Stock Trading for Intermediate: Lesson 2 – Portfolio Optimization and Risk Management

16 December 2023

215 views

Introduction to Portfolio Optimization

Portfolio optimization involves selecting the best mix of assets to maximize returns while minimizing risk. This lesson will cover advanced strategies for optimizing your portfolio and managing risk effectively.

Modern Portfolio Theory (MPT)

Understanding MPT

Modern Portfolio Theory, developed by Harry Markowitz, is a framework for constructing a portfolio that aims to maximize expected return for a given level of risk. MPT emphasizes the importance of diversification and the relationship between risk and return.

Key Concepts

- Expected Return: The weighted average of the expected returns of the assets in the portfolio.

- Calculate expected return by multiplying each asset’s return by its portfolio weight and summing the results.

- Portfolio Risk (Standard Deviation): Measures the volatility of the portfolio’s returns.

- Calculate portfolio risk by considering the standard deviations of individual assets and their correlations.

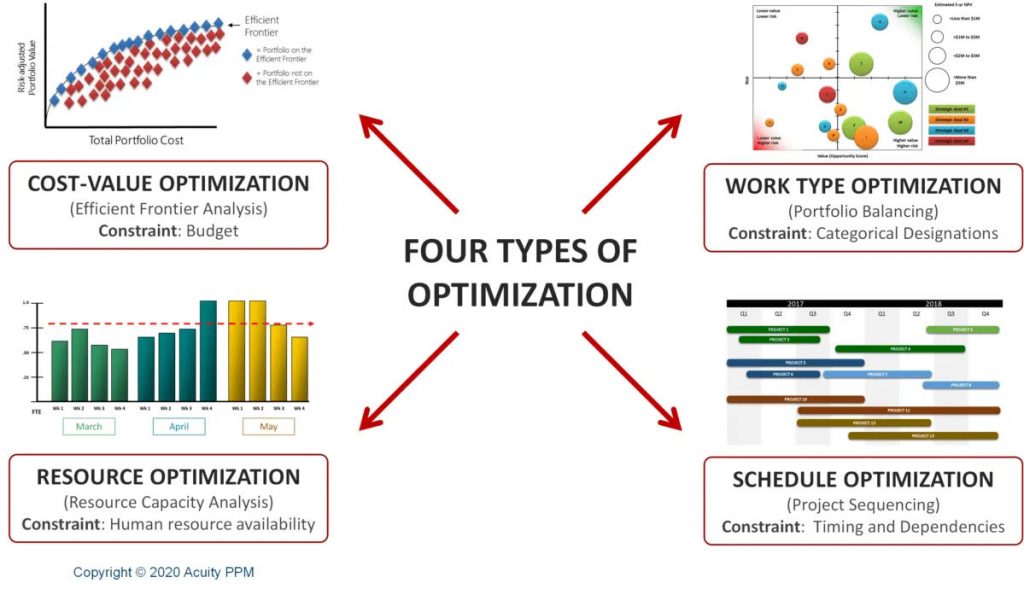

- Efficient Frontier: A graph representing portfolios that offer the highest expected return for a given level of risk.

- Portfolios on the efficient frontier are considered optimal.

- Capital Market Line (CML): Represents the risk-return trade-off of a portfolio that includes a risk-free asset and the market portfolio.

- The slope of the CML is the Sharpe ratio, which measures risk-adjusted return.

Risk Management Strategies

Diversification

Diversification reduces risk by spreading investments across various assets. It’s the core principle of risk management in portfolio optimization.

- Asset Allocation: Distribute investments among different asset classes (stocks, bonds, real estate, etc.) to reduce risk.

- Example: 60% in stocks, 30% in bonds, 10% in real estate.

- Sector Diversification: Invest in different sectors (technology, healthcare, finance, etc.) to avoid concentration risk.

- Example: 20% in technology, 20% in healthcare, 20% in finance, 20% in consumer goods, 20% in energy.

Hedging

Hedging involves using financial instruments to offset potential losses in investments.

- Options: Contracts that give the right, but not the obligation, to buy or sell an asset at a predetermined price.

- Put Options: Provide the right to sell an asset, used to hedge against price declines.

- Call Options: Provide the right to buy an asset, used to hedge against price increases.

- Futures: Contracts to buy or sell an asset at a future date and price.

- Used to hedge against price changes in commodities, currencies, or financial instruments.

Stop-Loss Orders

Stop-loss orders automatically sell a security when its price falls to a predetermined level, limiting potential losses.

- Trailing Stop-Loss: Adjusts the stop price at a fixed percentage below the market price, allowing for potential gains while protecting against losses.

- Example: Set a trailing stop-loss at 10% below the market price.

Practical Application

- Scenario: You have a diversified portfolio with stocks, bonds, and real estate investments.

- Steps:

- Apply MPT: Calculate the expected return and risk of your portfolio.

- Expected Return: Calculate the weighted average return.

- Portfolio Risk: Calculate standard deviation considering correlations between assets.

- Identify the Efficient Frontier: Plot your portfolio on the efficient frontier to ensure optimality.

- Implement Risk Management Strategies:

- Diversify by adding more asset classes or sectors.

- Hedge with options or futures to protect against potential losses.

- Set stop-loss orders to limit downside risk.

- Apply MPT: Calculate the expected return and risk of your portfolio.

Example

- Portfolio Composition:

- Stocks: $6,000 (60%)

- Bonds: $3,000 (30%)

- Real Estate: $1,000 (10%)

- Expected Returns and Standard Deviations:

- Stocks: Expected Return = 8%, Standard Deviation = 15%

- Bonds: Expected Return = 3%, Standard Deviation = 5%

- Real Estate: Expected Return = 6%, Standard Deviation = 10%

- Correlation Coefficients:

- Stocks and Bonds: -0.2

- Stocks and Real Estate: 0.4

- Bonds and Real Estate: 0.1

- Portfolio Optimization:

- Calculate the portfolio’s expected return and risk using the given data.

- Identify if the portfolio lies on the efficient frontier.

- Adjust the portfolio allocation to achieve an optimal balance of risk and return.

- Risk Management:

- Add more diversified assets if necessary.

- Use put options to hedge against a potential decline in stock prices.

- Set trailing stop-loss orders to protect gains while limiting losses.

Conclusion

Portfolio optimization and risk management are essential for achieving optimal returns while minimizing risk. By applying Modern Portfolio Theory, diversifying investments, using hedging strategies, and setting stop-loss orders, you can effectively manage risk and optimize your portfolio.