Crypto and Digital Assets Trading: Beyond Bitcoin

08 abril 2025

173 views

Crypto and Digital Assets Trading: Beyond Bitcoin

The modern financial landscape is rapidly shifting, presenting a new and lucrative frontier for intermediate-level traders who already grasp the mechanics of traditional markets. This frontier is digital assets trading. For decades, finance relied on centralized institutions and legacy infrastructure. However, the advent of blockchain trading technology has fundamentally reshaped our understanding of ownership, liquidity, and transparency.

Digital assets are the natural evolution of financial instruments. They offer 24/7 liquidity, fractional ownership, and verifiable data, challenging the status quo of traditional finance (TradFi). Understanding the bridge between TradFi and decentralized finance (DeFi) is now essential. For the experienced trader, the volatility and unique structure of the crypto trading ecosystem represent not just speculative novelty, but sophisticated, high-alpha opportunities that require structured risk management and a strategic approach to portfolio diversification.

Understanding the Landscape of Digital Assets

Digital assets are entries or ownership records stored on a decentralized ledger (blockchain). Unlike traditional securities, they are generally permissionless, can be transferred peer-to-peer, and are immutable.

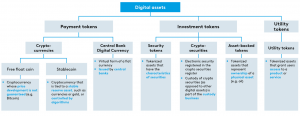

The Major Categories of Crypto Assets

The digital asset ecosystem is vast and extends far beyond initial speculative cryptocurrencies. A sophisticated crypto trading portfolio requires exposure across these key classes:

- Cryptocurrencies: These are the core digital currencies used primarily as a store of value, medium of exchange, or unit of account.

- Bitcoin (BTC): The original, primary store of value and digital gold.

- Ethereum (ETH): The foundational smart contract platform, enabling the entire DeFi ecosystem.

- DeFi Tokens: These tokens fuel the decentralized applications (DApps) and protocols built on blockchains like Ethereum. They fall into two main types:

- Governance Tokens: Grant holders voting rights over the future development and treasury management of a protocol (e.g., UNI, AAVE).

- Utility Tokens: Provide access to a service within the ecosystem, often acting as the network’s internal currency.

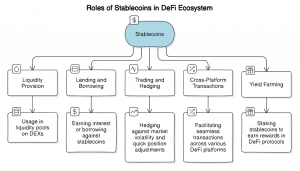

- Stablecoins: Digital assets designed to maintain a stable value, typically pegged 1:1 to a fiat currency (like the US Dollar). Stablecoins (e.g., USDT, USDC, DAI) are crucial for market participants, providing liquid capital for trading, hedging against crypto volatility, and acting as a primary settlement instrument.

- Tokenized Assets: The emerging class of assets representing ownership of real-world instruments on the blockchain. These tokenized commodities, stocks, real estate, or bonds offer enhanced liquidity and fractional ownership.

By understanding these categories, traders can build sophisticated portfolio diversification strategies that manage crypto-specific volatility while capturing different types of yield and risk.

How Crypto Derivatives and Tokenized Commodities Work

The maturation of the crypto trading space is defined by the exponential growth of derivative instruments, mirroring the complexity of legacy markets.

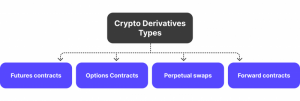

The Rise of Crypto Derivatives

Crypto derivatives (futures, perpetual swaps, and options) are contracts whose value is derived from an underlying digital asset.

Their purpose is identical to their TradFi counterparts:

- Hedging: Traders use Bitcoin futures or options to offset exposure in their spot holdings or correlated assets.

- Speculation: Allowing traders to take leveraged positions on the future price movements of assets like BTC, ETH, or major DeFi tokens.

- Arbitrage Strategies: Exploiting the typically higher volatility and pricing differences between derivative markets (e.g., the spread between the BTC perpetual swap and the quarterly future).

The perpetual swap is a unique and dominant product in crypto, acting like a future with no expiration date. It is kept tethered to the spot price via a funding rate, which is paid between long and short positions, making it a critical tool for sophisticated algorithmic trading. Platforms like Binance Futures and CME (offering regulated Bitcoin and Ethereum futures) are the primary arenas for this activity.

Tokenized Commodities and Synthetics

Tokenized commodities (like tokenized gold or silver) and synthetic assets allow traders to gain exposure to real-world assets without leaving the blockchain ecosystem.

These instruments provide:

- Interoperability: Traders can use tokenized gold as collateral for a DeFi loan or instantly trade it against an Ethereum-based DeFi token.

- Accessibility: They democratize ownership, allowing fractional investment in traditionally high-entry assets.

The use of these synthetic instruments enhances portfolio diversification while maintaining 24/7 liquidity on blockchain trading platforms.

Trading Strategies that Bridge Traditional and Crypto Markets

Professional crypto trading is increasingly defined by exploiting the friction and inefficiencies between the mature TradFi world and the nascent digital asset ecosystem.

Cross-Market Strategy Examples

Advanced traders apply knowledge of traditional quantitative strategies to the unique structure of digital assets:

- Arbitrage Strategies: These remain prevalent due to the fragmented nature of the market. Opportunities include:

- Inter-Exchange Arbitrage: Exploiting price differences for the same asset between two separate crypto exchanges.

- Cash-and-Carry Arbitrage: Simultaneously buying a spot asset and selling a higher-priced future or perpetual swap to lock in the difference (the funding rate or basis).

- Hedging and Correlation Trading: As the crypto market matures, its relationship with macroeconomic factors and technology stocks is evolving:

- Macro Correlation: Traders closely track the relationship between Bitcoin and proxies for liquidity/risk appetite (e.g., the U.S. Dollar Index or the NASDAQ Composite).

