Advanced Market Psychology: Understanding Cognitive Biases in Trading

24 October 2024

186 views

Advanced Market Psychology: Understanding Cognitive Biases in Trading

For the advanced trader, the pursuit of consistent performance quickly moves beyond mastering technical analysis or quantitative models. The true frontier of alpha generation lies not in the market itself, but in the decision-making apparatus of the individual: the human mind. Trading psychology is the discipline that connects a sound strategy to profitable execution, and its mastery is essential for survival in competitive financial markets.

In theory, financial markets operate on pure rationality. In reality, they are a crucible of human emotion, and these emotions are systematically distorted by cognitive biases. These mental shortcuts, hardwired into our brains for evolutionary efficiency, are the silent destroyers of capital. They subtly influence even seasoned professionals, leading to irrational choices that violate their own established rules.

Recognizing and actively managing these deep-seated cognitive biases is not merely a soft skill; it is a critical competitive advantage. It is the necessary bridge between strategy development and disciplined execution, offering a path to secure “psychological alpha.”

The Nature of Cognitive Biases in Trading

Cognitive biases are systematic patterns of deviation from norm or rationality in judgment. They are mental shortcuts, or heuristics, that the brain uses to process information quickly, especially under conditions of stress, uncertainty, and complexity—precisely the environment of financial trading.

Rooted deeply in human psychology, these biases are the subject of behavioral finance, a field pioneered by researchers like Daniel Kahneman and Amos Tversky. Behavioral finance demonstrates that investors are not the purely rational actors assumed by traditional economic theory. Instead, financial decision-making is heavily influenced by emotional and instinctive responses, often triggering primal human reactions:

- Fear leads to panic selling and hesitation.

- Greed fuels speculation and over-leveraging.

- Loss aversion causes the greatest damage to long-term profitability.

Understanding this link between market behavior and fundamental human psychology is the first step toward building the trading discipline necessary for elite performance.

Overconfidence Bias — The Illusion of Control

The overconfidence bias is the tendency for an individual to overestimate their own ability, knowledge, or control over outcomes. In trading, it is arguably the most destructive bias following a period of success.

Manifestations in Trading

Overconfidence often manifests after a significant winning streak, where the trader begins to attribute their success entirely to their skill rather than to a favorable market environment or variance.

- Over-leveraging: The trader increases position sizes far beyond their standard risk parameters, believing their “edge” is infallible.

- Excessive Trading (Churn): An overconfident trader believes they can successfully time every market fluctuation, leading to higher transaction costs and exposure to market noise.

- Ignoring Risk Signals: After a few successful calls, the trader discounts contradictory technical or fundamental evidence because they “know better” than the market or their own system.

Research from behavioral finance confirms this, showing that overconfident investors tend to trade more frequently, generating lower net returns after transaction costs compared to more conservative counterparts. A common example is the trader who, after five consecutive winning trades, triples their position size on the sixth trade—which inevitably turns out to be a decisive loser.

Mitigation Techniques

Combating the overconfidence bias requires structural, systematic countermeasures:

- Algorithmic Validation: Rely on objective, systematic entry and exit rules validated through robust backtesting, rather than discretionary “gut feelings.”

- Pre-Defined Risk Limits: Implement non-negotiable, hard-coded position size limits and maximum daily drawdown limits that cannot be overruled by impulse.

- Trading Journals & Accountability: Track the reasoning behind every trade, not just the outcome. Critically evaluate whether the decision process followed the established plan, especially after a winning streak.

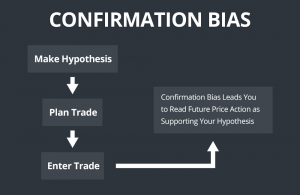

Confirmation Bias — Seeing What You Want to See

Confirmation bias is the pervasive tendency to seek out, interpret, and favor information that confirms or supports one’s prior beliefs or values. This bias is a major threat to objective trading discipline.

