Execution Quality in Copy Trading: Slippage, Latency, and Trade Replication Accuracy

30 octubre 2025

260 views

Level: Advanced

Core Concept: In the perfect world, a copied trade should exactly mirror the Master Trader’s action. However, in real-world trading, the follower’s executed price is often different from the original signal price due to technical factors. This deviation is critical because it directly impacts the follower’s final profit or loss, often leading to performance variance. This lesson explores the hidden technical costs of copy trading and explains how platforms attempt to bridge the gap between the ideal signal and the actual execution.

What is Slippage and Why It Is Higher for Copiers

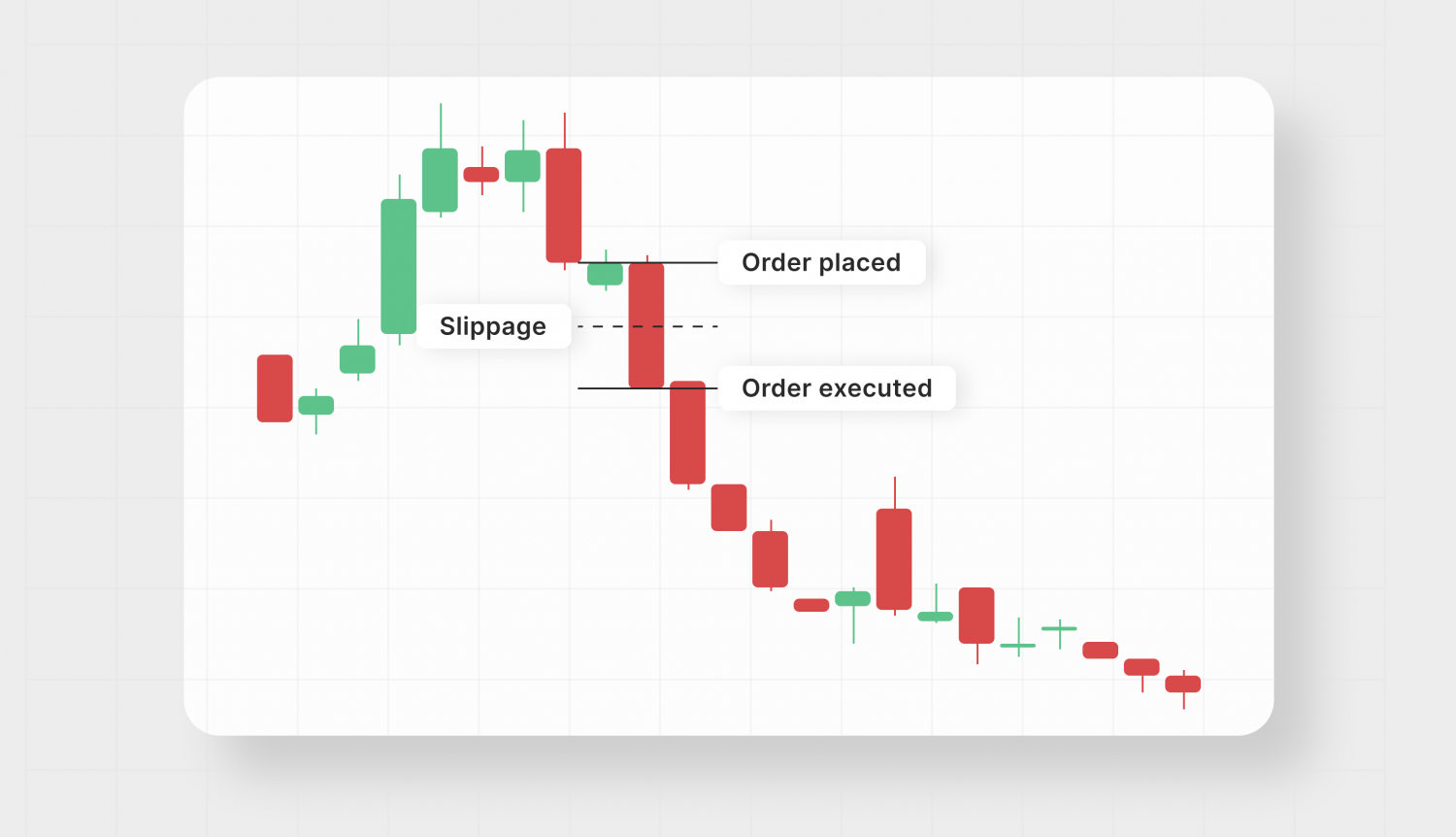

Slippage occurs when a trade is executed at a different price than the intended price. This happens between the time the order is placed and the moment it is filled.

The Mechanism of Slippage

Slippage is the time-delay cost. It is often negligible for professional traders using high-speed infrastructure, but it is amplified in a copy trading environment because of the required chain of events:

- Master Trade Execution: The Master Trader’s order is filled on the server.

- Signal Generation: The platform software identifies the filled trade and generates the copy signal.

- Transmission Delay (Latency): The signal is transmitted from the Master Trader’s server to the Copy Follower’s server.

