Futures Curve and Term Structure Trading: Contango, Backwardation, and Spreads

12 November 2025

167 views

Level: Advanced / Pro

Core Concept: The futures curve, or term structure, is the plot of futures prices across different contract maturities for a single commodity or index. Its shape—specifically whether it is in contango or backwardation—is not random noise; it reflects the market’s fundamental expectations, inventory levels, and carrying costs. Advanced traders utilize this structure to generate returns through calendar spread trading and by understanding the inherent cost or benefit of the roll yield.

What is Term Structure and How to Read It

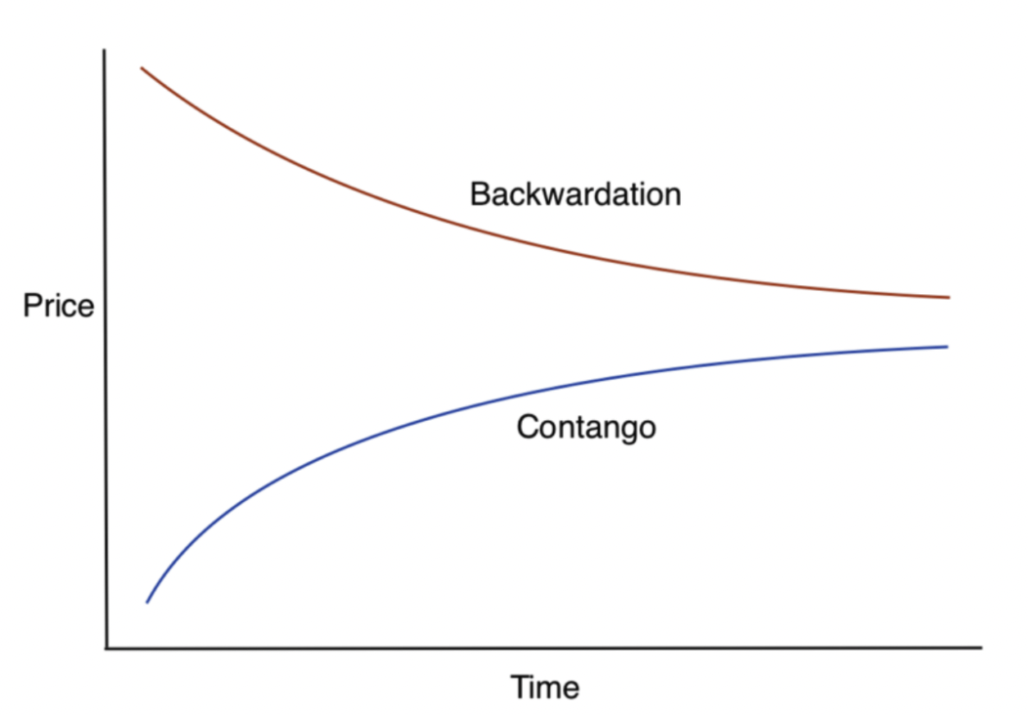

The term structure is a visual representation of the prices of futures contracts for a specific underlying asset, arranged sequentially by their expiration date.

- Axis: Price is plotted on the Y-axis, and time (expiration date) is plotted on the X-axis.

- Fundamental Value: The price of the nearest expiration contract is typically the closest reflection of the current spot price (the cash market price). Prices for contracts further out represent the market’s expected price at that future date.

- Market Interpretation: The shape of the curve provides immediate insight into the balance between supply, demand, inventory levels, and carrying costs (storage, insurance, financing).

Contango vs. Backwardation: Causes and Consequences

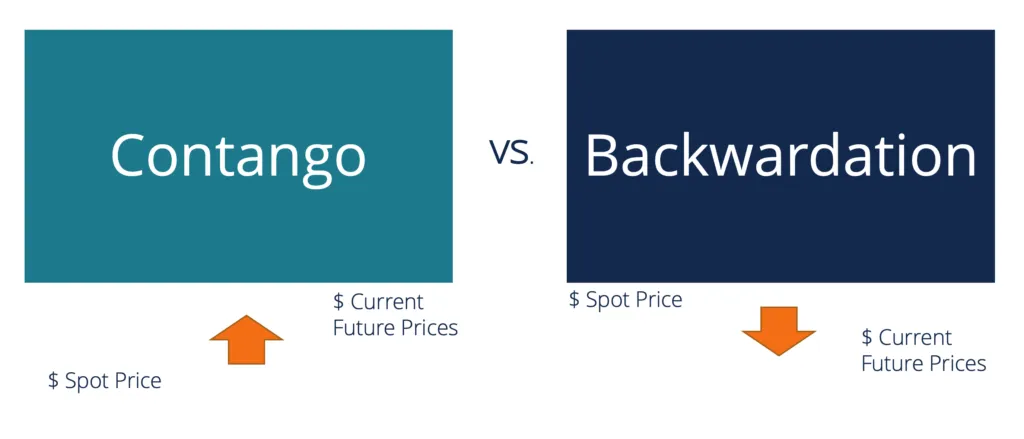

The relationship between the near-term price and the far-term price defines the market’s state.

