US Inflation Data Could Spark Trading Opportunities

12 June 2023

174 views

Key Points:

- Traders expect a 74% chance of the Fed pausing rate hikes this week.

- A significant drop in CPI is anticipated, which could influence market sentiment.

- Key assets to watch include US indices, US dollar pairs, and gold.

The next two days are poised to be eventful for traders, as a sharp drop in the Consumer Price Index (CPI) is expected on Tuesday, and the market largely anticipates that the Federal Reserve will pause its rate hiking cycle on Wednesday. According to the CME Group’s FedWatch tool, there’s a 74% probability of no rate hike. However, this is not a certainty, and any deviation from expectations could lead to significant market corrections.

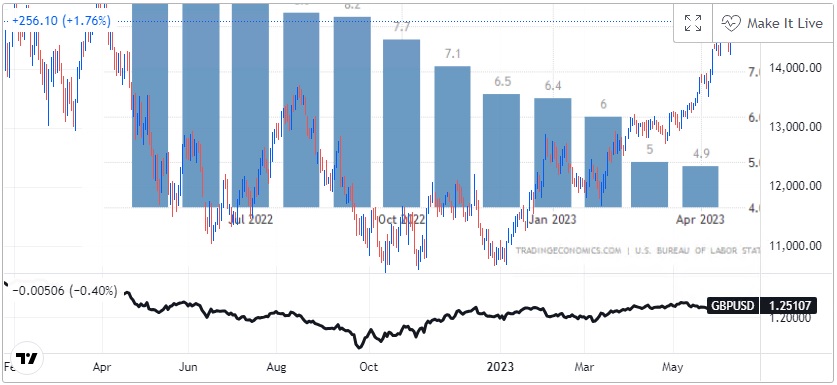

Analysts predict that the CPI will show a decrease in inflation to a 4.1% annual rate in May, down from 4.9% in April. If the inflation data supports this expectation, it could further solidify the belief that inflation is on the decline. However, if the data surprises to the upside, it could trigger market volatility similar to the recent Canadian Dollar’s reaction when the Bank of Canada unexpectedly raised rates by 25 basis points.

Key assets to monitor during this period include US indices, US dollar pairs, and gold. The S&P 500 recently crossed the 20% gain mark from its October low, while the Nasdaq Composite has soared 33% from its 52-week low. However, optimism in these indices could wane if inflation data exceeds expectations.

The US dollar’s performance, particularly against the British Pound, will also be in focus. The Pound has recently retreated from its yearly high, coinciding with a rise in the UK two-year bond yield, which reached its highest level since the market turmoil following Liz Truss’s mini-budget announcement. This could create potential trading opportunities in GBP/USD and other US dollar pairs.