- Delta-One Hedging: Using highly liquid instruments, such as CME crypto derivatives, to directly offset the market exposure of a portfolio of highly correlated tech stocks during periods of perceived macroeconomic risk.

- Quantitative Model Integration: Traditional statistical and quantitative models are now integrating crypto data as a factor. For example, a global momentum strategy might now use the performance of DeFi tokens as a leading or lagging indicator for high-beta technology sectors.

This cross-market strategic approach is key to achieving true risk management in crypto.

Risk Management in High-Volatility Digital Markets

High volatility is the defining characteristic of crypto trading—it’s the source of both massive opportunity and significant threat. Effective risk management in crypto must be dynamic and aggressive.

Key Risk Control Techniques

The standard trading toolkit must be adapted for the 24/7, high-leverage environment of digital assets:

- Dynamic Order Management: Due to flash crashes and high-speed moves, using hard stop-loss and take-profit orders is mandatory. Advanced traders use dynamic trailing stops or time-based stops rather than static price points.

- Responsible Leverage: High leverage amplifies profits but also accelerates liquidations. Professional traders prioritize position sizing based on worst-case volatility scenarios, typically risking a much smaller percentage of capital per trade than in traditional markets.

- Algorithmic Hedges: During market drawdowns, algorithmic systems can automatically convert volatile assets into stablecoins or execute short positions in correlated crypto derivatives to dampen portfolio volatility without fully exiting the market.

Unique Crypto Risks

Traders must also account for risks unique to this ecosystem:

- Counterparty Risk: While decreasing with institutionalization, the risk of an exchange hack or insolvency remains higher than with regulated banks. This dictates a strategy of asset diversification across multiple, reputable exchanges.

- Smart Contract Risk: When interacting with DeFi protocols, there is a risk of technical bugs or exploits in the underlying code, necessitating due diligence on protocol audits and insurance coverage.

- Liquidity Risk: Smaller DeFi tokens or new assets can suffer from periods of thin liquidity, making large trades difficult and increasing the cost of execution (slippage).

DeFi and the New Trading Ecosystem

Decentralized Finance (DeFi) is an open, global, and transparent financial system built on blockchain trading technology, allowing users to trade, lend, and borrow digital assets without a central intermediary.

Core DeFi Mechanisms

DeFi introduces novel trading concepts that rely on smart contracts rather than company infrastructure:

- Automated Market Makers (AMMs) & Liquidity Pools: Instead of order books, AMMs use pooled assets contributed by users (liquidity pools) to facilitate trades. This allows traders to execute swaps instantly and often at lower fees than traditional brokers.

- Yield Farming: Traders can earn a return (yield) by locking up their DeFi tokens or stablecoins in these liquidity pools, essentially acting as decentralized market makers.

The emerging trend of CeDeFi sees centralized institutions beginning to adopt and offer services based on underlying DeFi protocols, blending the speed of CEXs with the transparency of the blockchain.

Security, Regulation, and Transparency in Digital Markets

As institutional capital enters the market, the focus shifts to robust security, clear regulation, and enhanced transparency.

Navigating Security and Regulatory Risk

- Security: Traders must prioritize wallet management (e.g., using hardware wallets for large holdings) to mitigate theft risk. Furthermore, understanding smart contract vulnerabilities is essential before interacting with any new DeFi protocol.

- Regulation: The increasing oversight from bodies like the U.S. SEC, coupled with comprehensive frameworks like the EU’s MiCA, is crucial. While regulation introduces barriers, it provides necessary legitimacy and legal clarity, which in turn encourages larger institutional adoption and stabilization.

On-Chain Analytics

One major advantage of blockchain trading is transparency. On-chain analytics tools allow professional traders to track and verify trading activity, asset movements, and liquidity across the network. This ability to verify flow and holdings is unparalleled in traditional markets and is a powerful tool for compliance and strategy refinement.

Integrating Digital Assets into a Broader Portfolio

The strategic inclusion of digital assets is moving from speculation to long-term portfolio diversification strategy.

Traders utilize crypto exposure (often limited to 5–15% of total capital) to capture the unique, non-correlated returns offered by this asset class. Whether achieved through direct holdings of BTC/ETH, structured products like tokenized securities, or regulated crypto derivatives ETFs, the goal is to enhance the portfolio’s Sharpe ratio by adding an asset class that often acts independently of traditional equity and fixed-income cycles. This strategic blending is the future of multi-asset portfolio management.

The Future of Crypto Trading — Beyond Bitcoin

The future of crypto trading is one of interconnected, sophisticated markets defined by automation and integration.

Key emerging trends include:

- Real-World Asset (RWA) Integration: The tokenization of private credit, company stocks, and real estate will increase, providing massive liquidity to previously illiquid assets.

- AI-Driven Trading Bots: Algorithmic trading will become standard, with AI managing complex arbitrage strategies and dynamic risk-hedging across multiple blockchains and CEXs simultaneously.

- Interoperability: Protocols enabling seamless, cross-chain trading will unify fragmented markets, unlocking greater efficiency and liquidity.

The ultimate vision is the merging of DeFi, TradFi, and AI automation into a singular, highly efficient, global financial ecosystem.

Conclusion — Navigating the Digital Frontier with Strategy

Understanding crypto trading and digital assets is no longer optional; it is a prerequisite for generating diversified yield and managing risk in the 21st century. This digital frontier opens vast new opportunities, from sophisticated crypto derivatives to decentralized yield generation, enhancing rather than replacing traditional finance. Successful traders of the future will possess the dual fluency to think, analyze, and execute strategically in both the legacy and the digital markets.