Mastering Stock Trading: Lesson 1 – Fundamental Analysis

29 May 2024

203 views

Introduction to Advanced Fundamental Analysis

In this advanced course, we’ll delve deeper into sophisticated techniques of fundamental analysis, focusing on understanding economic moats, analyzing management quality, and conducting competitive analysis. These insights are crucial for making well-informed investment decisions and identifying long-term winners in the stock market.

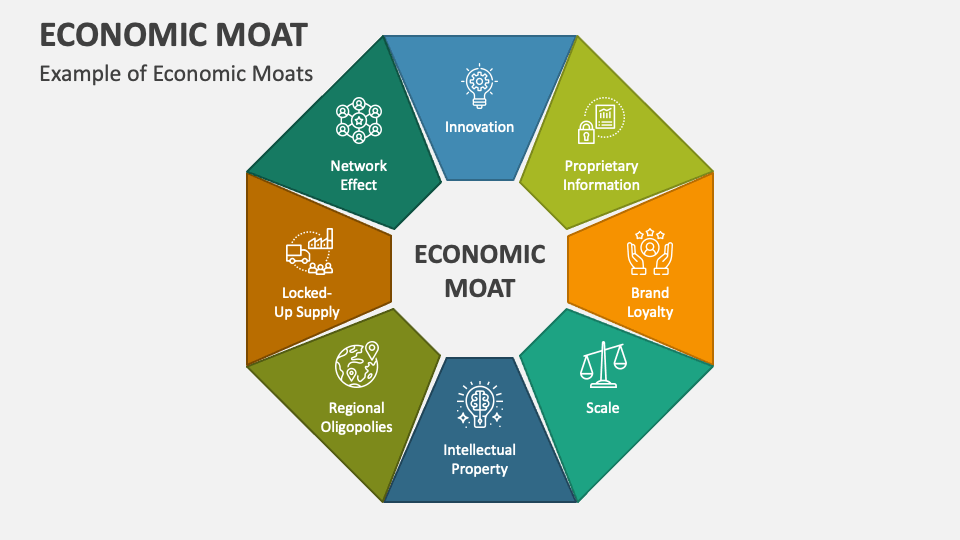

Understanding Economic Moats

What is an Economic Moat?

An economic moat refers to a company’s ability to maintain a competitive advantage over its rivals, protecting its market share and profitability in the long term. Companies with strong moats are better positioned to fend off competitors and sustain growth.

Types of Economic Moats

- Cost Advantage: The ability to produce goods or services at a lower cost than competitors, allowing for competitive pricing and higher margins.

- Example: Walmart’s efficient supply chain and economies of scale.

- Intangible Assets: Patents, trademarks, brand recognition, and regulatory licenses that create barriers to entry.

- Example: Coca-Cola’s brand value and secret formula.

- Switching Costs: High costs or inconvenience for customers to switch to a competitor.

- Example: Adobe’s suite of software tools integrated into the workflows of creative professionals.

- Network Effects: The value of a product or service increases as more people use it, creating a self-reinforcing competitive advantage.

- Example: Facebook’s social network where more users attract even more users.

- Efficient Scale: Serving a niche market with little room for competitors.

- Example: Utility companies in specific geographic areas.

Analyzing Management Quality

Importance of Management Quality

The quality of a company’s management team is crucial for its success. Effective management can navigate challenges, drive growth, and create shareholder value.

Key Factors to Consider

- Track Record: Evaluate the past performance of the management team.

- Look for: Consistent revenue and earnings growth, successful strategic initiatives, and strong return on equity (ROE).

- Capital Allocation: Assess how management allocates capital, including investments in growth, dividends, and share buybacks.

- Look for: Sensible capital allocation decisions that enhance shareholder value.

- Corporate Governance: Review the company’s governance practices, including board composition, executive compensation, and shareholder rights.

- Look for: Transparent governance practices and alignment of management’s interests with those of shareholders.

