Top Two Trading Opportunities This Week: AUD/USD and EUR/USD

29 January 2024

179 views

Key Points:

- Australian inflation data and the US Federal Reserve’s rate decision make AUD/USD a key pair to watch.

- Discrepancies in EU inflation forecasts heighten interest in EUR/USD.

- AUD/USD is poised for potential movements based on inflation and Fed decisions.

- EUR/USD’s outlook is influenced by conflicting inflation predictions and technical patterns.

This week presents two notable trading opportunities, with both AUD/USD and EUR/USD offering potential for significant movements.

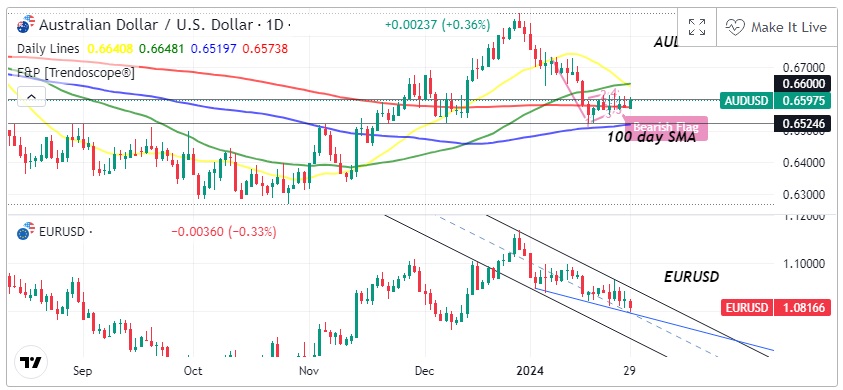

First Opportunity: AUD/USD Australian inflation data, set to be released on Tuesday evening, is expected to exceed 4.0%, making the AUD/USD pair particularly intriguing. Following this, the US Federal Reserve’s interest rate decision on Wednesday will be a key event for forex traders. The AUD/USD has recently traded within a narrow range and formed an ascending channel that resembles a bearish flag pattern. To maintain stability, the pair needs to hold above the 0.6600 level. A failure to do so could see the AUD/USD retest the 2024 low at 0.6524, aligning with the 100-day SMA.

Second Opportunity: EUR/USD The EUR/USD pair is also in focus due to significant uncertainty regarding EU inflation predictions set to be released on Thursday. Market forecasts vary widely, with some expecting a decrease to 2.2% from the current 2.9%, while others anticipate an increase to 3.1%. This discrepancy creates multiple potential targets on the charts. Currently, the EUR/USD appears bearish, trading below all moving averages and marking a third consecutive lower low and lower high, though selling pressure may be diminishing.

These developments suggest that both pairs could offer lucrative trading opportunities depending on how the respective economic data and central bank decisions unfold.