The Echo Chamber Effect

Once a trader has established a view—say, a long position on a specific currency pair—they instinctively begin to seek out data that supports that bullish outlook. This leads to what is known as the echo chamber effect in the analytical process:

- Selective Information Filtering: The trader focuses exclusively on news reports, analyst upgrades, or technical indicators that confirm their trade direction.

- Ignoring Contrary Indicators: Risk signals, like a break of key support, a surge in bearish sentiment, or negative macro data (e.g., unexpectedly high inflation), are quickly dismissed as “noise” or temporary fluctuations.

A classic real-world example is a trader ignoring a central bank’s hawkish shift because they are anchored to a deeply researched bullish outlook on a related asset. This refusal to adapt to evolving data is fatal to long-term returns.

Practical Tools to Combat It

Effective countermeasures involve institutionalizing contrarian thought and data-driven analysis:

- Contrarian Review: Before executing a trade, deliberately spend 10 minutes finding the strongest possible argument against the trade. Document the potential risks that could invalidate the thesis.

- AI Sentiment Checks: Utilize modern AI in trading tools that provide objective sentiment analysis across news and social media, ensuring the data is not being filtered through a human-biased lens.

- Pre-Mortem Analysis: Before entering a large position, imagine the trade has failed disastrously six weeks later. Write down all the possible reasons why it failed. This helps uncover neglected risks.

Loss Aversion — Why Fear of Losing Shapes Behavior

Loss aversion is one of the most powerful concepts in behavioral finance, introduced by Kahneman and Tversky in their seminal prospect theory. The theory posits that the psychological pain of a loss is roughly twice as powerful as the pleasure derived from an equivalent gain.

The Effects on Execution

This primal fear of losing distorts the risk-reward structure of a trade, leading to the infamous “disposition effect” in trading:

- Cutting Winners Too Early: The trader feels an intense need to lock in a profit (realizing the gain) as soon as possible to avoid the pain of watching a winning trade reverse. This caps upside potential.

- Holding Losers Too Long: The trader holds onto a losing position in the irrational hope that it will return to the entry price, thus avoiding the painful realization of a loss. This turns small, manageable losses into catastrophic drawdowns.

The unwillingness to accept a small, correct loss is the single greatest cause of account destruction, driven purely by the psychological desire to avoid regret and the pain of realization.

Behavioral Risk Management

The solution to loss aversion is to remove the emotional decision from the act of realization through robust behavioral risk management:

- Stop-Loss Automation: Use hard, automated stop-loss orders that execute the risk management plan without requiring a conscious emotional decision at the point of pain.

- Pre-Commitment Devices: Define your maximum acceptable loss (Max Drawdown, Max Loss per Trade) in advance and use platform tools to enforce these limits automatically.

- Mental Accounting Separation: Treat every dollar allocated to a trade as already spent. This separates the trading capital from personal savings, reducing the emotional weight of each position.

Emotions and Strategy Execution — When Feelings Sabotage Logic

Beyond the specific cognitive shortcuts, raw emotional trading—driven by feelings like fear, greed, frustration, and revenge—serves as a constant internal enemy to a rational plan.

Amplifying Bias-Driven Behavior

Emotions do not just influence decisions; they amplify the effect of existing biases. High stress and market uncertainty are accelerants for this interference:

- Revenge Trading: After taking a significant loss, a trader may experience frustration and a desire to “get back” at the market. This leads to impulsive, oversized trades that violate all trading discipline and are almost always destined for failure.

- Fear and Paralysis: During extreme market volatility, fear can paralyze a trader, preventing them from executing a valid entry or exit signal, effectively resulting in a loss of opportunity or failure to mitigate risk.

- Euphoria: Success breeds euphoria, which feeds directly into overconfidence and causes a trader to lower their guard, often leading to a sudden, large loss that erases weeks of careful gains.

Emotional Regulation Techniques

Mastery of the markets starts with mastery of the self. Techniques derived from cognitive-behavioral practices can help:

- Structured Trading Routines: Execute trades only during pre-defined hours and with a strict checklist. The routine creates a wall between the emotional self and the analytical self.

