BHP Group Eyes Record Highs Amid Bullish Momentum and Strategic Moves

15 August 2022

181 views

As the Australian Securities Exchange (ASX) experiences one of its busiest weeks, all eyes are on BHP Group (ASX: BHP), the nation’s largest mining company. BHP is set to release its FY2022 results on August 16, 2022, amidst a flurry of earnings reports from some of the biggest names on the ASX.

BHP’s recent announcement of an AU $8.4 billion bid to acquire OZ Minerals (ASX: OZL) has further intensified market interest. Although OZ Minerals rejected the initial offer, the possibility of additional bids in the coming weeks suggests a dynamic period ahead for BHP.

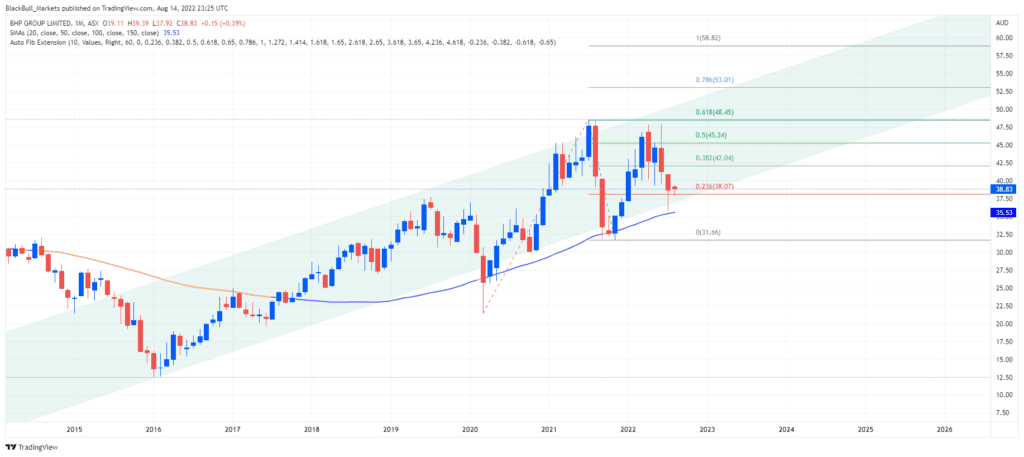

Currently, BHP’s stock is trading within a parallel channel, showing signs of a bullish trend. The monthly chart reveals that the company has tested a crucial resistance level just above $48 per share twice in the past six weeks. If this bullish momentum continues, supported by strong fundamentals, BHP could potentially reach an all-time high of $53, according to Fibonacci extension levels.

However, on the daily chart, BHP’s vulnerability becomes apparent due to fluctuating iron ore prices, one of its key exports. Despite a recent rebound from a multi-month low of $101 USD/T to $110 USD/T, the iron ore market remains under pressure, particularly with ongoing concerns surrounding the Chinese construction sector. The Relative Strength Index (RSI) suggests that iron ore is more oversold than overbought, adding another layer of complexity to BHP’s near-term outlook.

As BHP approaches its earnings release and navigates the challenges in the iron ore market, investors will be watching closely to see if the company can sustain its bullish trajectory and achieve new record highs.