Forex Advanced: Lesson 3 – Trading Psychology and Developing a Winning Mindset

19 April 2024

229 views

The Importance of Trading Psychology

Trading psychology refers to the emotional and mental state of a trader, which can significantly influence trading decisions. Understanding and managing your emotions is crucial for consistent success in forex trading.

Common Psychological Pitfalls

- Fear and Greed: Fear can lead to missed opportunities or premature exits from trades, while greed can result in overtrading or holding losing positions too long.

- Overconfidence: After a series of wins, traders may become overconfident, leading to risky trades and significant losses.

- Revenge Trading: Trying to recover losses quickly can result in irrational decision-making and further losses.

- Analysis Paralysis: Overanalyzing market data can lead to indecision and missed trading opportunities.

Developing Emotional Discipline

- Stick to Your Plan: Follow your trading plan rigorously to avoid impulsive decisions.

- Accept Losses: Understand that losses are part of trading. Accept them gracefully and learn from them.

- Set Realistic Goals: Avoid setting unrealistic profit targets. Set achievable goals based on your trading strategy.

- Take Breaks: Step away from trading if you feel overwhelmed or emotionally charged.

Creating a Positive Trading Environment

- Dedicated Workspace: Set up a quiet, organized, and comfortable trading environment free from distractions.

- Routine and Structure: Establish a daily routine that includes market analysis, trading, and review sessions.

- Healthy Lifestyle: Maintain a healthy lifestyle with proper sleep, nutrition, and exercise to keep your mind sharp.

Mindfulness and Stress Management Techniques

- Meditation: Practice meditation to improve focus and reduce stress.

- Deep Breathing: Use deep breathing exercises to calm your mind during high-stress situations.

- Visualization: Visualize successful trades and positive outcomes to build confidence.

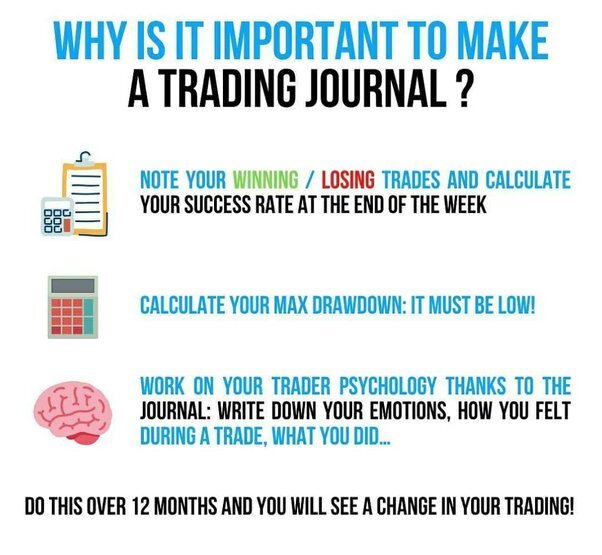

Keeping a Trading Journal

Maintaining a trading journal helps track your trades and reflect on your performance. Include the following in your journal:

- Trade Details: Record entry and exit points, position size, and the rationale behind each trade.

- Emotional State: Note your emotional state before, during, and after each trade.

- Performance Review: Regularly review your journal to identify patterns, strengths, and areas for improvement.

Developing a Resilient Mindset

- Learn from Mistakes: View mistakes as learning opportunities. Analyze what went wrong and how to avoid similar mistakes in the future.

- Stay Flexible: Be adaptable to changing market conditions. Modify your strategies based on new information.

- Patience and Perseverance: Understand that trading success takes time and persistence. Stay patient and committed to your long-term goals.

Practical Application

- Identify Triggers: Recognize what emotions or situations trigger impulsive trading decisions.

- Implement Techniques: Use stress management and mindfulness techniques to maintain emotional discipline.

- Review and Reflect: Regularly review your trading journal to understand your emotional responses and improve your trading behavior.

Example Scenario

- Scenario: You experience a series of losses and feel the urge to enter a high-risk trade to recover losses quickly.

- Response:

- Take a deep breath and step away from your trading station.

- Review your trading plan and remind yourself of your risk management rules.

- Reflect on your recent trades in your journal to understand what went wrong.

- Return to trading with a clear mind and a focus on following your plan.

Conclusion

Trading psychology plays a vital role in forex trading success. By understanding common psychological pitfalls, developing emotional discipline, and maintaining a positive trading environment, you can cultivate a winning mindset. Remember to use mindfulness and stress management techniques to stay focused and resilient.

This concludes the Forex 202: Intermediate Forex Tutorial course. We hope these lessons have provided you with valuable insights and advanced strategies to enhance your trading skills. Continue learning, practicing, and refining your approach to achieve long-term success in the forex market.