- Mindfulness and Body Scans: Brief mindfulness exercises before and during trading sessions help a trader identify when their heart rate or stress level is rising, serving as an early warning for emotional trading.

- Cognitive Reframing: Consciously reframe losses as “tuition paid” to the market—necessary data points for model improvement—rather than personal failures.

Behavioral Risk Management Frameworks

Advanced traders cannot rely on willpower alone. They must deploy systematic, external frameworks to enforce psychological resilience and limit the opportunity for biases to interfere.

Systematic Methods for Reducing Psychological Error

A robust behavioral risk management framework integrates self-assessment with analytical discipline:

- The Trading Journal: Move beyond tracking P&L. The journal must track behavioral data:

- Emotional State at Entry/Exit: (e.g., Anxious, Confident, Indifferent).

- Adherence Score: Did I follow every rule in my plan (Yes/No)? If No, why?

- Bias Check: What bias might have influenced this decision (e.g., Overconfidence after two wins)?

- Quantitative Self-Assessment: Use objective metrics like the Win/Loss ratio and Profit Factor, but also analyze trade frequency. A sudden spike in trade frequency often flags overconfidence or revenge trading.

- Behavioral Checklists: An essential pre-trade and post-trade tool. This structured list (e.g., “Is the stop-loss already placed?”, “Have I checked a macro signal that contradicts my view?”) prevents unforced errors and enforces trading discipline.

The Role of AI and Technology in Detecting Emotional Patterns

The most advanced defense against cognitive biases is technology. AI in trading and machine learning now provide objective, real-time mirrors of a trader’s own behavior.

Behavioral Data Tracking

AI platforms are moving beyond pure market analysis to include trader behavioral analysis. By tracking execution patterns, these systems can identify signatures of emotional trading invisible to the human eye:

- Impulsivity Detection: Machine learning algorithms can identify entries that occur without the required technical confirmations or exits that occur significantly before the pre-defined Take Profit level—a classic sign of loss aversion or anxiety.

- Overtrading Identification: The AI can flag a user when their trade volume or frequency exceeds their historical mean by a certain standard deviation, suggesting a lapse into overconfidence or revenge trading.

- Sentiment Correlation: Advanced tools can correlate a trader’s personal P&L with their subsequent trading decisions, spotting patterns where losses lead to larger, more reckless risk-taking.

Platforms (often referred to as “SmartT” or similar systems) integrate these behavioral analytics into the decision-making process. They can trigger alerts when a bias pattern is detected or even automatically block a trade if the risk parameters are dangerously inflated by impulsive, biased decisions. Technology becomes the ultimate enforcer of the trader’s rational self.

Practical Steps to Build Psychological Strength

Trading discipline is a muscle, not an innate trait. It must be developed through consistent, deliberate practice.

Here are actionable methods for advanced traders:

- Structured Journaling: Commit to logging behavioral data immediately after a trade, focusing on the decision process rather than the outcome. Evaluate the quality of the decision, not the profitability.

- Post-Trade Reflection: Schedule time away from the screens (e.g., 30 minutes post-session) for reflection. Ask, “What assumption was I confirming?” and “Was my position size influenced by a prior win or loss?”

- Trading Simulations/Paper Trading: Use a demo environment not just to test strategies, but to test your emotional control under simulated high-stress conditions.

- Limit Emotion Through Automation: Automate all execution mechanics: use bracket orders, automated stop-losses, and pre-set position sizing tools. Make the decision when you are calm, and let the machine execute the order when the market is chaotic.

Conclusion — Mastering the Mind for Market Mastery

Advanced trading psychology is the final frontier for consistent success. The difference between a perpetually profitable trader and one who struggles is often the successful management of their own internal biases. By understanding the insidious influence of cognitive biases—particularly overconfidence, confirmation bias, and loss aversion—and by deploying systematic countermeasures and leveraging the objectivity of AI in trading, the advanced trader can drastically reduce self-sabotage. Mastery of the market is, ultimately, mastery of the mind, securing the coveted “psychological alpha” that translates into enduring trading discipline and superior long-term results.