- Follower Execution: The platform submits the copy trade order on the follower’s behalf.

During the entire duration of steps 2, 3, and 4, the price of the asset continues to move. If the asset moves against the follower before the execution is complete, the copy trade is filled at a worse price. This differential is the slippage.

Amplified Slippage for Copy Followers

Copy followers face inherently higher slippage for two main reasons:

- Fixed Latency: The signal transmission and processing time adds a fixed amount of latency (delay) that the original trader did not have.

- Order Aggregation: Some platforms aggregate copy orders from many followers into larger batches before execution, which, while sometimes beneficial for cost, can increase the chance of negative slippage if the market is moving quickly.

Execution Speed vs. Market Volatility

The relationship between speed and volatility is the defining factor for copy accuracy.

Execution Speed (Latency)

Latency is the delay, usually measured in milliseconds (ms), between the Master Trader’s signal generation and the final execution in the follower’s account.

- Impact: Lower latency (faster execution) directly translates to higher replication accuracy. A platform that executes in 50ms will generally have less slippage than one that executes in 300ms, especially in fast markets.

- What Platforms Control: Platforms invest heavily in server co-location and fast API connections to minimize this delay.

The Role of Volatility

Volatility acts as a multiplier of execution risk.

- Low Volatility: During slow trading periods, latency of a few hundred milliseconds might have minimal impact, as the price barely moves. Slippage is low.

- High Volatility: During news events or sudden market spikes, the price can move several pips within 100ms. In this environment, even a small latency becomes highly problematic, and the follower is likely to be filled at a significantly worse price than the Master.

- The Key Point: The same latency that causes negligible slippage on a calm market can lead to a substantial cost on a volatile market.

Why Two Investors Have Different Results with the Same Trader

It is a common scenario for two investors copying the same Master Trader to have different profit-and-loss (P&L) results. This variance arises from individual account settings and broker mechanics.

Differences in Results are Driven By:

- Follower’s Broker/Liquidity Provider: If the Master Trader and the follower are on different brokers, they use different liquidity pools. The price feed, spread, and available depth of market can vary, leading to different execution prices even if the signal arrives simultaneously.

- Individual Copy Stop-Loss (CSL): One follower might set a CSL of 20%, while another sets 30%. When the Master Trader experiences a drawdown that hits the 20% limit, the first follower’s copy relationship is terminated, locking in their loss. The second follower continues, potentially recovering the loss later. The end result is completely different P&L figures.

- Starting and Stopping Time: Followers rarely start copying at the exact same moment. If Investor A starts copying just before a major profitable trade, and Investor B starts immediately after that trade is closed, their performance metrics will diverge permanently.

How Platforms Minimize Copying Errors

Leading copy trading platforms employ specialized technologies and rules to maximize replication accuracy and protect followers.

Order Routing and Smart Execution

Platforms use smart order routing to find the best available price for the follower, often trying to fill the copy order within a small acceptable tolerance (a maximum allowable slippage threshold). If the slippage exceeds this threshold (e.g., 0.5 pips), the platform may reject the order entirely to protect the follower from a bad fill.

Trade Scaling and Lot Size Accuracy

Precision in lot sizing is crucial. Platforms must accurately scale the Master Trader’s lot size (e.g., 0.5 lots) to the follower’s equity ratio. Even minor rounding errors, when compounded over hundreds of trades, can lead to noticeable performance variance. The best systems use high-precision calculations (up to eight decimal places) to ensure near-perfect scaling.

Instantaneous Stop/Loss and Take-Profit Replication

When the Master Trader sets or adjusts an S/L or T/P, this crucial information must be copied instantly, overriding any default settings. This requires the platform to treat S/L/T/P updates as priority signals to ensure the follower’s risk profile remains aligned with the Master’s intended exit plan.

Metrics for Execution Quality

Advanced traders should evaluate a platform’s technical performance, not just the Master Trader’s P&L.

1. Slippage Cost

This metric measures the average cost incurred by the follower due to negative slippage. A platform should track and publish the average positive vs. negative slippage experienced by its copy community. A good platform aims for the slippage cost to be as close to zero as possible.

2. Replication Accuracy

This metric compares the Master Trader’s final P&L to the average P&L of all followers for the same trade. An accuracy score of 98% means that, on average, followers achieved 98% of the Master’s profit (or loss). High replication accuracy is a testament to the platform’s execution quality.

3. Latency Monitoring

While not always public, traders can infer latency by monitoring execution times during high-volatility events. Frequent «bad fills» or «rejected orders» during news spikes are strong indicators of poor execution speed and high latency.

Conclusion

Execution quality is the hidden cost and silent determinant of success in copy trading. Moving beyond the Master Trader’s P&L, the truly advanced copier must scrutinize the technical efficiency of the platform itself. Understanding the unavoidable friction points — latency, slippage, and market volatility — empowers you to set realistic expectations and choose providers that actively minimize these systemic errors. By focusing on metrics like Replication Accuracy and Slippage Cost, you transform from a passive follower into a sophisticated manager who ensures that the signal received is as close as possible to the signal executed, safeguarding your returns in the face of market uncertainty.