Market Insights

-

Hot news

Asian Stocks Climb as Soft U.S. Data Fuels Fed Rate-Cut Hopes

Asian equity markets pushed higher today, with investors reacting positively to weaker-than-expected U.S. economic data — notably sluggish retail sales and cooling consumer confidence — which boosted expectations that the Federal Reserve will cut interest rates in December. Major indexes rallied broadly: the MSCI Asia-Pacific index (ex-Japan) rose about 1.1%, and Japan’s Nikkei 225…

26 November 2025

102 views

-

Hot news

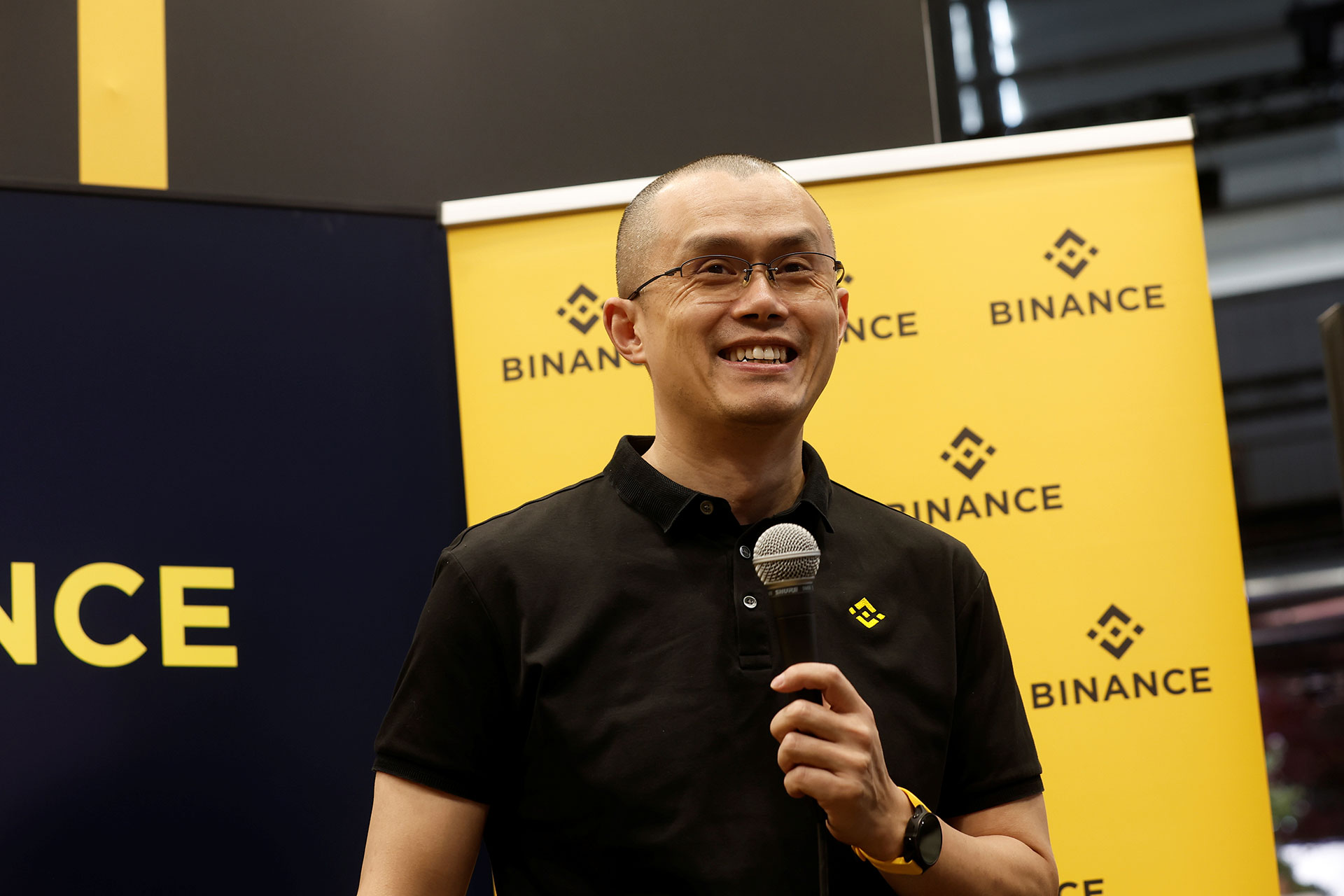

Binance Faces Mounting Legal Pressure as Global Regulators Tighten Oversight

Binance, the world’s largest cryptocurrency exchange by trading volume, is once again under intensifying regulatory scrutiny as multiple jurisdictions push forward with new enforcement actions and compliance demands. What’s Happening Authorities in several major markets are expanding investigations into the exchange’s past compliance practices, particularly around anti–money laundering controls and the handling of client assets….

