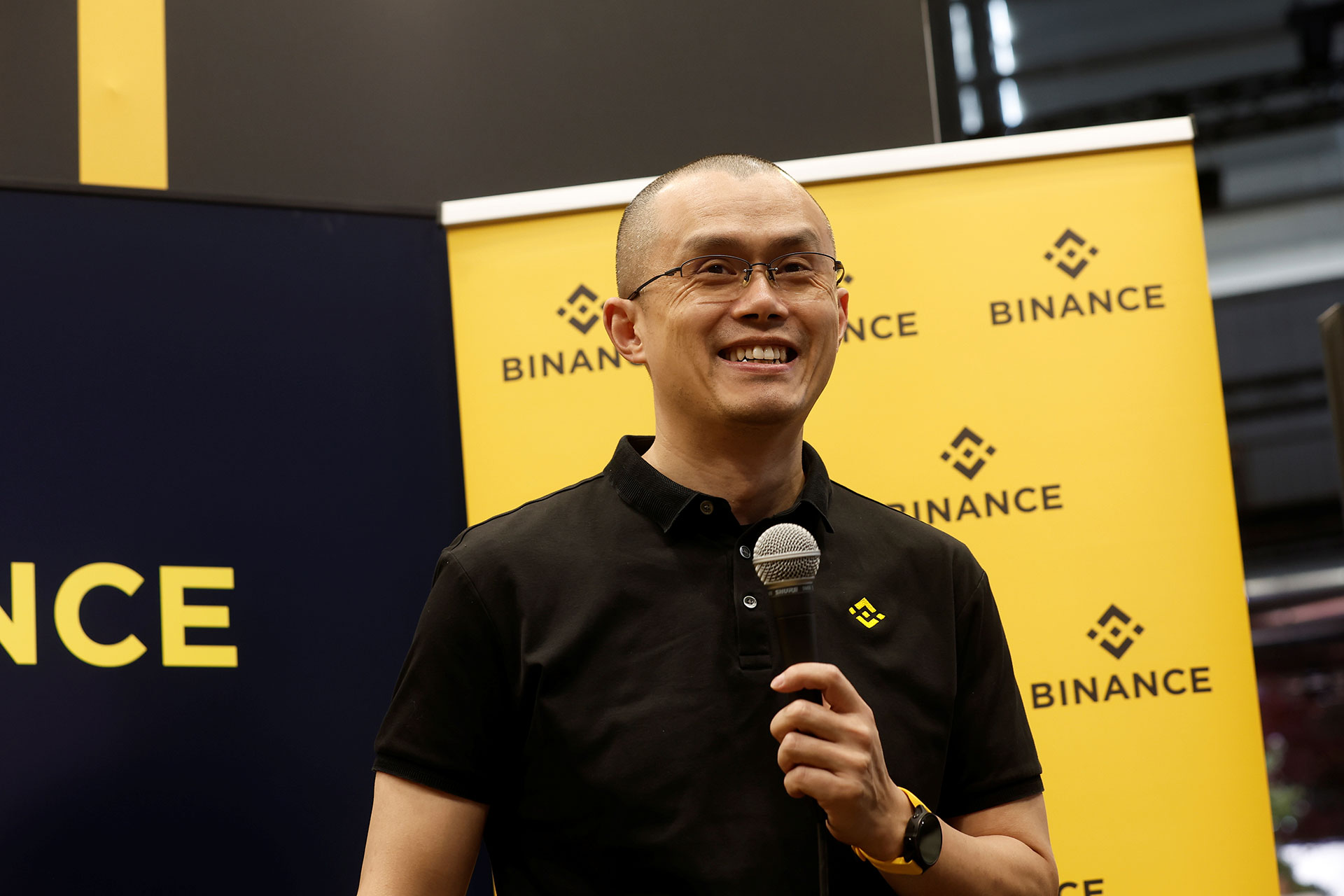

Binance Faces Mounting Legal Pressure as Global Regulators Tighten Oversight

25 noviembre 2025

117 views

Binance, the world’s largest cryptocurrency exchange by trading volume, is once again under intensifying regulatory scrutiny as multiple jurisdictions push forward with new enforcement actions and compliance demands.

What’s Happening

Authorities in several major markets are expanding investigations into the exchange’s past compliance practices, particularly around anti–money laundering controls and the handling of client assets. In recent days, additional European regulators have signaled they may require stricter licensing procedures for centralized crypto platforms — a move that could directly affect Binance’s operations.

Meanwhile, renewed debate in the U.S. over crypto market structure and custody rules has placed further pressure on international exchanges seeking access to American users, even indirectly.

Why It Matters

-

Operational uncertainty: New compliance requirements could restrict Binance’s regional activity or delay key product launches.

-

Liquidity concerns: Heightened regulatory focus often leads to outflows from centralized exchanges, which may reduce liquidity in high-volume trading pairs.

-

Market spillover: Broader crypto markets reacted cautiously, with major tokens slightly weaker as traders assess potential disruptions to spot and derivatives flows.

Market Impact

Bitcoin and Ethereum traded modestly lower, while exchange-linked tokens saw sharper intraday declines. Derivatives markets showed a slight rise in implied volatility, reflecting growing uncertainty around regulatory outcomes.

What Traders Should Watch

-

Any formal actions or licensing deadlines announced by European or Asian regulators.

-

Binance’s response in the form of new compliance updates or structural changes.

-

Whether liquidity on major pairs begins to thin — a key indicator of potential market instability.