How to Build a Balanced Copy Trading Portfolio for Consistent Returns

21 mayo 2025

234 views

How to Build a Balanced Copy Trading Portfolio for Consistent Returns

For many beginners, Copy Trading seems simple: find a successful trader, copy their moves, and watch your profits grow.

But what happens when that trader hits a losing streak, changes their strategy, or faces unexpected market volatility? Relying on a single trader is like putting your entire investment in one stock — it leaves you exposed to unnecessary risk.

A truly smart investor doesn’t just copy one trader — they build a portfolio of traders and strategies that balance each other out. This approach, known as Copy Trading diversification, helps you reduce risk, smooth out returns, and stay consistent through all market conditions. In other words: you’re not copying a trader — you’re building an ecosystem of strategies.

Understanding the Concept of a Diversified Copy Trading Portfolio

Before you start diversifying, it’s essential to understand what a Copy Trading portfolio actually is. Unlike a traditional investment portfolio, your Copy Trading portfolio is built from people — traders with their own strategies, risk profiles, and decision-making styles.

Think of each trader as a separate “asset.” Your goal is to combine them in a way that reduces overall risk and creates a smoother profit curve.

A strong Copy Trading portfolio includes:

- Multiple traders with different levels of risk and trading styles.

- Smart allocation of capital among them.

- Cross-market exposure — Forex, commodities, crypto, or indices.

- Non-correlated performance — so one trader’s loss doesn’t drag down the whole account.

In essence, you’re building a multi-strategy investment system, where each trader contributes a unique strength.

Key Takeaway: Don’t put all your trust — or your capital — into a single trader. A diversified approach gives you protection, flexibility, and consistency.

Step 1: Define Your Investment Goals and Risk Appetite

The foundation of a balanced portfolio is clarity. Before selecting any trader, define your objectives and limits.

Ask yourself:

-

Am I looking for steady passive income or high growth?

-

How much drawdown am I emotionally and financially comfortable with?

-

Am I okay with small but consistent returns, or do I prefer taking calculated risks for higher profit?

These answers define your risk tolerance — the cornerstone of portfolio design.

Risk Profile Examples

Conservative Investor

-

Primary Focus: Capital Preservation.

-

Strategy Characteristics: Stable, low-volatility, long-term strategies.

-

Example Allocation: 60% low-risk traders, 30% medium risk, 10% high risk.

Aggressive Investor

-

Primary Focus: High Growth Potential.

-

Strategy Characteristics: Higher returns, accepting larger drawdowns, short-term or high-leverage trading.

-

Example Allocation: 40% high risk, 40% medium, 20% low risk.

Balanced Investor

-

Primary Focus: Growth and Safety.

-

Strategy Characteristics: Combines stability and moderate growth across different timeframes.

-

Example Allocation: 50% moderate-risk traders, 30% conservative, 20% opportunistic.

Once you understand your risk tolerance, you can start selecting traders who align with it—not just emotionally, but statistically.

Pro Tip: Define your goal before you define your traders. Your portfolio should serve you, not the other way around.

Step 2: Select Traders with Complementary Strategies

Most investors mistakenly pick several traders with similar styles (e.g., all high-frequency scalpers in Forex). When volatility spikes, their trades often fail simultaneously. A balanced Copy Trading portfolio is built on strategic contrast.

Look for diversity across:

1. Asset Classes

Choose traders who operate in different markets — Forex, indices, commodities, stocks, or crypto. When one sector underperforms, another may balance it out.

-

Example: Combine a Forex swing trader, a gold-focused commodities trader, and a crypto trend-follower.

2. Trading Timeframes

Mix short-term and long-term strategies:

-

Scalpers and Day Traders bring frequent, small profits but higher noise.

-

Swing or Position Traders offer steadier, more predictable returns over time.

3. Risk Behavior and Drawdown Patterns

Study each trader’s maximum drawdown and recovery time. The goal is to blend these patterns so your portfolio always has “steady performers” to offset temporary declines in riskier accounts.

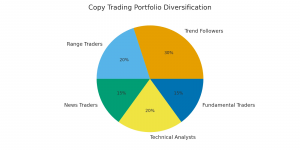

4. Strategy Type and Style

Ensure that the traders’ methods don’t fully overlap.

-

A trend-following strategy pairs well with a mean-reversion one.

-

A technical analyst complements a news/event-driven trader.

Key Insight: True balance comes not from the number of traders you copy, but from how differently they behave when the market changes.

Step 3: Determine Allocation and Position Sizing

The next critical step is deciding how much capital to assign to each trader. Allocation determines both your return potential and risk exposure.

Effective Allocation Frameworks

Equal Weighting

- Description: Each trader receives the same portion of capital (e.g., 20% for five traders).

- Best For: Beginners or those prioritizing simplicity and low maintenance.

Risk-Adjusted Weighting

- Description: Allocate more to traders with stable returns and lower volatility; less to high-drawdown profiles.

- Best For: Long-term consistency and professional portfolio structuring.

Performance-Based

- Description: Rebalance allocations periodically based on actual sustained results (increase weight of consistent performers).

- Best For: Experienced investors who commit to fixed, scheduled reviews.

