Intermarket Analysis: Connecting Stocks, Bonds, Commodities, and Currencies

11 October 2025

164 views

Intermarket Analysis: Connecting Stocks, Bonds, Commodities, and Currencies

Level: Advanced

Core Concept: Financial markets are not isolated silos. They are deeply interconnected, with major shifts in one asset class often preceding or influencing movements in others. Intermarket analysis is the advanced discipline of understanding these complex relationships to identify global trends, anticipate shifts in market sentiment, and filter trading signals with a macro-economic perspective. It teaches you to trade within the context of global capital flows.

The Global Drivers: Inflation, Interest Rates, and the Dollar

These three macro factors are the gravitational forces that exert influence across all asset classes, shaping the fundamental backdrop for global market trends.

Inflation: The Silent Market Mover

Inflation (the rate at which prices for goods and services are rising) impacts the purchasing power of money and, consequently, the value of all investments.

- Impact on Bonds: High inflation erodes the fixed purchasing power of future bond payments, making existing bonds less attractive and driving bond prices down (and yields up).

- Impact on Stocks: For some companies, moderate inflation can boost revenues. However, high, unexpected inflation increases input costs, squeezes profit margins, and can lead to aggressive central bank tightening, hurting equity valuations.

- Impact on Commodities: Commodities (like oil and gold) are often seen as a hedge against inflation. As the cost of goods rises, so too does the value of raw materials.

- Impact on Currencies: A country with higher inflation relative to its peers might see its currency weaken if central banks are perceived to be behind the curve. Conversely, aggressive anti-inflationary policies (higher rates) can strengthen a currency.

Interest Rates: The Cost of Capital

Central bank interest rates are the “price of money.” They dictate borrowing costs and investment returns, profoundly affecting all markets.

- Impact on Bonds: Rising interest rates make new bonds more attractive than older, lower-yielding ones, driving down existing bond prices (and yields up). Bonds are highly sensitive to rate expectations.

- Impact on Stocks: Higher rates increase borrowing costs for companies and consumers, slowing economic growth, reducing corporate profits, and making equity valuations less appealing compared to risk-free bond yields. Growth stocks are particularly vulnerable.

- Impact on Currencies: A country’s currency typically strengthens when its central bank raises interest rates, attracting foreign capital seeking higher returns.

- Impact on Commodities: Higher rates strengthen the dollar (see below), which typically makes dollar-denominated commodities more expensive for foreign buyers, potentially dampening demand.

The US Dollar: The Global Reserve Currency

As the world’s primary reserve currency, the strength or weakness of the US Dollar (USD) reverberates across the globe.

- Impact on Commodities: Most major commodities (oil, gold, copper) are priced in USD. A stronger USD makes these commodities more expensive for buyers using other currencies, often leading to lower demand and lower commodity prices (inverse correlation).

- Impact on Emerging Markets: A strong USD makes it more expensive for emerging market countries and corporations to service their dollar-denominated debt, increasing financial stress.

- Impact on Global Trade: A strong USD can make US exports more expensive, potentially hurting US corporate earnings, while making imports cheaper.

The Great Divide: Correlations Between Stocks and Bonds

The relationship between stocks and bonds is a classic intermarket signal, often revealing underlying economic health and investor sentiment.

Normal Environment: Negative Correlation (Flight to Safety)

Historically, stocks and bonds often move in opposite directions.

- When Stocks Fall (Fear): During times of economic uncertainty or stock market downturns, investors typically seek safety, moving capital from equities into government bonds. This “flight to safety” drives up bond prices (and drives down yields).

- When Stocks Rise (Optimism): During periods of strong economic growth and rising corporate profits, investors favour riskier assets (stocks), leading to capital flowing out of bonds, driving bond prices down (and yields up).

Abnormal Environment: Positive Correlation (Systemic Risk)

Sometimes, stocks and bonds move in the same direction, signaling deeper systemic issues.

- Stocks and Bonds Both Fall: This is a red flag, often indicating significant inflationary pressure or rising interest rate expectations. In this scenario, bonds fail as a hedge, and both asset classes suffer as rising discount rates (from inflation/rates) erode the present value of future earnings (for stocks) and fixed payments (for bonds). This happened significantly in 2022.

- Trading Implication: A breakdown in the normal negative correlation suggests a fundamental shift in macro conditions, demanding a re-evaluation of portfolio construction.

The Influence Web: Oil, Gold, and Currencies on Equities

Commodities and currencies are not just standalone markets; their movements provide vital clues about economic activity and investor preferences, often impacting stock markets.

