Advanced Copy Trading: Diversification, Scaling, and Risk Control

17 September 2025

154 views

Advanced Copy Trading: Diversification, Scaling, and Risk Control

Level: Advanced / Pro

Core Concept: The goal of advanced copy trading is to transcend simple following and build a robust, multi-layered portfolio of strategies. This guide reveals how seasoned investors construct sophisticated copying structures using multiple traders, strategic scaling, and automated risk filters to manage copy trading like a professional fund.

The Pro Mindset: Managing Copy Trading as a Strategic Portfolio

The biggest difference between a novice and a professional copy trader lies in perspective. A pro doesn’t look for the “next big winner”; they focus on managing risk across a portfolio of diverse trading styles. Your objective shifts from maximizing returns from one source to achieving stable, risk-adjusted returns from a combination of uncorrelated “assets”—which, in this case, are the strategies of the traders you follow.

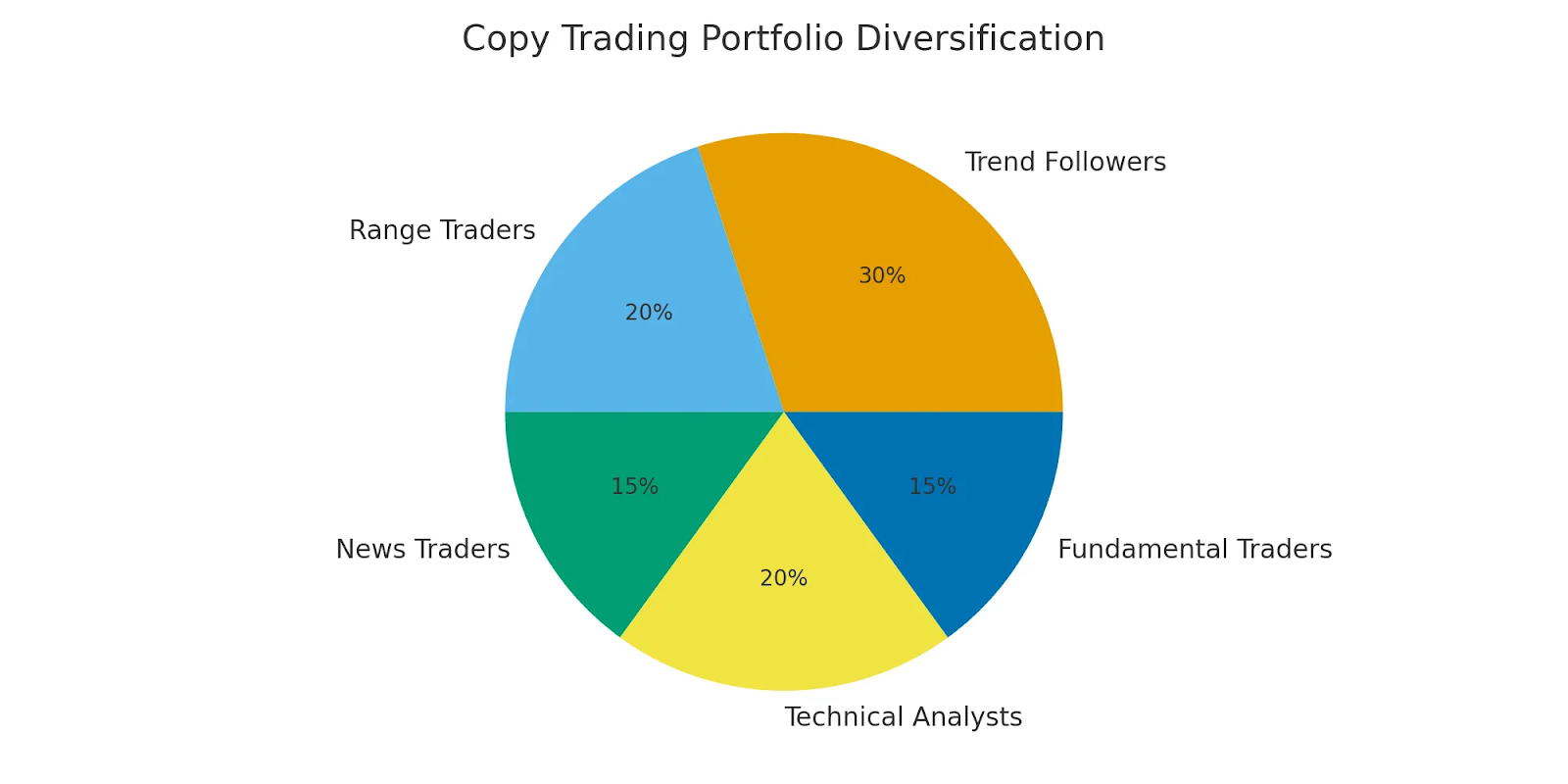

Spreading the Bets: True Multi-Trader Diversification

Diversification is the bedrock of intelligent risk management. By spreading your capital across multiple traders with fundamentally different approaches, you effectively smooth out the high volatility inherent in any single trader’s performance.

Finding Non-Correlated Partners

The secret sauce of diversification is non-correlation. If Trader A and Trader B trade the same asset (like EUR/USD) using the same strategy (like trend following), their profits and losses will rise and fall together. This is poor diversification.

The ideal is finding strategies that react differently to the same market conditions. For example, pairing a long-term, low-frequency equity investor with a short-term, high-frequency currency scalper. When one strategy faces a challenge, the other might be thriving, which helps balance the overall portfolio’s performance.