- Communication and Transparency: Evaluate the quality and transparency of management’s communication with investors.

- Look for: Clear, consistent, and honest communication in earnings calls, annual reports, and press releases.

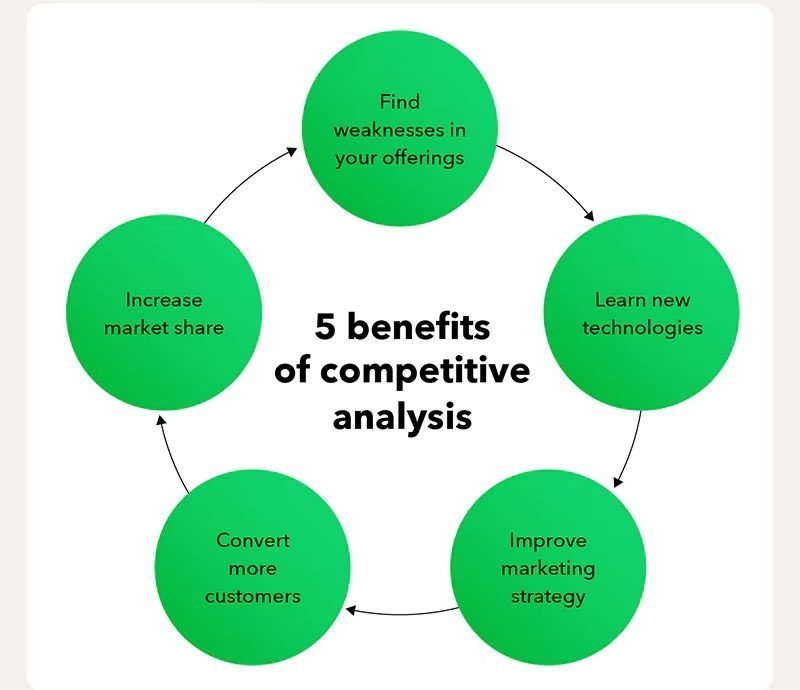

Conducting Competitive Analysis

Importance of Competitive Analysis

Competitive analysis helps you understand a company’s position within its industry and its ability to sustain its competitive advantage. This analysis involves assessing the strengths and weaknesses of both the company and its competitors.

Key Factors to Consider

- Market Share: Evaluate the company’s market share relative to its competitors.

- Look for: Companies with stable or growing market share.

- Product Differentiation: Assess the uniqueness and quality of the company’s products or services compared to competitors.

- Look for: Strong product differentiation that appeals to customers.

- Cost Structure: Compare the cost structure of the company with its competitors.

- Look for: Lower cost structures that provide a competitive pricing advantage.

- Innovation and R&D: Assess the company’s investment in research and development (R&D) and its track record of innovation.

- Look for: Companies with a strong pipeline of new products and technologies.

- Customer Loyalty: Evaluate customer loyalty and brand strength.

- Look for: High customer retention rates and strong brand equity.

Practical Application

- Scenario: You are evaluating Company XYZ for a potential long-term investment.

- Steps:

- Economic Moat: Identify and assess the type of economic moat that XYZ possesses.

- Management Quality: Evaluate the management team’s track record, capital allocation decisions, corporate governance, and communication transparency.

- Competitive Analysis: Conduct a competitive analysis to understand XYZ’s position within its industry.

Example

- Company XYZ:

- Economic Moat: Strong brand recognition and patents on key technologies.

- Management Quality: Experienced management team with a history of successful product launches and sensible capital allocation.

- Competitive Analysis: Leading market share in its industry, strong product differentiation, and a robust pipeline of innovative products.

- Conclusion: Company XYZ demonstrates a strong economic moat, high-quality management, and a favorable competitive position, making it a promising long-term investment.

Conclusion

Mastering advanced fundamental analysis involves understanding economic moats, evaluating management quality, and conducting thorough competitive analysis. These skills are essential for identifying companies with sustainable competitive advantages and long-term growth potential.