Market Insights

-

Hot news

European Commission Set to Expand Supervision of Stock and Crypto Exchanges

The European Commission is preparing a major overhaul of financial-market supervision across the European Union, targeting cross-border exchanges—including both traditional stock markets and crypto platforms. The proposal, expected in a December “markets-integration package,” would significantly expand the powers of the European Securities and Markets Authority (ESMA) to act as a unified regulator for “systemically important”…

02 November 2025

127 views

-

Hot news

U.S. Financial Markets End Week on Cautious Note as Fed Signals Put-Off Rate Cuts

U.S. financial markets closed the week on a tempered tone as investors digested signals from the Federal Reserve that future rate cuts may not come as soon as expected. This shift in messaging weighed on risk sentiment, prompting bargains in equities to stall and safe-haven demand to creep back into focus. What’s Driving the…

01 November 2025

118 views

-

Hot news

Global Central Banks Shift Toward Caution in Rate Cuts

Major global central banks are increasingly adopting a cautious stance on interest-rate cuts, as uncertainty over inflation, growth, and geopolitics clouds the outlook. Key Highlights The Federal Reserve recently cut rates by 25 bps to 3.75%-4.00% but stressed that future cuts are not a given, citing elevated uncertainty. The European Central Bank and the Bank…

31 October 2025

127 views

-

Hot news

Copper Hits Record High Near ~$11,200 Amid Supply Strains and Fund Surge

Copper futures on the London Metal Exchange (LME) soared to a new peak near $11,200 per metric ton, driven by a potent mix of mine production disruptions, inventory tightness and renewed institutional fund interest. Key Drivers Mine output shortfalls & supply risks Major producers such as Glencore plc and Anglo American plc reported lower-than-expected production…

30 October 2025

139 views

-

Hot news

Major U.S. Stock Indexes Close Sharply Lower Amid Big Tech Earnings & Risk-Off

U.S. stock markets plunged Thursday, led by declines in the tech sector after disappointing earnings from Meta Platforms and Microsoft. The tech-heavy Nasdaq Composite dropped around 1.6 %, the S&P 500 fell 1 %, while the Dow Jones Industrial Average declined marginally by 0.2 %. Meta’s shares tumbled over 11 % after the company revealed…

29 October 2025

113 views

-

Hot news

US Government Shutdown Delays Critical Economic Data, Raises Policy Uncertainty

The ongoing US federal government shutdown, which began on October 1, is disrupting the publication of key economic indicators at a time when markets and policymakers require clarity most. Major Effects The Bureau of Labor Statistics (BLS) and other agencies have paused most data collection and releases — including the monthly jobs report and upcoming…

28 October 2025

114 views

-

Hot news

U.S.–China Trade & Tech War: New Controls Add Market Risk

Tensions between the U.S. and China are escalating in both trade and technology, adding fresh layers of uncertainty to global markets. Recent developments suggest the risk of ¬¬renewed action, especially in semiconductors and software. Key Developments • The U.S. is considering sweeping export controls that would ban or restrict goods containing U.S. software if exported…

27 October 2025

115 views

-

Hot news

Nifty 50 & Nikkei 225 Slide as Asian Markets React to Risk Off

Asian equity markets came under pressure today, with major indices reflecting growing concerns about global growth and trade tensions. The Nikkei 225 declined approximately 1.5%, while India’s Nifty 50 slipped by around 0.3%. What’s Behind the Drop Renewed fears over U.S.–China trade tensions weighed heavily, dampening risk appetite across the region. Weak cues from global…

26 October 2025

143 views

-

Hot news

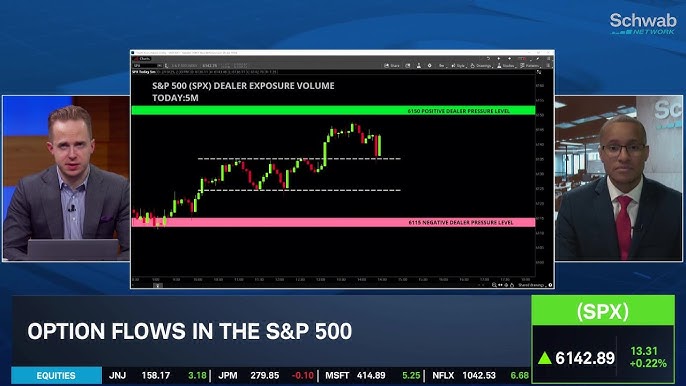

Bullish Options Flows Amplifying S&P 500 Moves

A surge in upside call-option buying has left options dealers in a pronounced “short gamma” position, raising the potential for exaggerated swings both upward and downward as the S&P 500 approaches the 7,000 level. Key Dynamics The S&P 500’s year-to-date rally of ~17% has coincided with the highest one-month calls-to-puts ratio in about four years. …

25 October 2025

129 views

-

Hot news

Global Markets Rally on US-China Trade Hopes & Tech Earnings

Asian equity markets advanced Friday as optimism grew around a potential U.S.–China trade breakthrough, offsetting oil price pressures from fresh U.S. sanctions. The MSCI Asia-Pacific index rose ~0.4% while Japan’s Nikkei jumped ~1.4%. The rally was supported by stronger-than-expected earnings at U.S. tech heavyweight Intel Corporation and remarks that President Donald Trump will meet Chinese…

24 October 2025

123 views

-

Hot news

Bitcoin and Ethereum Show Divergent Moves as Crypto Sentiment Shifts

The crypto market is experiencing a cautious reset, with major tokens moving in different directions and traders hesitating ahead of key data and regulatory signals. While Bitcoin held above the $110K level, Ethereum showed signs of weakness. In contrast, Solana popped by over 5% as it attracted fresh interest. Market Highlights Bitcoin climbed ~1.7 %…

23 October 2025

126 views

-

Hot news

Crypto Trading Firm FalconX to Acquire 21Shares in Major ETF Push

Crypto trading firm FalconX announced its acquisition of 21Shares, a leading crypto investment-management company, in a move to expand its exchange-traded fund (ETF) offerings. The deal was disclosed on Wednesday and marks one of the largest strategic plays yet in the regulated crypto investment space. 21Shares manages over $11 billion in assets across dozens of…

22 October 2025

154 views