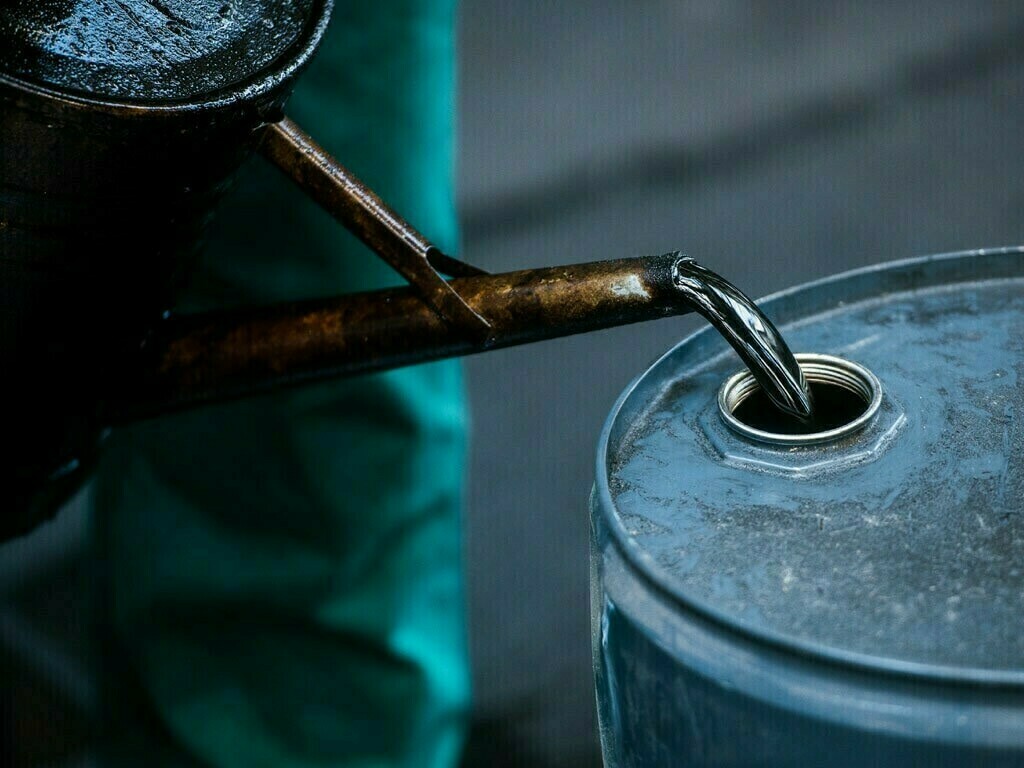

Oil Panic Buying After Iran Strikes?

23 junio 2025

223 views

President Trump confirmed that the U.S., together with Israel, carried out three strikes on Iranian nuclear facilities. In response, Iran’s parliament has backed a proposal to seal the Strait of Hormuz — a vital global oil shipping route. The final decision rests with Iran’s Supreme National Security Council and Supreme Leader Khamenei.

A blockade could cause oil prices to surge dramatically.

)

ClearView Energy Partners estimates a short-term closure might add between $8 and $31 per barrel, while JPMorgan warns that a full-scale conflict and complete shutdown could drive prices up to $120–$130 per barrel.

However, recent market reactions were more muted. Oil prices fell back below $70 after Iran retaliated with missile strikes on a U.S. base, but the Strait remained open.

Additional insights:

- The U.S. strikes on June 22, called “Operation Midnight Hammer,” targeted Fordow, Natanz, and Isfahan using bunker-buster bombs. While President Trump claimed the sites were “completely obliterated,” intelligence and IAEA sources reported that nuclear infrastructure was badly damaged but not beyond repair.

- Iran has already begun repairs at the Fordow site, and the IAEA warns that uranium enrichment could resume within months.

- Despite threats to close the Strait of Hormuz, it remains open. A cease-fire agreement brokered around June 24 helped calm immediate market fears.

- Analysts note that Middle East disruptions now have less impact on oil prices than in previous decades due to more diversified global supply chains.