Oil: The Pulse of Global Growth and Inflation

Oil prices are a crucial barometer for global economic activity and a direct input cost for many industries.

- Rising Oil Prices: Can indicate strong global demand (positive for growth-sensitive sectors but negative for consumer discretionary and transport stocks due to higher input costs). Also, a significant contributor to inflation.

- Falling Oil Prices: Can signal weakening global demand (negative for growth) or increased supply. Generally positive for consumers and transport sectors.

- Intermarket Link: Watch for divergences. If oil prices are falling but stock markets are rising, it might indicate a disconnect or a shift in market narratives.

Gold: The Safe Haven and Inflation Hedge

Gold’s role as a non-yielding asset makes it sensitive to real interest rates and perceived risk.

- Rising Gold Prices: Often coincide with:

- Economic Uncertainty/Risk-Off Sentiment: Investors seek safety away from equities.

- Falling Real Interest Rates: Gold becomes more attractive when bond yields (adjusted for inflation) are low or negative.

- Inflationary Fears: Gold is seen as preserving purchasing power.

- Intermarket Link: A rising gold price while stock markets are under pressure often confirms a “risk-off” environment, suggesting further equity weakness.

Currencies: Competitiveness and Capital Flows

Currency movements reflect a country’s economic health, central bank policy, and capital flows, all of which influence domestic stock markets.

- Strong Domestic Currency: Makes a country’s exports more expensive (hurting export-oriented companies) but imports cheaper (benefiting companies reliant on imports). Can deter foreign investment if it makes local assets overpriced.

- Weak Domestic Currency: Boosts exports, making a country’s goods more competitive globally, potentially lifting earnings for multinational corporations.

- Intermarket Link (e.g., JPY/USD and Nikkei): Often, a weaker JPY (Yen) strengthens the export-heavy Japanese Nikkei stock index, as it makes Japanese products cheaper abroad.

Practical Application: Forecasting and Signal Filtering

The true power of intermarket analysis lies in its ability to provide context, confirm trends, and filter out false signals.

Confirming Trends

- Example: If the S&P 500 is breaking out to new highs, but bond yields are also falling (suggesting a flight to safety) and gold is rising (risk-off), this lack of confirmation from other markets could signal a weak equity rally or a “bull trap.”

- Confirming Strength: A robust equity rally is often accompanied by rising bond yields (risk-on flow out of safety) and potentially falling gold (less fear).

Anticipating Market Turns

- Leading Indicators: Often, bond markets (especially the yield curve) and commodities (like copper, “Dr. Copper,” due to its use in industrial activity) can signal economic shifts before equities react.

- Example: If bond yields are rapidly increasing (indicating inflation/rate hike expectations) while stocks are still high, it may be a warning that equities are due for a correction as the cost of capital rises.

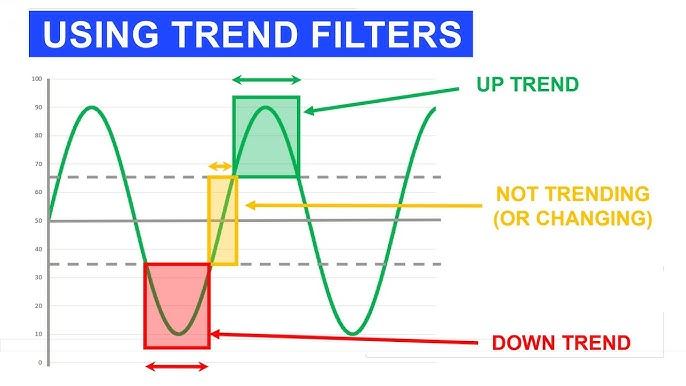

Filtering Trading Signals

- Avoid Contradictions: If your stock chart gives a buy signal, but intermarket analysis (e.g., rapidly strengthening USD, falling oil) points to a macro headwind, it’s wise to either reduce your position size or pass on the trade.

- Enhance Conviction: If your stock signal aligns with strong intermarket confirmation (e.g., a stock breakout accompanied by falling bond prices and rising commodity prices), your conviction in the trade can be significantly higher.

Conclusion

Intermarket analysis transforms a trader’s perspective from a narrow focus on individual charts to a holistic understanding of global capital flows. By consistently monitoring the intricate dance between stocks, bonds, commodities, and currencies, you gain the ability to think macro-economically, anticipate major market shifts, and trade with a much deeper, context-driven conviction. This advanced approach is indispensable for navigating the complexities of modern financial markets.