To build a robust portfolio, consider distributing your capital across these axes:

- Asset Class: Mix Forex with Commodities, Indices, or Cryptocurrencies.

- Trading Style: Combine Scalping with Swing Trading or Long-Term Position Holding.

- Strategy Focus: Pair Trend-Following systems with Mean-Reversion (contrarian) approaches.

Pro Tip: Allocate smaller, equal amounts to 5-7 traders who use distinct strategies rather than committing a large sum to just 1-2 traders whose performance is likely linked.

Smart Capital Deployment: The Art of Scaling Strategies

“Scaling in” is the disciplined process of gradually increasing the capital allocated to a successful trader over time. This approach prevents you from committing all your capital right before a major drawdown and allows you to test the trader’s resilience.

The Phased Commitment Approach

- The Pilot Phase: Start copying a promising new trader with only a small portion (e.g., 10-20%) of your intended allocation. This acts as a real-money test drive.

- The Observation Window: Give the trader 3 to 6 months to prove consistency across different market environments. Crucially, observe how they handle drawdowns and unexpected volatility.

- The Scaling Trigger: If the trader consistently meets your risk and return expectations over the period, you can safely and gradually increase the allocation (e.g., from 20% to 40%, then to 70%).

When to De-Scale: The Safety Protocol

Scaling out is just as vital. If a trader experiences a drawdown that exceeds their historical maximum, shows a prolonged period of underperformance, or visibly deviates from their stated strategy, a professional investor will reduce the copied volume or pause copying immediately. This preserves capital and adheres to your predefined risk tolerance.