Diversification Ratios by Risk Category

A common starting point is a ratio based on your risk tolerance:

-

50% stable / low-risk traders (long-term, steady growth)

-

30% moderate-risk traders (balanced performers)

-

20% high-risk traders (potential growth drivers)

Common Allocation Mistakes to Avoid

-

Do not assign large portions based purely on a trader’s confidence or short-term gains.

-

Avoid copying multiple traders who use the same strategy or instrument — this cancels diversification.

-

Never invest 100% of your funds; keep 10–15% as liquidity reserve for reallocation or emergencies.

Key Takeaway: Allocation is where psychology meets mathematics — your confidence in a trader should never exceed the logic of your portfolio.

Step 4: Monitor, Analyze, and Rebalance Regularly

Building a balanced portfolio isn’t a one-time task — it’s an ongoing process. Without regular monitoring, even the best-designed portfolio can drift out of balance.

Set a Monitoring Routine

Establish a clear review schedule to avoid emotional reactions:

-

Weekly: Check open trades and major drawdowns.

-

Monthly: Analyze performance consistency.

-

Quarterly: Evaluate overall portfolio balance and correlations.

Key Metrics to Analyze

When reviewing, focus on measurable indicators:

-

Maximum Drawdown: To assess risk tolerance.

-

Sharpe or Profit Factor: To evaluate risk-adjusted returns.

-

Correlation Between Traders: To detect when they begin moving too similarly (losing diversification).

When and How to Rebalance

Rebalancing means adjusting your portfolio weights to restore balance after performance shifts. Do it when:

-

A trader’s volatility grows beyond your comfort level.

-

One strategy dominates more than 40–50% of portfolio exposure.

-

A trader’s style changes (e.g., from conservative to aggressive).

Key Takeaway: Your portfolio is a living system. Rebalancing is not about chasing perfection; it’s about keeping harmony between risk and reward.

Step 5: Protect Your Capital — Risk Management Essentials

Capital protection is the cornerstone of sustainable Copy Trading. In this step, you move from diversification to defense.

1. Set Portfolio-Level Loss Limits

Always define a maximum acceptable drawdown for your entire account (e.g., 10–15%). Use platform tools like Copy Stop-Loss (CSL) or equity protection to enforce it automatically.

2. Use Risk Caps per Trader

Don’t let any single trader control too large a portion of your balance.

-

Conservative rule: No single trader > 25% of total capital.

-

For high-risk traders, limit exposure to 10–15%.

3. Diversify by Market Conditions

Combine trend-followers (who profit in strong moves) with range or mean-reversion traders (who thrive in stable markets). This ensures your portfolio performs under both volatile and sideways conditions.

4. Keep a Liquidity Reserve

Hold back 10–15% of your total capital as unallocated funds. This buffer allows you to respond to new opportunities or reinforce the portfolio after a drawdown.

Pro Insight: Risk management isn’t about avoiding loss — it’s about ensuring that no single loss can end your game.

The Role of Smart Automation in Portfolio Management

Smart automation tools act as a protective layer between your emotions and your capital, helping you maintain discipline.

How Automation Enhances Portfolio Balance

Automated systems, like those offered by many trading platforms, execute predefined adjustments with precision, applying logic instead of emotion.

Automation can:

-

Filter traders by verified risk-to-reward ratios and drawdowns.

-

Prevent overexposure by capping position sizes automatically.

-

Monitor portfolio health and send alerts when volatility spikes.

Emotional Buffer and Behavioral Stability

By outsourcing repetitive or stressful decisions to automation, you protect yourself from impulsive reactions. AI tools can execute risk management rules faster than emotion ever could, leading to steadier performance.

Pro Tip: Let automation handle precision. You handle perspective.

Common Mistakes When Building a Copy Trading Portfolio

Recognizing these traps early can save you from avoidable losses.

-

Following Popularity, Not Performance: Choosing the “Top Trader” on the leaderboard simply because they have thousands of followers. Popularity ≠ Consistency.

-

Ignoring Correlation: Copying five traders who all trade the same instrument. True balance comes from uncorrelated strategies.

-

No Rebalancing Plan: Failing to review and adjust your portfolio at fixed, objective time intervals.

-

Emotional Decision-Making: Exiting after a single bad month or chasing “hot” new traders. Patience and system thinking always outperform reactionary moves.

-

Over-Diversification: Copying 15–20 traders dilutes profits and increases monitoring complexity. The optimal range is 4–8 carefully selected traders.

-

Ignoring Risk Controls: Starting to copy without setting Copy Stop-Loss (CSL) or allocation caps.

Conclusion — Build Systems, Not Reactions

Building a balanced Copy Trading portfolio is about structuring your thinking. Instead of chasing returns, you design a system that can adapt, evolve, and protect itself through different market cycles.

A good portfolio is not one that avoids losses entirely, but one that absorbs them intelligently. It spreads exposure, blends trading styles, and uses automation to control risk while preserving flexibility.

Remember:

-

Your traders are not your portfolio — your strategy is.

-

Balance is not static — it’s an ongoing discipline.

-

Technology helps you stay structured, but mindset keeps you consistent.

In the long run, the investors who succeed in Copy Trading are those who think like portfolio architects — they don’t react, they build systems.

Final Insight: A balanced Copy Trading portfolio doesn’t chase the market — it adapts to it.