Post-Twitter Buyout: Is Pinterest the Next Big Stock for Traders?

31 October 2022

181 views

With Elon Musk’s acquisition of Twitter now finalized and the company no longer publicly traded, investors are on the hunt for comparable stocks to fill the void. Traders might find a suitable alternative in Pinterest, a social media platform that often positions itself as the antithesis of Twitter and Instagram, promoting inspiration over negativity.

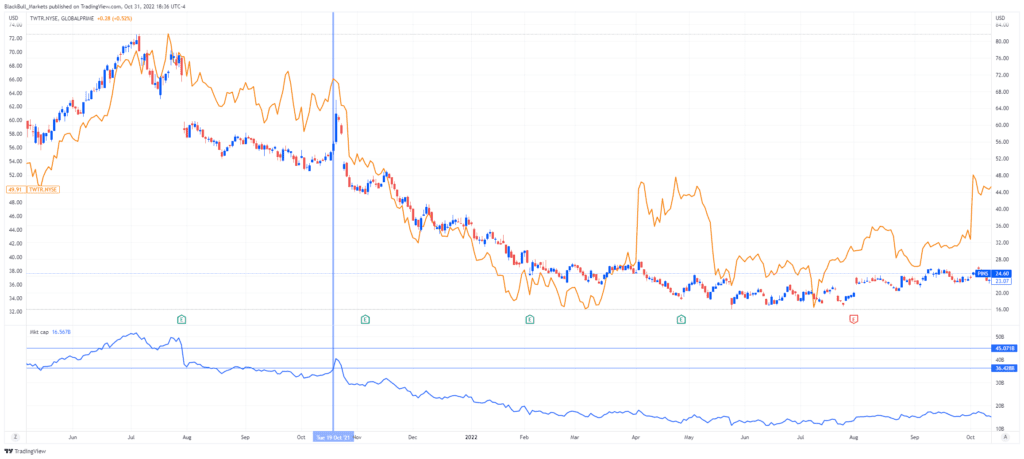

Pinterest, though distinct in its branding, shares similarities with Twitter in terms of market behavior. Both stocks have experienced parallel price trajectories, although Twitter’s stock price was notably inflated by Musk’s high-profile bid in April 2022 and the ensuing legal battles that culminated in the final buyout.

Pinterest could also become the target of acquisition offers, potentially at a significant premium. In October 2021, PayPal made headlines with a $45 billion bid for Pinterest, which would have marked the largest social media acquisition since Microsoft’s $26 billion purchase of LinkedIn in 2016. However, PayPal withdrew its offer after facing investor backlash, which led to a sharp 12% drop in PayPal’s stock.

By November 2022, Pinterest’s valuation had declined to $16.5 billion, making it a potentially more attractive target for suitors. Despite the lower valuation, Pinterest demonstrated its resilience with an 8% year-over-year revenue increase in its third-quarter earnings report. The company’s stock surged by approximately 11% in the five days following the report, standing out amid broader declines in the social media and tech sectors. For instance, Facebook saw a 29% drop, while Alphabet (which owns YouTube) fell by 8% after their respective earnings reports.

Rumors have even surfaced that Alphabet might be eyeing Pinterest for acquisition, fueled by Alphabet CEO Sundar Pichai’s evasive response to questions about potential takeover targets in September. As traders seek new opportunities post-Twitter, Pinterest could emerge as a compelling option with significant upside potential.