Pro Commodities Trading: Lesson 2 – Risk Management and Portfolio Optimization

10 June 2024

220 views

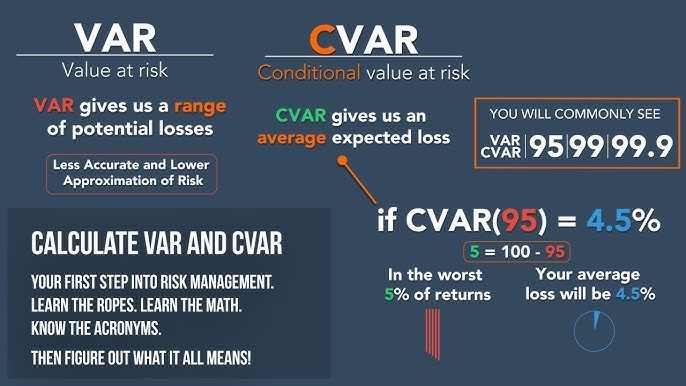

Value at Risk (VaR) and Conditional Value at Risk (CVaR)

VaR Explained:

Value at Risk (VaR) is a tool to estimate the potential loss in a portfolio over a certain period, given a specific confidence level. For instance, if a portfolio has a 1-day VaR of $1 million at a 95% confidence level, there’s a 5% chance that the loss will exceed $1 million in one day.

CVaR Insights:

Conditional Value at Risk (CVaR) goes a step further by measuring the average loss assuming the loss exceeds the VaR threshold. For example, if the VaR is $1 million and the CVaR is $1.5 million, the average loss beyond $1 million would be $1.5 million. This helps in understanding extreme loss scenarios.

Stress Testing and Scenario Analysis

Stress Testing:

This involves simulating extreme market conditions to see their impact on the portfolio. For example, you might test how a 20% drop in commodity prices affects your investments.

Scenario Analysis:

Evaluating different hypothetical situations, such as economic shocks or geopolitical events, can help understand potential portfolio performance under various conditions.

Dynamic Hedging

Dynamic hedging involves continuously adjusting hedge positions in response to market changes. This can be done using derivatives to manage risk as market conditions evolve. For example, you might adjust the size of options or futures contracts based on changes in the underlying commodity’s price volatility.

Portfolio Optimization Techniques

- Mean-Variance Optimization:

This technique involves constructing a portfolio to maximize return for a given risk level, or minimize risk for a given return. It uses historical returns and covariance data to find the optimal asset weights. For instance, allocating investments across different commodities to achieve the highest possible return for a given risk level. - Black-Litterman Model:

An extension of mean-variance optimization that incorporates investor views and market equilibrium. For example, adjusting commodity weights in the portfolio based on the belief that oil prices will rise more than the market predicts. - Risk Parity:

This strategy allocates capital based on the risk contribution of each asset rather than its nominal weight. It aims to balance the risk contribution, leading to a more diversified portfolio. For example, adjusting portfolio weights so that each commodity contributes equally to the overall risk. - Maximum Diversification:

This approach seeks to achieve the highest level of diversification by including assets with low or negative correlations. Combining different types of commodities, like agricultural products, energy, and metals, can enhance portfolio stability and reduce risk.

Example: Implementing Advanced Risk Management

VaR and CVaR Calculation:

Calculate the VaR and CVaR for a portfolio consisting of oil and gold futures using historical price data to estimate potential loss and tail risk.

Stress Testing:

Simulate a 30% drop in global commodity prices and assess the impact on portfolio value, adjusting hedging strategies accordingly.

Portfolio Optimization:

Optimize a portfolio including commodities such as oil, gold, and agricultural products using mean-variance optimization to determine the best asset weights for maximum return relative to risk

Conclusion

Utilizing advanced risk management techniques like VaR, CVaR, dynamic hedging, and portfolio optimization frameworks is essential for managing complex commodity portfolios effectively. These methods help in better risk management and enhancing portfolio performance.