Euro’s Struggle Below Parity: Bearish Momentum Signals Further Downside for EUR/USD

23 August 2022

179 views

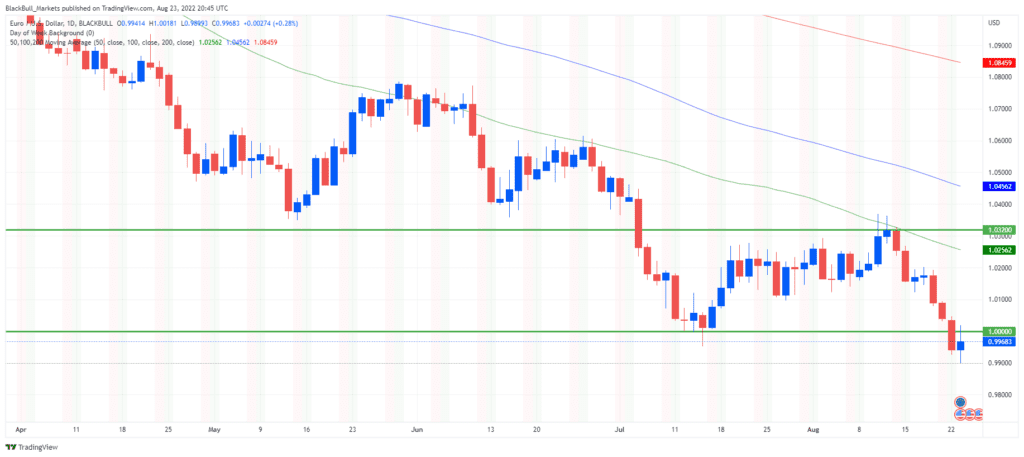

The euro’s recent attempt to rally was met with resistance, as the EUR/USD pair failed to close above the critical 1.0320 level last week. This inability to breach the 50-Day Moving Average has created a potential bull trap, providing an opportunity for short sellers and setting the stage for the euro to hit parity with the dollar once again.

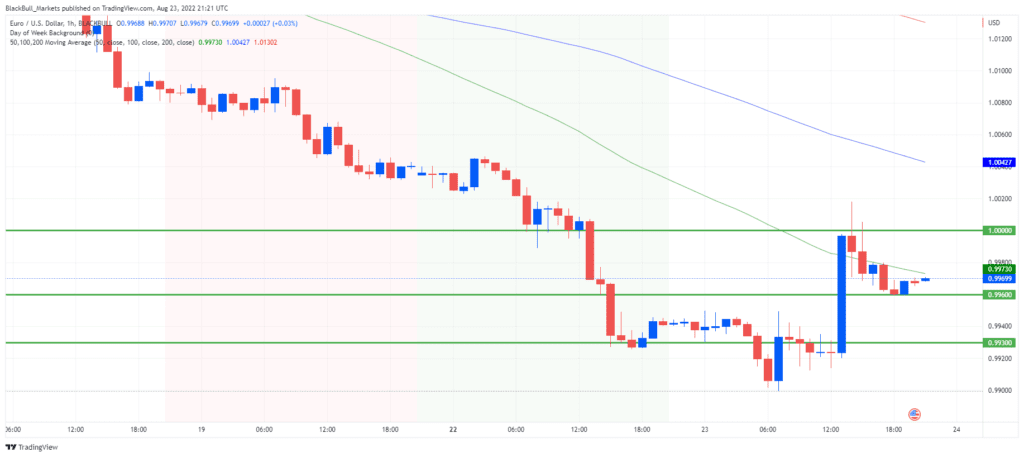

After breaking below parity on August 22, the EUR/USD pair has been experiencing downward pressure, though a pullback remains possible as traders become wary of the unusual valuation. A similar situation occurred on July 14, when the pair briefly dipped below parity before rebounding.

Bearish Signals and Support Levels

Despite testing the 0.9900 level and seeing a rejection, the euro’s medium-term outlook appears bearish. The pair spent much of its time consolidating just below parity, organizing near 0.9930 before the European session began. Strong economic data from Europe, particularly a surprising rise in consumer confidence by 2.1 points in August, gave the euro a brief lift, leading to two significant hourly gains that pushed the pair back above parity. However, this upward momentum was short-lived, as the EUR/USD quickly retreated.

Currently, support is forming below 0.9960, with the market likely needing to clear out buyers around the 0.9900 level to continue its downward trajectory. While a pullback remains a possibility, the euro faces significant resistance, and bears should remain vigilant as the currency could extend its decline to new lows in the medium term.

The battle between bulls and bears continues, with the euro’s fate hanging in the balance as market participants closely watch the 0.9900 level for further cues on the pair’s direction.