Contango

Definition: A market is in Contango when the futures price of a contract is higher than the current spot price, and contracts further out are progressively more expensive than those closer to expiration.

- Cause: This is the normal market structure, especially in storable commodities (like gold, oil). The difference in price represents the cost of carry—the expenses incurred for storing, insuring, and financing the physical commodity until the future delivery date.

- Consequences for Traders: Contango is detrimental to traders who continuously buy the nearest contract and roll it forward, as they are constantly selling the near, cheaper contract and buying the next, more expensive contract.

Backwardation

Definition: A market is in Backwardation when the futures price is lower than the current spot price, and contracts further out are progressively cheaper than those closer to expiration.

- Cause: Backwardation is considered an abnormal structure. It typically signals a shortage or very high current demand for immediate delivery. Buyers are willing to pay a premium for immediate supply because current inventory levels are low (e.g., immediate necessity outweighs the cost of storing it later).

- Consequences for Traders: Backwardation is favorable for continuous long positions, as the rolling process results in a net gain.

Calendar Spreads: Long/Short Different Maturities

Calendar spread trading is a core strategy that exploits perceived mispricing or expected changes in the term structure. It is a lower-risk, directional-neutral strategy compared to outright directional futures trading.

- Mechanism: A calendar spread involves simultaneously buying one futures contract (e.g., the near month) and selling another futures contract (e.g., a deferred month) on the same underlying asset. The trade profits not from the direction of the underlying price, but from the change in the spread between the two contracts.

- Contango Spread Trade: If a trader believes the Contango is too wide, they might sell the deferred month and buy the near month, betting the spread will narrow.

- Backwardation Spread Trade: If a trader believes the Backwardation is too steep, they might buy the deferred month and sell the near month, betting the scarcity will ease and the spread will narrow.

- Risk Mitigation: Since the trader is long and short the same asset, the trade is less sensitive to sharp directional price swings in the underlying commodity or index.

Roll Yield: The Cost or Benefit of Holding Futures

Roll Yield is the profit or loss generated when a trader closes out the expiring near-month futures contract and simultaneously opens a position in the next (deferred) contract month to maintain their market exposure.

- The Mechanism: This is the intrinsic cost or benefit of holding a futures position over time.

- In Contango: The trader sells the near, cheaper contract and buys the deferred, more expensive contract. The roll yield is Negative, acting as a continuous drag on returns. This is often called the “cost of carry.”

- In Backwardation: The trader sells the near, more expensive contract (closer to the spot premium) and buys the deferred, cheaper contract. The roll yield is Positive, adding a steady stream of passive income to the directional return.

- Impact on ETFs: This is why commodity ETFs (like those tracking oil or natural gas) often underperform the actual spot price of the commodity over time—they are continuously subject to the negative roll yield inherent in a Contango market structure.

Examples Across Global Markets

Crude Oil (WTI and Brent)

- Typical Structure: Oil is often in Contango because global storage capacity is large, and carrying costs are significant.

- Backwardation Signal: Oil flipping into backwardation is a strong indicator of current supply crunch or geopolitical disruption, signaling immediate demand outweighs future expectations.

Gold and Precious Metals

- Typical Structure: Gold is almost always in Contango because it is cheap and easy to store, and the cost of carry (interest rates lost on capital) is the primary driver of the curve shape.

Grains and Agriculture (e.g., Corn, Soybeans)

- Volatility: These markets can flip between Contango and Backwardation rapidly due to seasonal factors. Backwardation often occurs just before the harvest season (low inventory, high immediate demand), reverting to Contango post-harvest as inventories are replenished.

Index Futures (e.g., S&P 500 E-minis)

- Primary Driver: Index futures are driven primarily by interest rate parity, not physical storage costs. The curve is usually in slight Contango, reflecting the cost of borrowing to buy the underlying assets until the deferred delivery date, minus the expected dividend yield.

- Arbitrage: If the spread deviates significantly from the interest rate differential, cash-and-carry arbitrageurs step in to stabilize the spread.

Conclusion

The futures curve is far more than a simple pricing tool; it is a real-time diagnostic map of supply, demand, and market expectations. The sophisticated trader must look beyond the immediate spot price and understand the implications of the term structure. Recognizing whether the market is in contango (normal state, defined by carrying costs) or backwardation (abnormal state, defined by immediate scarcity) provides a powerful fundamental edge. Mastery of the curve allows for the implementation of calendar spread strategies, which seek to profit from the narrowing or widening of the time-based price difference. Ultimately, understanding the roll yield transforms continuous futures exposure from a simple directional bet into a trade where the inherent cost (in contango) or benefit (in backwardation) is fully integrated into the profit equation. This knowledge is essential for capital-efficient trading and managing the hidden expenses of long-term commodity exposure.