Gold’s Jackson Hole Rally: Key Levels to Watch

23 August 2023

175 views

Key Points:

- Gold prices rose due to lower bond yields and a weaker USD.

- Potential upside is limited around $1920; downside risks focus on $1880 and $1885.

- Jerome Powell’s upcoming Jackson Hole speech could shape gold’s near-term movement.

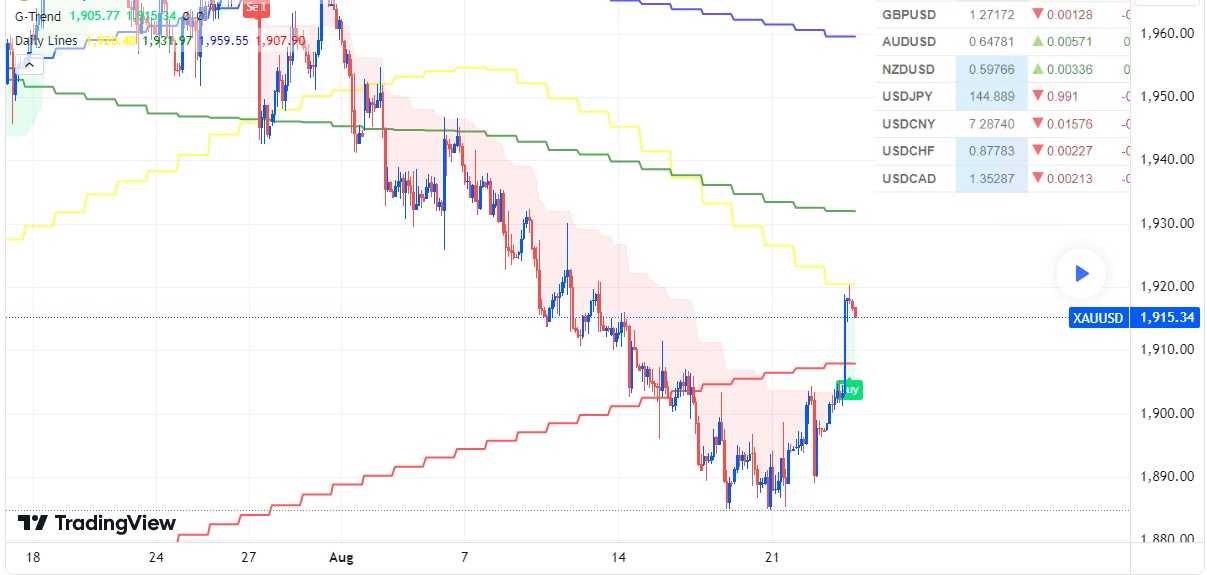

Gold prices have surged from $1900 to $1916 this week, buoyed by lower bond yields and a weaker USD following disappointing US economic data. Despite this rally, gold remains within a descending channel and could face resistance if it falls below the $1908 level, with downside risks targeting $1880 and $1885.

The recent price increase is supported by weaker-than-expected US data, including declines in both the Composite PMI and Manufacturing PMI. However, with expectations for the Fed funds rate to stay high for an extended period, gold’s upside potential might be limited.

Jerome Powell’s speech at the Jackson Hole Symposium, scheduled for Friday at 10:05 am ET, is anticipated to influence gold’s short-term trajectory. Meanwhile, the GBP/USD is weakening, reflecting recent disappointing UK economic data, including the sharpest drop in Private Sector Output in 31 months.