Forex Mastery: Lesson 1 – Trading Strategies

17 November 2023

220 views

Introduction to Advanced Trading Strategies

Advanced trading strategies combine multiple technical and fundamental analysis techniques to identify high-probability trading opportunities. These strategies require a deep understanding of market dynamics and the ability to analyze complex data.

Price Action Trading

Price action trading involves making trading decisions based on the price movements of a currency pair, without relying on indicators. This strategy focuses on interpreting price patterns and market sentiment.

Key Concepts

- Candlestick Patterns: Recognize patterns like pin bars, engulfing candles, and inside bars to predict price movements.

- Support and Resistance: Identify key levels where the price tends to reverse or consolidate.

- Trend Lines: Draw trend lines to identify the direction and strength of a trend.

Carry Trade Strategy

The carry trade strategy involves borrowing a currency with a low-interest rate and using it to buy a currency with a higher interest rate. The goal is to profit from the interest rate differential, known as the “carry.”

Key Concepts

- Interest Rate Differentials: Identify pairs with significant interest rate differences.

- Risk Management: Manage the risk of currency fluctuations that can offset the interest gains.

Example

If the Japanese yen has a low-interest rate and the Australian dollar has a high-interest rate, a trader could borrow yen to buy Australian dollars, earning the interest rate differential as profit.

Advanced Ichimoku Cloud Strategy

The Ichimoku Cloud, or Ichimoku Kinko Hyo, is a comprehensive indicator that provides information about trend direction, support and resistance levels, and momentum.

Key Concepts

- Components: Understand the five components of the Ichimoku Cloud (Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span).

- Signals: Identify buy and sell signals based on the interaction of these components.

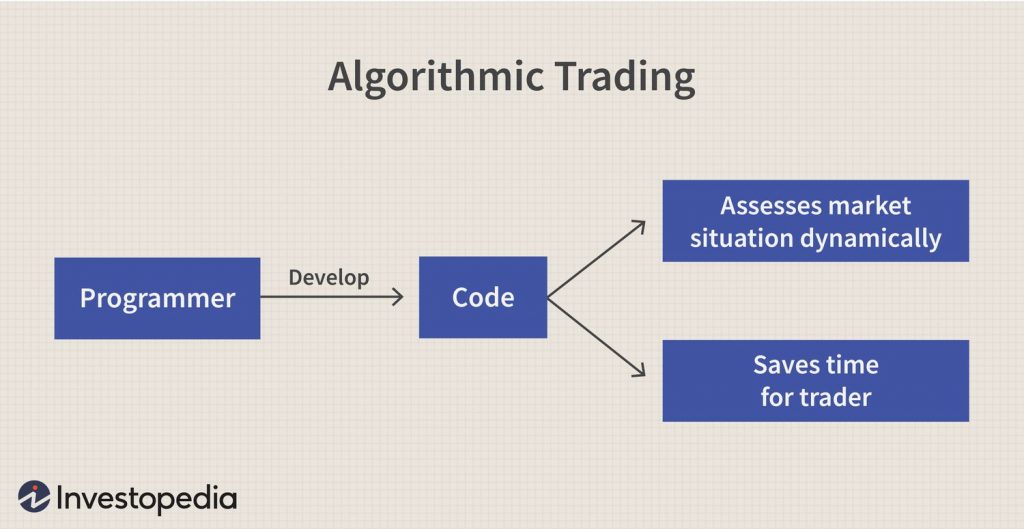

Algorithmic Trading

Algorithmic trading involves using computer algorithms to execute trades based on predefined criteria. This strategy is ideal for traders with programming skills and a deep understanding of market mechanics.

Key Concepts

- Backtesting: Test your algorithm on historical data to evaluate its performance.

- Optimization: Adjust the parameters of your algorithm to improve its profitability.

- Execution: Use reliable trading platforms to execute your algorithm in real-time.

Example

An algorithm might be programmed to:

- Buy a currency pair when the RSI drops below 30 (indicating oversold conditions).

- Sell the currency pair when the RSI rises above 70 (indicating overbought conditions).

Practical Application

- Develop Your Strategy: Choose an advanced strategy that suits your trading style and expertise.

- Backtest: Test your strategy on historical data to validate its effectiveness.

- Paper Trade: Practice your strategy in a demo account to refine your approach without risking real capital.

- Execute with Discipline: Apply your strategy consistently in live trading, adhering to your predefined rules.

Example Scenario

- Scenario: You identify a strong uptrend in the EUR/USD pair using the Ichimoku Cloud.

- Response:

- Confirm the trend with additional indicators (e.g., moving averages, RSI).

- Enter a long position when the price moves above the cloud and the Tenkan-sen crosses above the Kijun-sen.

- Set a stop-loss below the cloud to manage risk.

- Take profit at a predefined resistance level or when the price moves below the Tenkan-sen.

Conclusion

Advanced trading strategies require a deep understanding of market dynamics, technical and fundamental analysis, and disciplined execution. By mastering these strategies, you can enhance your trading performance and increase your profitability.

In the next lesson, we will explore advanced risk management techniques and portfolio optimization.