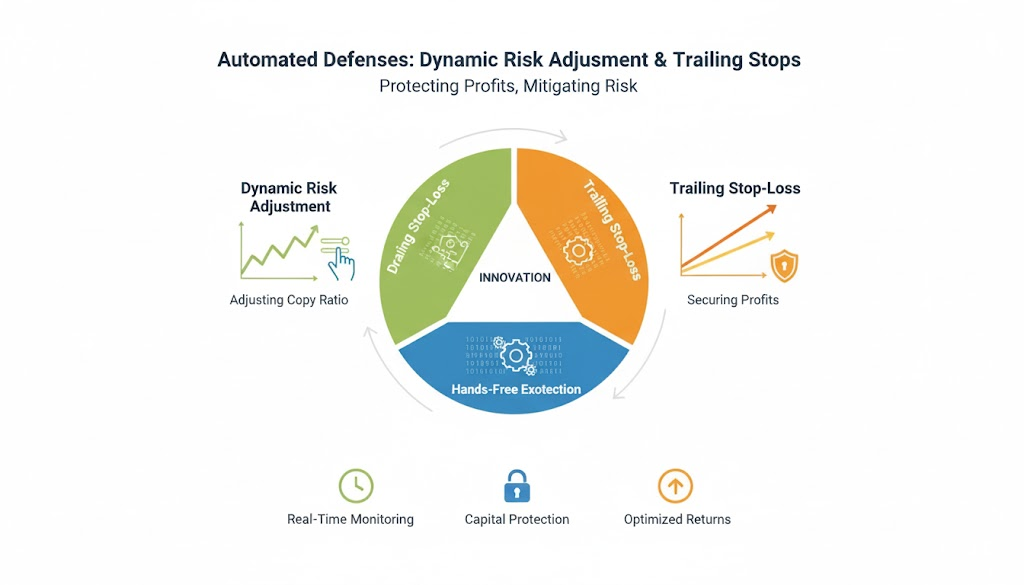

Automated Defenses: Dynamic Risk Adjustment and Trailing Stops

Advanced copy traders don’t just set a static stop-loss and hope for the best. They use dynamic, automated tools to actively manage risk and lock in profits as the trade relationship matures.

Fine-Tuning with Dynamic Risk

This practice involves adjusting your copy ratio or volume multiplier based on the trader’s immediate performance or market volatility.

- After a spectacular winning streak, some experienced investors might slightly reduce the copy ratio, anticipating a potential market correction or mean reversion.

- Conversely, during a minor, statistically expected drawdown from an otherwise reliable trader, an investor might maintain the ratio, viewing it as a temporary buying opportunity.

The Copy Trading Trailing Stop

A Trailing Stop for copy trading is a highly effective tool for profit protection. It automatically adjusts your stop-loss level upwards as the overall profit generated from the copied trader increases.

How it protects you:

- You set a Trailing Stop (e.g., 25% of maximum profit).

- If your total accrued profit from the trader hits $1000, your trailing stop automatically moves to $750.

- If the profit continues to rise to $1500, the stop automatically adjusts to $1125.

- Should the trader then enter a sudden, deep drawdown and your total profit drops below that stop level (e.g., below $1125), the copy relationship is automatically terminated, ensuring you lock in the remaining gains and prevent further losses.

Beyond the Hype: Performance Analytics and Correlation

Professional copy traders base their decisions on statistical facts, not marketing promises. They look past the simple P&L number to the underlying health of the strategy.

Essential Metrics for Strategy Health

Don’t just look at total profit. Evaluate traders based on these critical risk metrics:

- Maximum Drawdown (Max DD): This is the largest peak-to-trough drop in capital. It’s the single best measure of the real risk you face. Only copy traders whose Max DD is less than the maximum loss you can comfortably afford.

- Recovery Factor: A simple ratio of (Total Profit) divided by (Max Drawdown). A high factor (ideally above 3.0) indicates the trader is efficient at recovering losses and generating sustainable returns.

- Sharpe or Sortino Ratio: These are the gold standards for comparing strategies, as they measure the return generated per unit of risk taken. A higher ratio signifies superior risk-adjusted performance.

Measuring Strategy Interdependence (Correlation)

Correlation analysis is the most sophisticated tool for building a genuinely diversified portfolio. It tells you how closely the performance movements of two traders are related.

- Perfect Correlation (+1.0): Their performance moves in lockstep. Avoid pairing these.

- Zero Correlation (0): Their returns are independent of each other. Highly desirable for portfolio stability.

- Negative Correlation (e.g., −0.5): Their returns tend to move in opposite directions. The ultimate goal for hedging and maximum portfolio stability.

The final objective is to build a portfolio where the average correlation between all your copied traders approaches zero. This is the definitive mark of a professional approach, ensuring your capital is protected across all market cycles.