Forex for Beginners: Lesson 1 – Understanding the Basics of Forex Trading

28 June 2023

264 views

Welcome to the first lesson of Forex for Beginners! In this course, we will guide you through the fundamental concepts of forex trading. By the end of this lesson, you will have a solid foundation to build upon as you delve deeper into the exciting world of forex.

What is Forex Trading?

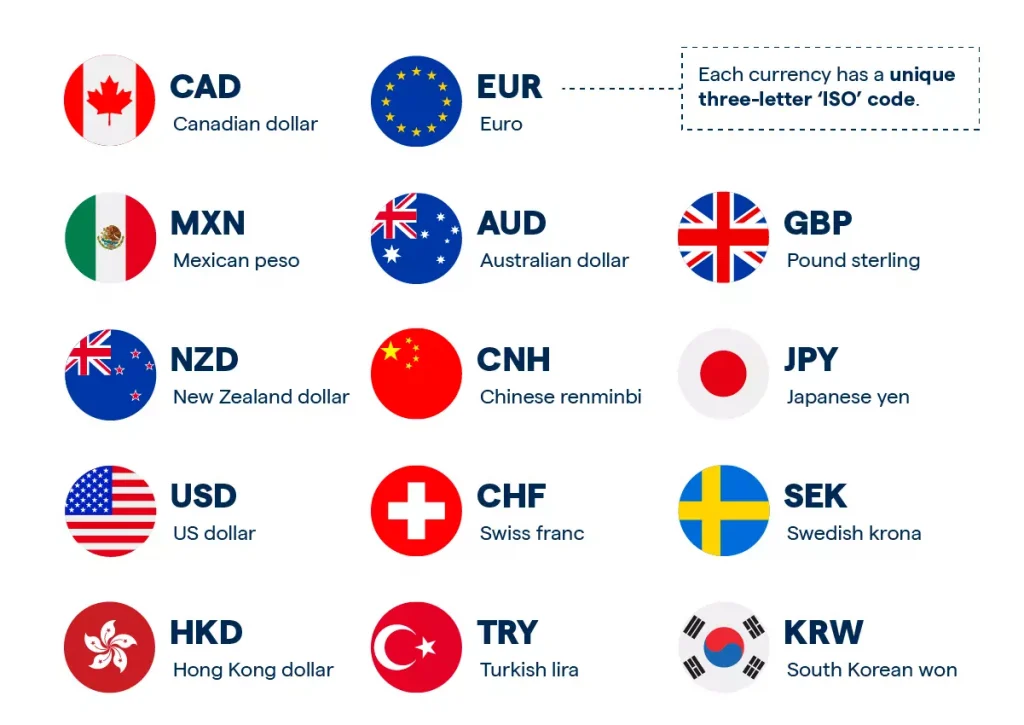

Forex, short for “foreign exchange,” refers to the global marketplace for buying and selling currencies. Unlike stock markets, forex operates 24 hours a day, five days a week, allowing traders to engage in currency trading anytime.

How Forex Trading Works

Forex trading involves exchanging one currency for another with the aim of making a profit. For example, if you believe the value of the Euro (EUR) will increase against the US Dollar (USD), you would buy EUR/USD. If the value of EUR/USD goes up, you can sell it at a higher price, earning a profit.

Key Terminology in Forex

Currency Pairs

In forex trading, currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is known as the “base currency,” and the second is the “quote currency.” The price of the currency pair reflects how much of the quote currency is needed to buy one unit of the base currency.

Bid and Ask Prices

– Bid Price: The price at which the market will buy a currency pair from you.

– Ask Price: The price at which the market will sell a currency pair to you.

– Spread: The difference between the bid and ask prices. This represents the cost of trading.

Pips and Lots

– Pip: The smallest price movement in a currency pair, usually measured to the fourth decimal place (e.g., 0.0001 for EUR/USD).

– Lot: A standard unit of trading volume. There are different types of lots:

– Standard Lot: 100,000 units

– Mini Lot: 10,000 units

– Micro Lot: 1,000 units

Market Participants

The forex market comprises various participants, including:

– Banks and Financial Institutions: Major players that engage in large-scale trades.

– Retail Traders: Individual traders who participate in forex trading via online platforms.

– Corporations: Companies involved in international business and currency exchange for operational needs.

Market Hours

Forex operates around the clock, starting in Sydney, followed by Tokyo, London, and New York. The market opens on Sunday evening (GMT) and closes on Friday night (GMT), with peak trading hours occurring when major financial centers overlap.

Basic Trading Strategies

Trend Following

Trend following involves identifying and trading in the direction of the prevailing market trend. Tools such as moving averages and trend lines can help you spot trends.

Range Trading

Range trading involves buying and selling currency pairs within a defined price range. Traders use support and resistance levels to determine entry and exit points.

Risk Management

Effective risk management is crucial for success in forex trading. Always set stop-loss orders to limit potential losses and never risk more than you can afford to lose.

Conclusion

In this lesson, we’ve covered the basics of forex trading, including key terminology, market structure, and how to get started. Understanding these fundamentals will help you build a strong foundation for further learning and successful trading.