue and TV/EBITDA multiples.

- Apply Multiples: Use the average multiples to value DEF based on its revenue and EBITDA.

Example

- DCF Analysis Example:

- Company ABC: Estimated free cash flows of $10 million annually for the next 5 years, terminal value calculated with a 2% growth rate, and discounted using an 8% WACC.

- Intrinsic Value: Summed present values of cash flows and terminal value to get an enterprise value of $120 million. Subtracted $20 million in net debt, resulting in an equity value of $100 million. With 10 million shares outstanding, the intrinsic value per share is $10.

- Comparable Company Analysis Example:

- Company XYZ: Average P/E multiple of 15x, EV/EBITDA multiple of 10x, and P/B multiple of 2x from comparables.

- Valuation: Applied multiples to XYZ’s financial metrics, resulting in a valuation range of $50-$60 per share.

- Precedent Transactions Analysis Example:

- Company DEF: Average TV/Revenue multiple of 3x and TV/EBITDA multiple of 8x from recent transactions.

- Valuation: Applied multiples to DEF’s revenue and EBITDA, resulting in a valuation of $200 million.

Conclusion

Advanced valuation techniques such as DCF analysis, Comparable Company Analysis, and Precedent Transactions Analysis are essential tools for determining the intrinsic value of stocks. By mastering these methods, you can make more informed investment decisions and better assess the true value of potential investments.