Nvidia and the Top 10 S&P 500 Stocks: Bubble Concerns and Shorting Opportunities

13 марта 2024

179 views

Key Points:

- Nvidia’s stock surge raises concerns about an AI bubble, prompting Cathie Wood to reduce exposure.

- Analysts warn of overvaluation in top S&P 500 companies, while others remain optimistic about AI’s potential.

- Debate over market valuation and AI’s future creates uncertainty for investors.

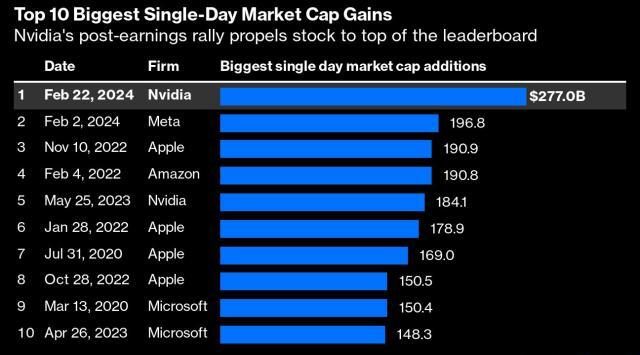

Nvidia’s recent stock surge has triggered discussions of a potential “bubble” in AI-related stocks. Cathie Wood, CEO of Ark Invest, has recently reduced her firm’s exposure to Nvidia, selling approximately $4.5 million worth of shares. This move highlights concerns about overly optimistic expectations driving stock prices, although it might also suggest she isn’t fully convinced of an imminent crash.

Beyond Nvidia, there are broader worries about overvaluation in the stock market. Torsten Sløk, chief economist at Rowan’s wealth management, has noted that the top 10 S&P 500 companies are currently more overvalued than their counterparts during the mid-1990s tech bubble. Jeremy Grantham has also voiced concerns about a potential burst of the AI bubble, though his warnings often carry a bearish tone.

Conversely, Jamie Dimon, CEO of JPMorgan Chase, remains bullish on AI, citing its tangible applications in sectors like cybersecurity and pharmaceuticals. Dimon argues that AI’s potential is genuine and not just hype, unlike the internet bubble of the late 1990s.

This dichotomy in views raises questions for investors. While some see potential shorting opportunities in highly inflated stocks like CrowdStrike and Eli Lilly, others believe these stocks might fulfill their high valuations given the substantial AI advancements. The debate over AI’s true impact and the valuation of top stocks presents both risks and opportunities in the current market landscape.