Basics of Commodities Trading: Lesson 1 – Introduction to Commodities

28 November 2023

235 views

What Are Commodities?

Commodities are basic goods used in commerce that are interchangeable with other goods of the same type. They are the building blocks of the global economy and include items such as metals, energy, and agricultural products.

Types of Commodities

- Metals: Includes precious metals like gold and silver, and industrial metals like copper and aluminum.

- Energy: Includes oil, natural gas, and coal.

- Agricultural: Includes crops like wheat, corn, soybeans, and livestock such as cattle and hogs.

Why Invest in Commodities?

- Diversification: Commodities can reduce portfolio risk by providing diversification.

- Inflation Hedge: Commodities often increase in value during inflationary periods.

- Supply and Demand: Prices can be influenced by changes in supply and demand, offering investment opportunities.

How to Invest in Commodities

- Direct Investment: Buying physical commodities, such as gold bars or oil barrels.

- Futures Contracts: Agreements to buy or sell a commodity at a future date for a predetermined price.

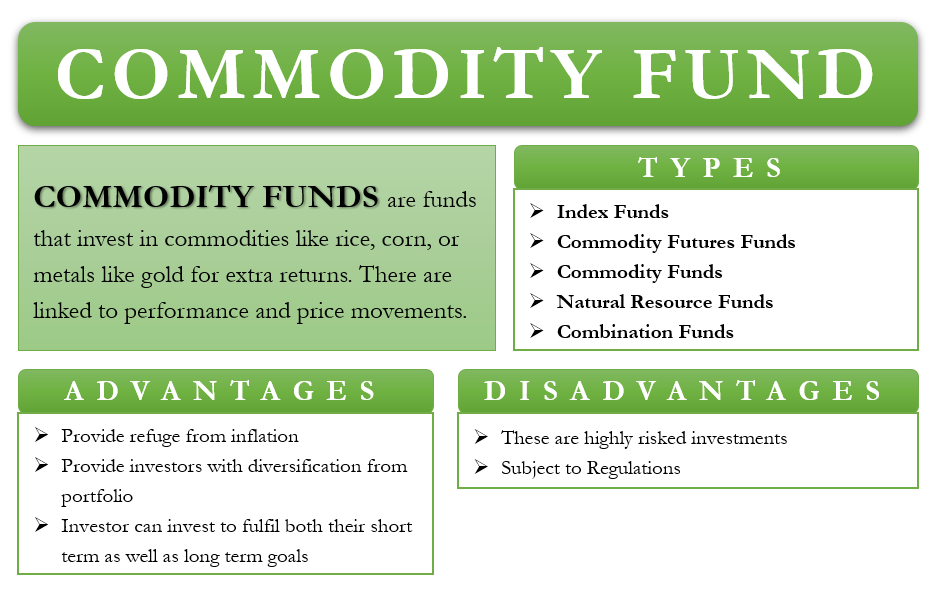

- ETFs and Mutual Funds: Funds that track the price of commodities or commodity indices.

- Commodity Stocks: Investing in companies involved in the production or extraction of commodities.

Example: Gold Investment

- Physical Gold: Buying gold coins or bars.

- Gold ETFs: Funds that track the price of gold.

- Gold Mining Stocks: Shares of companies that mine and produce gold.

Conclusion

Understanding the basics of commodities is essential for diversifying your investment portfolio and taking advantage of market opportunities. In the next lesson, we will explore how commodity prices are determined and the factors that influence them.