Reliance Power’s Stock Volatility Sparks Exchange Inquiry Amid New Funding Deal

06 сентября 2022

176 views

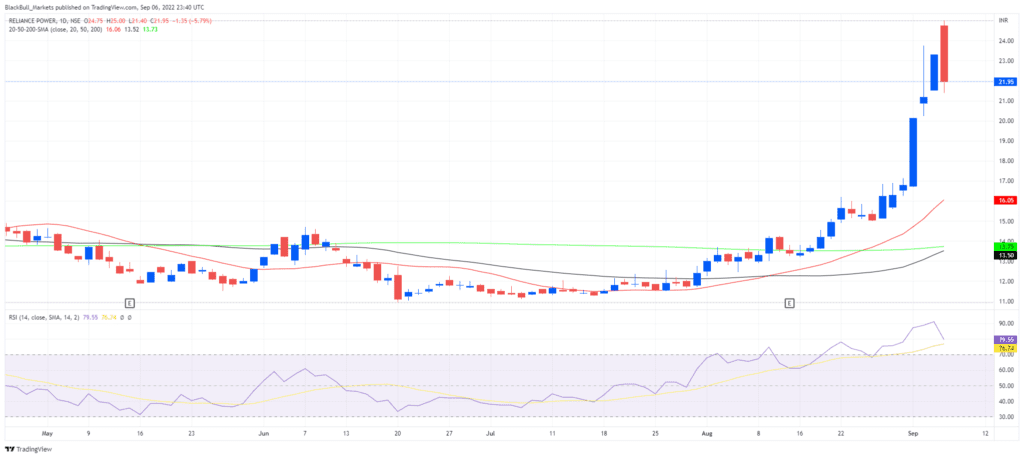

Reliance Power, a leading private sector power generation and coal resources company in India, has recently experienced significant stock volatility following a major financial development. The company, majority-owned by Anil Ambani, announced a long-term debt agreement for up to 12 billion rupees (approximately $150.4 million) with Varde Partners, a U.S.-based investment firm focused on distressed assets in India. This news, disclosed on September 5th, initially sent Reliance Power’s shares surging by 9.9%, closing at 23.30 rupees. However, the following day, the stock retreated by 6.0%, ending at 21.95 rupees.

The sudden spike in Reliance Power’s stock price, though short-lived, prompted the National Stock Exchange of India Ltd. (NSE) and BSE Ltd. to issue a warrant for explanation. In response, Reliance Power stated that it could not comment on the price movement but assured that any necessary announcements would be made in due course.

Notably, the surge in the stock price occurred before the official announcement, with shares climbing 37% in the two days leading up to the news. This has raised concerns and speculation within the market.

Reliance Power’s Role in India’s Energy Sector

Based in Mumbai, Reliance Power is a key player in India’s energy sector, operating one of the largest portfolios of power projects in the private sector. The company’s diversified energy sources include coal, gas, hydro, and renewable energy, with a total operating capacity of 5,945 megawatts.

A member of the Reliance Group conglomerate, Reliance Power has a market capitalization of $992.8 million. Despite its significant presence, the company reported a loss of 708.4 million rupees for the quarter ending June 30th, compared to a profit of 122.8 million rupees in the same period the previous year.

To support its future plans, Reliance Power is exploring options to raise additional capital from both domestic and international investors. In addition to the recent deal with Varde Partners, the company is considering issuing equity shares, equity-linked securities, or convertible warrants to secure long-term funding. The board is scheduled to meet on September 8th to discuss their future fundraising strategy.

Challenges Within the Ambani Conglomerate

Reliance Power is part of the Reliance Anil Dhirubhai Ambani Group, led by Anil Ambani, the younger brother of Mukesh Ambani, who heads Reliance Industries, India’s most valuable company. While Mukesh Ambani has continued to expand his business empire, Anil Ambani’s ventures have faced significant challenges, including defaults and administration issues.

One of Reliance Power’s affiliates, Reliance Capital, is currently up for sale, with investor groups including the Hinduja Group and Oaktree Capital offering 45 billion rupees for the financial services company. This sale includes a range of assets, including a stake in a life insurance venture with Japan’s Nippon Life.

While it remains unclear whether the difficulties faced by its affiliates will impact Reliance Power, the company’s recent financial losses and fundraising efforts suggest that it is not in a particularly strong capital position, potentially dampening investor confidence.