Forex for Beginners: Lesson 4 – Exploring Different Trading Strategies

01 October 2023

195 views

In this lesson, we will dive into various trading strategies that traders use to navigate the forex market. By understanding these strategies, you’ll be able to select the one that best suits your trading style and objectives.

Introduction to Trading Strategies

A trading strategy is a set of rules and guidelines that a trader follows to make decisions about entering and exiting trades. Effective strategies often combine technical and fundamental analysis, risk management, and a clear understanding of market conditions. Let’s explore some popular trading strategies used in the forex market.

Scalping

What is Scalping?

Scalping is a short-term trading strategy that involves making numerous trades throughout the day to capture small price movements. Scalpers aim to profit from minimal changes in currency prices, often holding positions for just a few minutes.

Key Characteristics

– High Frequency: Scalpers execute a large number of trades daily.

– Short Holding Period: Positions are held for a very short time.

– Low Profit Margins: Profits per trade are small but accumulate over many trades.

Tools and Techniques

– Technical Indicators: Scalpers often use indicators like the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) to identify entry and exit points.

– Quick Execution: A reliable and fast trading platform is crucial for executing trades promptly.

Day Trading

What is Day Trading?

Day trading involves buying and selling currency pairs within the same trading day. Day traders aim to profit from short-term market movements, closing all positions before the end of the trading day to avoid overnight risk.

Key Characteristics

– No Overnight Risk: Positions are closed before the market closes for the day.

– Moderate Holding Period: Positions may be held from minutes to hours.

– Active Monitoring: Day traders need to monitor the market continuously.

Tools and Techniques

– Economic News: Day traders often rely on economic news and data releases to inform their trading decisions.

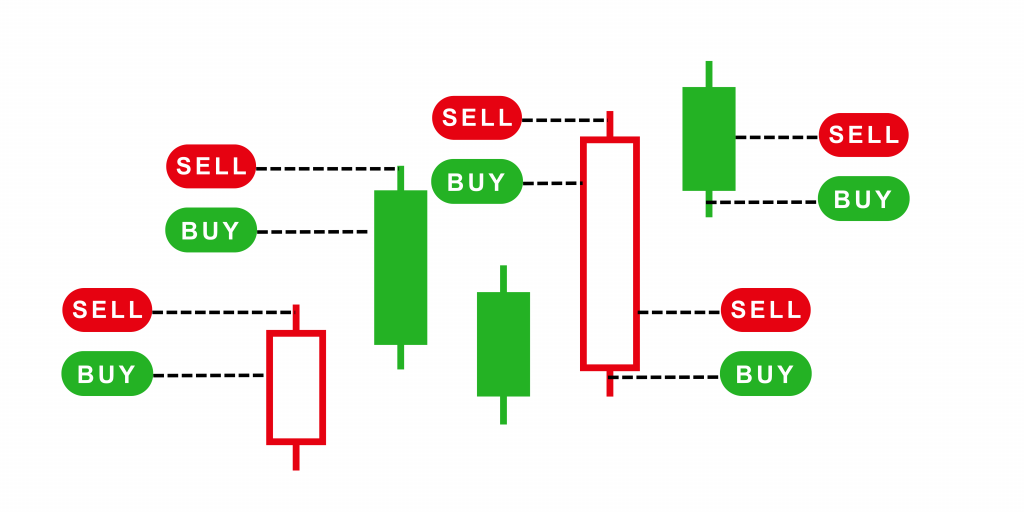

– Technical Analysis: Chart patterns and indicators like Bollinger Bands and Moving Averages are used to make trading decisions.

Swing Trading

What is Swing Trading?

Swing trading focuses on capturing short- to medium-term price movements. Swing traders typically hold positions for several days to weeks, aiming to profit from price “swings” or fluctuations.

Key Characteristics

– Medium Holding Period: Positions are held from a few days to several weeks.

– Less Frequent Trading: Fewer trades compared to scalping or day trading.

– Trend Analysis: Swing traders analyze both technical and fundamental factors to identify potential trade opportunities.

Tools and Techniques

– Trend Indicators: Tools like moving averages and trendlines help identify the direction of the market trend.

– Chart Patterns: Patterns such as head and shoulders and double tops/bottoms are used to predict potential price movements.

Position Trading

What is Position Trading?

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. Position traders base their trades on long-term trends and fundamental factors rather than short-term price movements.

Key Characteristics

– Long-Term Horizon: Positions are held for an extended period.

– Low Trading Frequency: Fewer trades, with a focus on long-term trends.

– Fundamental Analysis: Emphasis on economic indicators and geopolitical events.

Tools and Techniques

– Economic Reports: Long-term trends are often influenced by major economic reports and events.

– Technical Analysis: Long-term charts and trend analysis are used to determine entry and exit points.

Developing Your Trading Strategy

Personalization

Choosing the right strategy depends on your trading style, risk tolerance, and time commitment. Consider your personal preferences and schedule when selecting a strategy. For instance, if you prefer short-term trading and can monitor the market frequently, scalping or day trading might suit you. If you prefer a less active approach, swing or position trading could be a better fit.

Risk Management

Regardless of the strategy you choose, effective risk management is essential. Always use stop-loss orders to protect your capital and avoid over-leveraging. Define your risk-reward ratio for each trade and ensure that you adhere to your trading plan.

Continuous Learning

Forex trading is dynamic, and market conditions can change rapidly. Continuously educate yourself, practice your strategies in a demo account, and adapt to evolving market conditions to enhance your trading skills.

Conclusion

In this lesson, we explored various trading strategies, including scalping, day trading, swing trading, and position trading. Each strategy has its unique characteristics, and selecting the right one depends on your individual trading style and goals.