25 November 2025

114 views

-

Hot news

Oil Prices Extend Losses as Market Awaits OPEC+ Decision

Oil prices continued to decline on Monday, pressured by uncertainty surrounding the upcoming OPEC+ meeting and doubts over whether the group will deepen or extend production cuts into early 2026. Market Moves Brent and WTI both slipped further after last week’s drop, with traders increasingly cautious as messaging from key producers remains…

24 November 2025

100 views

-

Hot news

Gulf Markets Rise as Fed Rate-Cut Bets Gain Momentum

Most equity markets across the Gulf region finished the session higher on Sunday, supported by growing expectations that the Federal Reserve will deliver a rate cut in December. The improving rate outlook helped offset pressure from weaker oil prices. Regional Market Highlights Qatar: The Qatari index outperformed, rising around 0.4%. Investor sentiment was boosted by…

23 November 2025

103 views

-

Hot news

2025 G20 Johannesburg Summit Could Reshape Global Trade and Finance Outlook

The 2025 G20 Summit has officially begun in Johannesburg, marking the first time the forum is hosted in South Africa. This year’s meeting is shaping up to be one of the most consequential in recent cycles, with an agenda aimed at redefining global economic cooperation and addressing persistent financial vulnerabilities. The summit places heightened…

22 November 2025

130 views

-

Hot news

Fed’s Williams Signals December Rate Cut as Markets Seek Direction

Markets found a moment of clarity on Friday after New York Federal Reserve President John Williams indicated that a rate cut at the upcoming December meeting is now a likely option. His comments offered traders a rare policy signal at a time when the government shutdown continues to block critical economic data, leaving both investors…

21 November 2025

97 views

-

Hot news

Stocks Soar as Nvidia’s Earnings Ease AI Fears and Jobs Data Awaited

A sharp relief rally swept across global equity markets Thursday, lifted by stronger-than-expected earnings from Nvidia Corporation and a growing sense of optimism ahead of the U.S. labour-market report. Investors reacted positively to the chip-maker’s robust performance, while hanging hopes remain that delayed U.S. jobs data may restore some clarity to monetary-policy expectations. Nvidia’s CEO…

20 November 2025

104 views

-

Hot news

Markets Teeter Ahead of Nvidia Earnings, Fed Data and AI Bubble Checks

Global markets entered a fragile phase today as investors pivoted into a “hold-pat” mode ahead of key catalysts: Nvidia Corporation’s quarterly earnings and the delayed U.S. labour-market report. Asian equities struggled, the U.S. tech sell-off deepened, and hopes for a December rate cut by the Federal Reserve diminished sharply — the probability of a move…

19 November 2025

119 views

-

Hot news

S&P 500 Extends Losses as Rate-Cut Hopes Fade and Earnings Disappoint

U.S. stocks resumed their downward trajectory on Tuesday, with the S&P 500 posting another day of declines as fading expectations for near-term Fed rate cuts collided with a new round of underwhelming corporate earnings. With the government shutdown still limiting access to official economic data, markets remained heavily reactive to Fed commentary and company guidance…

18 November 2025

136 views

-

Hot news

Wall Street Slips as Valuation Concerns Rise and Data Fog Deepens

U.S. equities ended Monday in the red as renewed worries over stretched valuations and the continued absence of official economic data weighed on investor sentiment. With the federal government shutdown still blocking key releases — including inflation, retail sales, and labour-market figures — traders were left navigating markets with limited visibility, amplifying caution across risk…

17 November 2025

113 views

-

Hot news

Gold Pulls Back as Traders Reassess Fading Fed Rate-Cut Prospects

Gold prices slipped on Sunday as traders recalibrated expectations for U.S. interest-rate cuts, with fading confidence in a December move weighing on safe-haven demand. After weeks of strong gains fueled by political uncertainty and a record-long government shutdown, momentum in the precious metal eased as markets shifted into a more cautious wait-and-see mode. The retreat…

16 November 2025

138 views

-

Hot news

Global Markets Pivot as World Moves Beyond “America First”

Global financial markets are undergoing a noticeable shift as governments and multinational blocs begin recalibrating their trade and economic strategies away from the long shadow of the “America First” era. With the U.S. still mired in political gridlock and navigating its longest government shutdown on record, international partners are accelerating efforts to build alternative trade…

15 November 2025

98 views